TripAdvisor 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

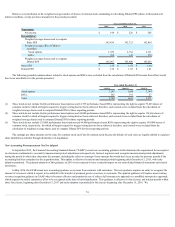

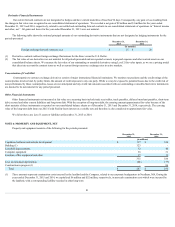

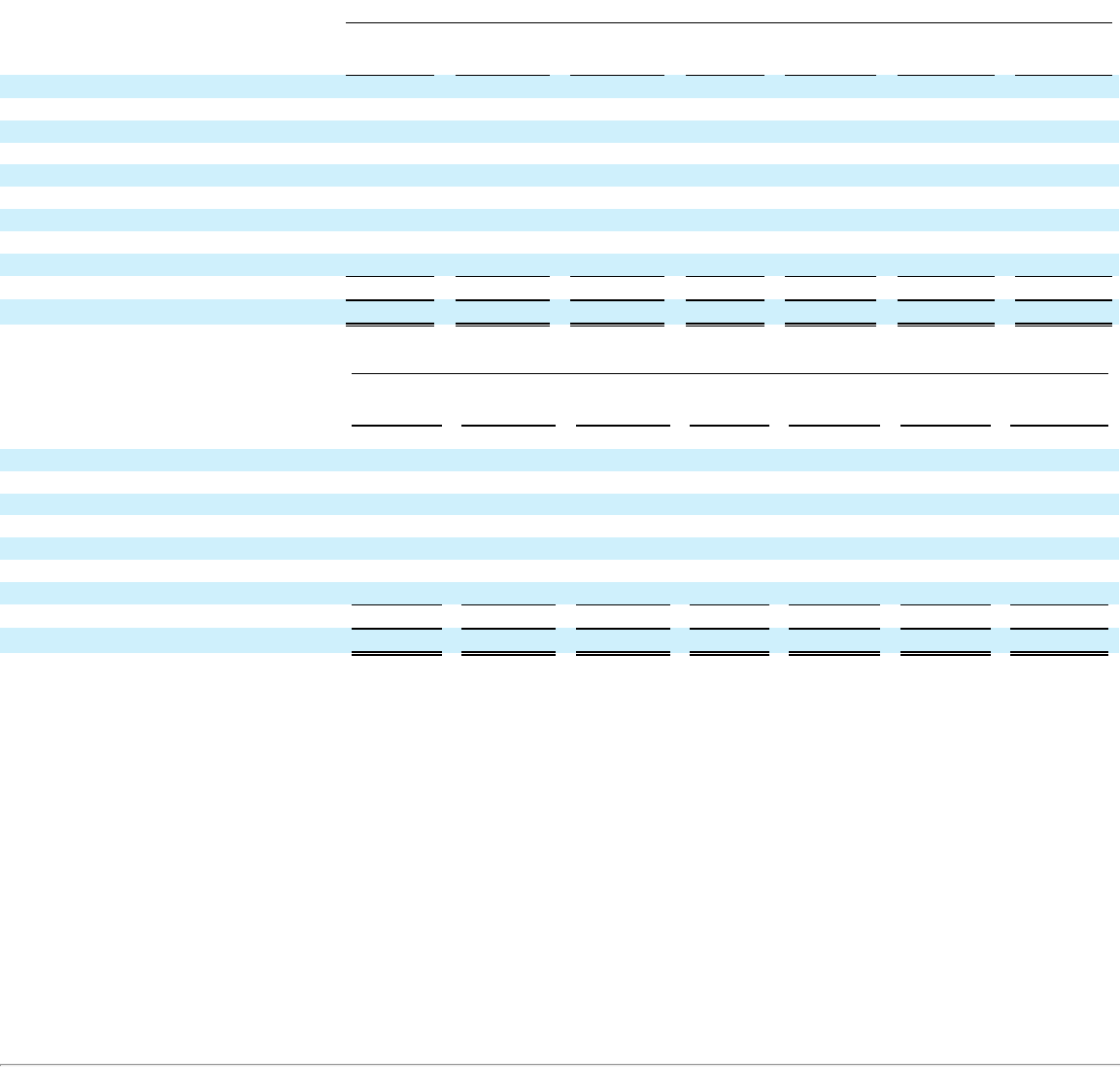

NOTE 5: FINANCIAL INSTRUMENTS

Cash, Cash Equivalents and Marketable Securities

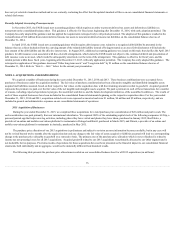

Thefollowingtablesshowourcashandavailable-for-salesecurities’amortizedcost,grossunrealizedgains,grossunrealizedlossesandfairvalueby

significantinvestmentcategoryrecordedascashandcashequivalentsorshortandlong-termmarketablesecuritiesasofDecember31,2015andDecember31,

