TripAdvisor 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OnSeptember12,2014,wefiledaRegistrationStatementonFormS-8withrespecttoupto100,595sharesofourcommonstockforissuanceunderthe

Viator,Inc.2010StockIncentivePlan,asamended(the“ViatorPlan”).PursuanttotheAmendedandRestatedAgreementandPlanofMergeramong

TripAdvisorLLC;VineyardAcquisitionCorporationandViator,Inc.,datedasofJuly24,2014(the“MergerAgreement”),VineyardAcquisitionCorporation

mergedwithandintoViator,Inc.withViator,Inc.survivingasawholly-ownedsubsidiaryoftheCompany.InaccordancewiththeMergerAgreement,we

assumedcertainoutstandingoptionstopurchasesharesofcommonstockofViatorgrantedundertheViatorPlan(the“AssumedOptions”).Asaresultofthis

assumption,theAssumedOptionswereconvertedintooptionstopurchasesharesofourcommonstock.Wedonotintendtograntnewequityorequity-based

awardsundertheViatorPlan.

Pursuanttothe2011IncentivePlan,wemay,amongotherthings,grantRSUs,restrictedstock,stockoptionsandotherstock-basedawardstoourdirectors,

officers,employeesandconsultants.Thesummaryofthematerialtermsofthe2011IncentivePlanisqualifiedinitsentiretybythefulltextofthe2011Incentive

Planpreviouslyfiled.

AsofDecember31,2015,thetotalnumberofsharesavailableforissuanceunderthe2011IncentivePlanis17,200,758shares.Allsharesofcommonstock

issuedinrespectoftheexerciseofoptionsorotherequityawardssinceSpin-Offhavebeenissuedfromauthorized,butunissuedcommonstock.

Stock Based Award Activity and Valuation

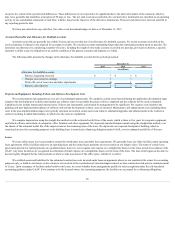

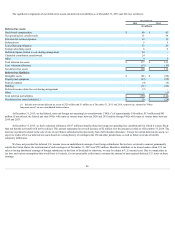

2015 Stock Option Activity

DuringtheyearendedDecember31,2015,wehaveissued586,851ofservicebasednon-qualifiedstockoptionsfromthe2011IncentivePlan.Thesestock

optionsgenerallyhaveatermoftenyearsfromthedateofgrantandgenerallyvestequitablyoverafour-yearrequisiteserviceperiod.

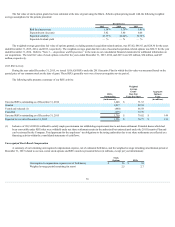

Asummaryofourstockoptionactivityispresentedbelow:

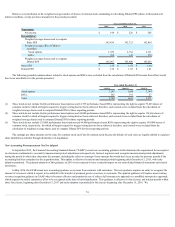

Weighted Weighted

Average Average

Exercise Remaining Aggregate

Options Price Per Contractual Intrinsic

Outstanding Share Life Value

(in thousands) (in years) (in millions)

OptionsoutstandingatDecember31,2014 8,651 $ 44.47

Granted 587 83.78

Exercised(1) (3,187) 33.78

Cancelledorexpired (331) 57.44

OptionsoutstandingatDecember31,2015 5,720 $ 53.71 5.6 $ 187

ExercisableasofDecember31,2015 2,480 $ 36.69 4.3 $ 122

VestedandexpectedtovestafterDecember31,2015 5,610 $ 53.30 5.6 $ 186

(1) Inclusiveof1,978,692options,whichwerenotconvertedintosharesduetonetsharesettlementinordertocovertheaggregateexercisepriceandthe

minimumamountofrequiredemployeewithholdingtaxes.Potentialshareswhichhadbeenconvertibleunderstockoptionsthatwerewithheldundernet

sharesettlementremainintheauthorizedbutunissuedpoolunderthe2011IncentivePlanandcanbereissuedbytheCompany.Totalpaymentsforthe

employees’taxobligationstothetaxingauthoritiesduetonetsharesettlementsarereflectedasafinancingactivitywithintheconsolidatedstatementsof

cashflows.

Aggregateintrinsicvaluerepresentsthedifferencebetweentheclosingstockpriceofourcommonstockandtheexercisepriceofoutstanding,in-the-money

options.OurclosingstockpriceasreportedonNASDAQasofDecember31,2015was$85.25.Thetotalintrinsicvalueofstockoptionsexercisedfortheyears

endedDecember31,2015,2014,and2013were$149million,$75million,and$58million,respectively.

78