TripAdvisor 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

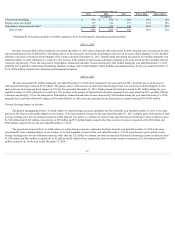

amountofanyunrecognizeddeferredincometaxliabilityonthistemporarydifferenceisnotpracticablebecauseofthecomplexitiesofthehypotheticalcalculation.

CashheldisprimarilydenominatedinU.S.dollars.

AsofDecember31,2015,wehad$798millionofborrowingcapacityavailableunderour2015CreditFacility.Inaddition,wehadapproximately$49

millionofavailableborrowingcapacityunderourChineseCreditFacilities,whichcurrentlybearinterestataratebasedon100%ofthePeople’sBankofChina’s

baserate,or4.35%asofDecember31,2015.

Historically,thecashwegeneratefromoperationshasbeensufficienttofundourworkingcapitalrequirements,capitalexpendituresandtomeetourlong

termdebtobligationsandotherfinancialcommitments.Managementbelievesthatourcash,cashequivalentsandavailable-for-salemarketablesecurities,

combinedwithexpectedcashflowsgeneratedbyoperatingactivitiesandavailablecashfromourcreditfacilities,willbesufficienttofundourongoingworking

capitalrequirements,capitalexpendituresandbusinessgrowthinitiatives;meetourlongtermdebtobligationsandotherfinancialcommitments;andfundournew

corporateleaseobligations,sharerepurchasesandanypotentialacquisitionsforatleastthenexttwelvemonths.However,ifduringthatperiodorthereafter,weare

notsuccessfulingeneratingsufficientcashflowfromoperationsorinraisingadditionalcapital,includingrefinancingorincurringadditionaldebt,whenrequired

insufficientamountsandontermsacceptabletous,wemayberequiredtoreduceourplannedcapitalexpendituresandscalebackthescopeofourbusinessgrowth

initiatives,eitherofwhichcouldhaveamaterialadverseeffectonourfuturefinancialconditionorresultsofoperations.

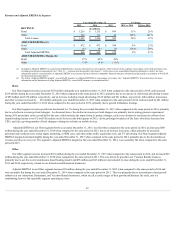

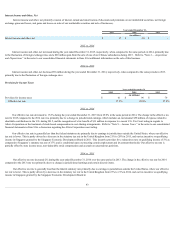

2015 vs. 2014

Operating Activities

FortheyearendedDecember31,2015,netcashprovidedbyoperatingactivitiesdecreasedby$5millionor1%whencomparedtothesameperiodin2014,

primarilyduetoadecreaseinnetincomeof$28millionandworkingcapitalmovementsof$16million,offsetbyanincreaseinnon-cashitemsaffectingcash

flowsof$39million,whichisprimarilyduetoanincreaseinthefollowingitems;stock-basedcompensation;depreciation;amortizationofintangibles;and

charitablecontributions,partiallyoffsetbyadecreaseinexcesstaxbenefitsfromstock-basedawards;deferredtaxbenefits;fluctuationofforeignexchangerates;

andthegainonsaleofabusiness.Thedecreaseinworkingcapitalmovementsof$16millionwasprimarilyrelatedtoanoveralllowerincometaxprovisionfor

2015,partiallyoffsetbyanincreaseinoperatingcashflowfromdeferredmerchantpayables.

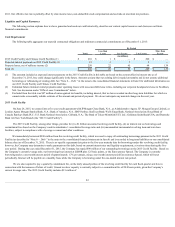

Investing Activities

FortheyearendedDecember31,2015,netcashusedininvestingactivitiesdecreasedby$174millionwhencomparedtothesameperiodin2014,primarily

duetoanetdecreaseincashpaidforbusinessacquisitionsof$302millionandnetproceedsfromthesaleofoneofourChinesesubsidiariesof$25millionin

2015,partiallyoffsetbyanetincreaseincashusedforthepurchases,salesandmaturitiesofourmarketablesecuritiesof$125million,andanincreaseincapital

expendituresof$28million,primarilydrivenbyexpendituresonourcorporateheadquarters.

Financing Activities

FortheyearendedDecember31,2015,netcashusedinfinancingactivitiesincreasedby$112millionwhencomparedtothesameperiodin2014,

primarilyduetotherepaymentofourTermLoanof$300millionin2015,oranincrementaloutflowof$260million,partialrepaymentofouroutstanding

borrowingsrelatedtoour2015CreditFacilityof$90million,incrementalrepaymentsofouroutstandingborrowingsrelatedtoourChineseCreditFacilitiesof$38

million,andanincreaseintaxwithholdingspaymentsof$40millionprimarilyrelatedtotheexerciseofourstockoptions,partiallyoffsetbynetborrowingsonour

2015CreditFacilityof$287million,incrementalexcesstaxbenefitsrelatedtostock-basedcompensationof$16million,andreceiptsof$12millioninlease

incentivepaymentsrelatedtoourcorporateheadquartersbuildingfinancingobligation.

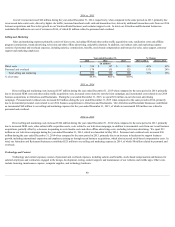

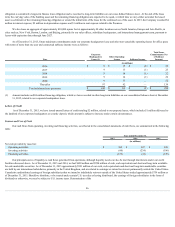

2014 vs. 2013

Operating Activities

FortheyearendedDecember31,2014,netcashprovidedbyoperatingactivitiesincreasedby$38millionor11%whencomparedtothesameperiodin

2013,primarilyduetoanincreaseinnetincomeof$21millionandanincreaseinnon-cashitemsaffectingcashflowsof$23million,whichisprimarilyduetoan

increaseinthefollowingitems;stock-basedcompensation;depreciation;amortizationofintangibles;fluctuationofforeignexchangerates,offsetbyanincreasein

excesstaxbenefitsfromstock-basedawardsanddeferredtaxbenefits.Workingcapitalmovementsdecreased$6millionmainlyrelatedtothetimingofcustomer

receipts,incometaxpayments,vendorandmerchantpayments,partiallyoffsetbygrowthinourbusiness.

47