TripAdvisor 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Critical Accounting Policies and Estimates

Criticalaccountingpoliciesandestimatesarethosethatwebelieveareimportantinthepreparationofourconsolidatedfinancialstatementsbecausethey

requirethatmanagementusejudgmentandestimatesinapplyingthosepolicies.Weprepareourconsolidatedfinancialstatementsandaccompanyingnotesin

accordancewithGAAP.

Preparationoftheconsolidatedfinancialstatementsandaccompanyingnotesrequiresthatmanagementmakeestimatesandassumptionsthataffectthe

reportedamountsofassetsandliabilitiesandthedisclosureofcontingentassetsandliabilitiesasofthedateoftheconsolidatedfinancialstatementsaswellas

revenueandexpensesduringtheperiodsreported.Managementbasesitsestimatesonhistoricalexperience,whereapplicable,andotherassumptionsthatit

believesarereasonableunderthecircumstances.Actualresultsmaydifferfromestimatesunderdifferentassumptionsorconditions.

Therearecertaincriticalestimatesthatwebelieverequiresignificantjudgmentinthepreparationoftheconsolidatedfinancialstatements.Weconsideran

accountingestimatetobecriticalif:

·Itrequiresustomakeanassumptionbecauseinformationwasnotavailableatthetimeoritincludedmattersthatwerehighlyuncertainatthetime

managementwasmakingtheestimate;and/or

·Changesintheestimateordifferentestimatesthatmanagementcouldhaveselectedmayhavehadamaterialimpactonourfinancialconditionor

resultsofoperations.

Oursignificantaccountingpoliciesandestimatesaremorefullydescribedin“Note2—Significant Accounting Policies ”inthenotestoourconsolidated

financialstatementsinItem8.Adiscussionofinformationaboutthenatureandrationaleforourcriticalaccountingestimatesisbelow.

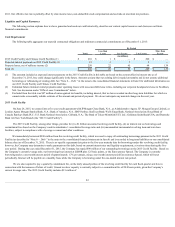

Business Combination Valuations and Recoverability of Goodwill, Indefinite and Definite-Lived Intangible Assets

Goodwill .Weaccountforacquiredbusinessesusingthepurchasemethodofaccountingwhichrequiresthattheassetsacquiredandliabilitiesassumedbe

recordedatthedateofacquisitionattheirrespectivefairvalues.Anyexcessofthepurchasepriceovertheestimatedfairvaluesofthenetassetsacquiredis

recordedasgoodwill.Weassessgoodwill,whichisnotamortized,forimpairmentasofOctober1,ormorefrequently,ifeventsandcircumstancesindicate

impairmentmayhaveoccurred.Wetestgoodwillforimpairmentatthereportingunitlevel(operatingsegmentoronelevelbelowanoperatingsegment).Eachof

ouroperatingsegmentswithgoodwillrepresentsareportingunitforthepurposeofassessingimpairment.Goodwillisallocatedtoourreportingunitsatthedate

thegoodwillisinitiallyrecorded.Oncegoodwillhasbeenallocatedtothereportingunits,itnolongerretainsitsidentificationwithaparticularacquisitionand

becomesidentifiedwiththereportingunitinitsentirety.Accordingly,thefairvalueofthereportingunitasawholeisavailabletosupporttherecoverabilityofits

goodwill.

Intheevaluationofgoodwillforimpairment,wegenerallyfirstperformaqualitativeassessmenttodeterminewhetheritismorelikelythannot(i.e.,a

likelihoodofmorethan50%)thattheimpliedfairvalueofthereportingunitislessthanthecarryingamount.Ifwedeterminethatitisnotmorelikelythannotthat

theimpliedfairvalueofthegoodwillislessthanitscarryingamount,nofurthertestingisnecessary.If,however,wedeterminethatitismorelikelythannotthat

theimpliedfairvalueofthegoodwillislessthanitscarryingamount,wethenperformaquantitativeassessmentandcomparetheimpliedfairvalueofthe

reportingunittothecarryingvalue.Ifthecarryingvalueofareportingunitexceedsitsimpliedfairvalue,thegoodwillofthatreportingunitispotentiallyimpaired

andweproceedtosteptwooftheimpairmentanalysis.Insteptwooftheanalysis,wewillrecordanimpairmentlossequaltotheexcessofthecarryingvalueof

thereportingunit’sgoodwilloveritsimpliedfairvalueshouldsuchacircumstancearise.

Indeterminingtheestimatedfairvalueofassetsacquiredandliabilitiesassumedinbusinesscombinationsandfordeterminingimpliedfairvaluesof

reportingunitsinaquantitativegoodwillimpairmenttest,weuseone,orablend,ofthefollowingrecognizedvaluationmethods:theincomeapproach(including

discountedcashflows),themarketapproachorthecostapproach.Oursignificantestimatesinthosefairvaluemeasurementsmayincludeidentifyingbusiness

factorssuchassize,growth,profitability,riskandreturnoninvestmentandassessingcomparablerevenueand/oroperatingincomemultiples.Further,when

measuringfairvaluebasedondiscountedcashflows,wemakeassumptionsaboutrisk-adjusteddiscountrates,ratesofincreaseinrevenue,costofrevenue,and

operatingexpenses,weightedaveragecostofcapital,ratesoflong-termgrowth,andincometaxrates.Valuationsareperformedbymanagementorthirdparty

valuationspecialistsundermanagement'ssupervision,whereappropriate.Webelievethatthefairvaluesassignedtotheassetsacquiredandliabilitiesassumedin

businesscombinationsandimpairmenttestsarebasedonreasonableassumptionsthatmarketplaceparticipantswoulduse.However,suchassumptionsare

inherentlyuncertainandactualresultscoulddifferfromthoseestimates.

Aspartofourqualitativeassessmentforour2015goodwillimpairmentanalysis,thefactorsthatweconsideredincluded,butwerenotlimitedto:

(a)changesinmacroeconomicconditionsintheoveralleconomyandthespecificmarketsinwhichweoperate,

49