2014(inmillions):

December 31, 2015

Cash and Short-Term Long-Term

Amortized Unrealized Unrealized Fair Cash Marketable Marketable

Cost Gains Losses Value Equivalents Securities Securities

Cash $ 598 $ — $ — $ 598 $ 598 $ — $ —

Level1:

Moneymarketfunds 11 — — 11 11 — —

Level2:

U.S.agencysecurities 13 — — 13 — 9 4

U.S.treasurysecurities 16 — — 16 4 12 —

Certificatesofdeposit 5 — — 5 — 4 1

Commercialpaper 1 — — 1 — 1 —

Corporatedebtsecurities 54 — — 54 1 21 32

Subtotal 89 — — 89 5 47 37

Total $ 698 $ — $ — $ 698 $ 614 $ 47 $ 37

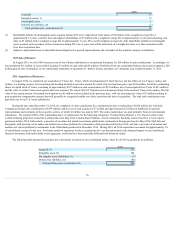

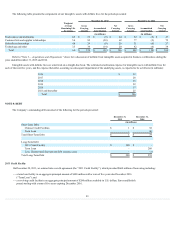

December 31, 2014

Cash and Short-Term Long-Term

Amortized Unrealized Unrealized Fair Cash Marketable Marketable

Cost Gains Losses Value Equivalents Securities Securities

Cash $ 447 $ — $ — $ 447 $ 447 $ — $ —

Level1:

Moneymarketfunds 8 — — 8 8 — —

Level2:

U.S.agencysecurities 38 — — 38 — 35 3

Certificatesofdeposit 8 — — 8 — 8 —

Commercialpaper 1 — — 1 — 1 —

Corporatedebtsecurities 92 — — 92 — 64 28

Subtotal 139 — — 139 — 108 31

Total $ 594 $ — $ — $ 594 $ 455 $ 108 $ 31

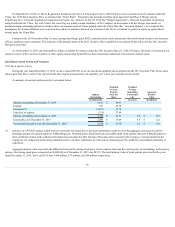

Ourcashandcashequivalentsconsistofcashonhandinglobalfinancialinstitutions,moneymarketfundsandmarketablesecurities,withmaturitiesof90

daysorlessatthedatepurchased.Theremainingmaturitiesofourlong-termmarketablesecuritiesrangefromonetothreeyearsandourshort-termmarketable

securitiesincludematuritiesthatweregreaterthan90daysatthedatepurchasedandhave12monthsorlessremainingatDecember31,2015and2014,

respectively.

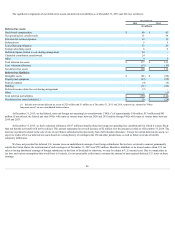

WeclassifyourcashequivalentsandmarketablesecuritieswithinLevel1andLevel2aswevalueourcashequivalentsandmarketablesecuritiesusing

quotedmarketprices(Level1)oralternativepricingsources(Level2).Thevaluationtechniqueweusedtomeasurethefairvalueofmoneymarketfundswere

derivedfromquotedpricesinactivemarketsforidenticalassetsorliabilities.FairvaluesforLevel2investmentsareconsidered“Level2”valuationsbecausethey

areobtainedfromindependentpricingsourcesforidenticalorcomparableinstruments,ratherthandirectobservationsofquotedpricesinactivemarkets.Our

proceduresincludecontrolstoensurethatappropriatefairvaluesarerecorded,includingcomparingthefairvaluesobtainedfromourindependentpricingservices

againstfairvaluesobtainedfromanotherindependentsource.

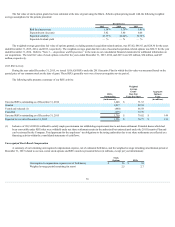

TherewerenomaterialrealizedgainsorlossesrelatedtosalesofourmarketablesecuritiesfortheyearsendedDecember31,2015,2014,and2013.We

consideranyindividualinvestmentsinanunrealizedlosspositiontobetemporaryinnatureanddonotconsideranyofourinvestmentsother-than-temporarily

impairedasofDecember31,2015.

80