TripAdvisor 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

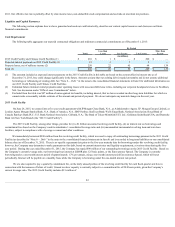

borrowingcapacityavailableforlettersofcreditand$40millionforborrowingsonsame-daynotice.AsofDecember31,2015,wehadissued$2millionof

outstandinglettersofcreditunderthe2015CreditFacility.

Wemayvoluntarilyrepayanyoutstandingborrowingunderthe2015CreditFacilityatanytimewithoutpremiumorpenalty,otherthancustomarybreakage

costswithrespecttoEurocurrencyloans.Certainwholly-owneddomesticsubsidiariesoftheCompanyhaveagreedtoguaranteetheCompany’sobligationsunder

the2015CreditFacility.

The2015CreditFacilitycontainsanumberofcovenantsthat,amongotherthings,restrictourabilityto:incuradditionalindebtedness,createliens,enter

intosaleandleasebacktransactions,engageinmergersorconsolidations,sellortransferassets,paydividendsanddistributions,makeinvestments,loansor

advances,prepaycertainsubordinatedindebtedness,makecertainacquisitions,engageincertaintransactionswithaffiliates,amendmaterialagreementsgoverning

certainsubordinatedindebtedness,andchangeourfiscalyear.The2015CreditFacilityalsorequiresustomaintainamaximumleverageratioandcontainscertain

customaryaffirmativecovenantsandeventsofdefault,includingachangeofcontrol.Ifaneventofdefaultoccurs,thelendersunderthe2015CreditFacilitywill

beentitledtotakevariousactions,includingtheaccelerationofallamountsdueunder2015CreditFacility.AsofDecember31,2015,weareincompliancewith

allofourdebtcovenants.

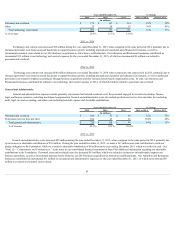

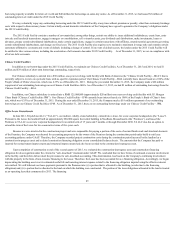

Chinese Credit Facilities

Inadditiontoourborrowingsunderthe2015CreditFacility,wemaintainourChineseCreditFacilities.AsofDecember31,2015and2014,wehad$1

millionand$38millionofshorttermborrowingsoutstanding,respectively.

OurChinesesubsidiaryisenteredintoa$30million,one-yearrevolvingcreditfacilitywithBankofAmerica(the“ChineseCreditFacility—BOA”)thatis

currentlysubjecttoreviewonaperiodicbasiswithnospecificexpirationperiod.OurChineseCreditFacility—BOAcurrentlybearsinterestbasedata100%ofthe

People’sBankofChina’sbaserate,whichwas4.35%asofDecember31,2015.DuringtheyearendedDecember31,2015,theCompanymadea$22million

repaymentofouroutstandingborrowingsonourChineseCreditFacilities-BOA.AsofDecember31,2015,wehad$1millionofoutstandingborrowingsfromthe

ChineseCreditFacility—BOA.

Inaddition,ourChinesesubsidiaryisenteredintoaRMB125,000,000(approximately$20million)one-yearrevolvingcreditfacilitywithJ.P.Morgan

ChaseBank(“ChineseCreditFacility-JPM”).OurChineseCreditFacility—JPMcurrentlybearsinterestbasedata100%ofthePeople’sBankofChina’sbase

rate,whichwas4.35%asofDecember31,2015.DuringtheyearendedDecember31,2015,theCompanymadea$19millionrepaymentofouroutstanding

borrowingsonourChineseCreditFacilities-JPM.AsofDecember31,2015,therearenooutstandingborrowingsunderourChineseCreditFacility–JPM.

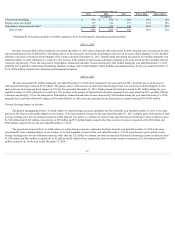

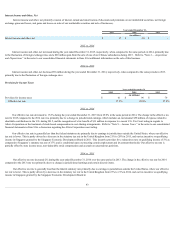

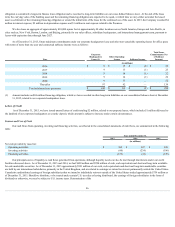

Office Lease Commitments

InJune2013,TripAdvisorLLC(“TALLC”),ourindirect,whollyownedsubsidiary,enteredintoalease,foranewcorporateheadquarters(the“Lease”).

PursuanttotheLease,thelandlordbuiltanapproximately280,000squarefootrentalbuildinginNeedham,Massachusetts(the“Premises”),andleasedthe

PremisestoTALLCasournewcorporateheadquartersforaninitialtermof15yearsand7monthsorthroughDecember2030.TALLCalsohasanoptionto

extendthetermoftheLeasefortwoconsecutivetermsoffiveyearseach.

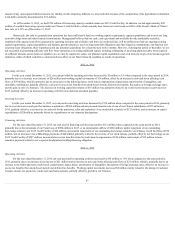

Becausewewereinvolvedintheconstructionprojectandwereresponsibleforpayingaportionofthecostsofnormalfinishworkandstructuralelements

ofthePremises,theCompanywasdeemedforaccountingpurposestobetheownerofthePremisesduringtheconstructionperiodunderbuildtosuitlease

accountingguidanceunderGAAP.Therefore,theCompanyrecordedprojectconstructioncostsduringtheconstructionperiodincurredbythelandlordasa

construction-in-progressassetandarelatedconstructionfinancingobligationonourconsolidatedbalancesheets.TheamountsthattheCompanyhaspaidor

incurredfornormaltenantimprovementsandstructuralimprovementshadalsobeenrecordedtotheconstruction-in-progressasset.

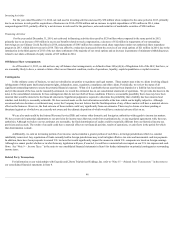

Uponcompletionofconstructionatendofthesecondquarterof2015,weevaluatedtheconstruction-in-progressassetandconstructionfinancing

obligationforde-recognitionunderthecriteriafor“sale-leaseback”treatmentunderGAAP.Weconcludedthatwehaveformsofcontinuedeconomicinvolvement

inthefacility,andthereforedidnotmeettheprovisionsforsale-leasebackaccounting.ThisdeterminationwasbasedontheCompany'scontinuinginvolvement

withthepropertyintheformofnon-recoursefinancingtothelessor.Therefore,theLeasehasbeenaccountedforasafinancingobligation.Accordingly,webegan

depreciatingthebuildingassetoveritsestimatedusefullifeandincurringinterestexpenserelatedtothefinancingobligationimputedusingtheeffectiveinterest

ratemethod.WewillbifurcateourleasepaymentspursuanttothePremisesinto:(i)aportionthatisallocatedtothebuilding(areductiontothefinancing

obligation)and;(ii)aportionthatisallocatedtothelandonwhichthebuildingwasconstructed.Theportionoftheleaseobligationsallocatedtothelandistreated

asanoperatingleasethatcommencedin2013.Thefinancing

45