TripAdvisor 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

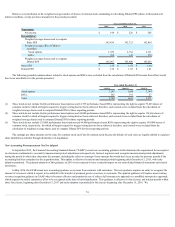

Foreign Currency Translation and Transaction Gains and Losses

OurconsolidatedfinancialstatementsarereportedinU.S.dollars.CertainofoursubsidiariesoutsideoftheUnitedStatesusetherelatedlocalcurrencyas

theirfunctionalcurrencyandnottheU.S.dollar.Thereforeassetsandliabilitiesofourforeignsubsidiariesaretranslatedatthespotrateineffectattheapplicable

reportingdate,andtheconsolidatedstatementsofoperationsaretranslatedattheaverageexchangeratesineffectduringtheapplicableperiod.Theresulting

unrealizedcumulativetranslationadjustmentisrecordedasacomponentofaccumulatedothercomprehensiveincome(loss)instockholders’equityonour

consolidatedbalancesheet.

Wealsohavesubsidiariesthathavetransactionsinforeigncurrenciesotherthantheirfunctionalcurrency.Transactionsdenominatedincurrenciesother

thanthefunctionalcurrencyarerecordedbasedonexchangeratesatthetimesuchtransactionsarise.Subsequentchangesinexchangeratesresultintransaction

gainsandlosseswhicharereflectedinourconsolidatedstatementsofoperationsasunrealized(basedontheapplicableperiod-endexchangerate)orrealizedupon

settlementofthetransactions,ininterestincomeandother,net.

Accordingly,wehaverecordedforeignexchangelossesof$4million,$10millionand$0millionfortheyearsendedDecember31,2015,2014and2013,

respectively,ininterestincomeandother,netonourconsolidatedstatementofoperations.Theseamountsalsoincludegainsandlosses,realizedandunrealized,on

foreigncurrencyforwardcontracts.

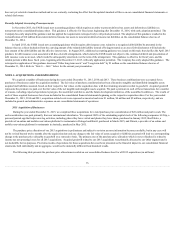

Advertising Expense

Weincuradvertisingexpense,whichincludestrafficgenerationcostsfromsearchenginesandInternetportals,otheronlineandoffline(including

television)advertisingexpense,promotionsandpublicrelationstopromoteourbusiness.Weexpensethecostsassociatedwithcommunicatingtheadvertisements

intheperiodinwhichtheadvertisementtakesplace.Weinitiallycapitalizeandthenexpensetheproductioncostsassociatedwithtelevisionadvertisementsinthe

periodinwhichtheadvertisementfirsttakesplace.FortheyearsendedDecember31,2015,2014and2013,ouradvertisingexpensewas$507million,$341

million,and$237million,respectively.AsofDecember31,2015and2014,wehad$2millionand$5millionofprepaidmarketingexpensesincludedinprepaid

expensesandothercurrentassets.Weexpecttofullyexpenseourprepaidmarketingassetof$2millionasofDecember31,2015totheconsolidatedstatementof

operationsduring2016.

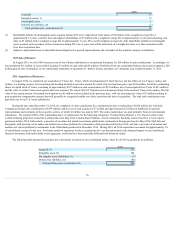

Stock-Based Compensation

Stock Options. Theexercisepriceforallstockoptionsgrantedbyustodatehasbeenequaltothemarketpriceoftheunderlyingsharesofcommonstockat

thedateofgrant.Inthisregard,whenmakingstockoptionawards,ourpracticeistodeterminetheapplicablegrantdateandtospecifythattheexercisepriceshall

betheclosingpriceofourcommonstockonthedateofgrant.

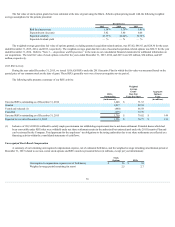

Theestimatedgrant-datefairvalueofstockoptionsiscalculatedusingaBlack-ScholesMertonoption-pricingmodel(“Black-Scholesmodel”).TheBlack-

Scholesmodelincorporatesassumptionstovaluestock-basedawards,whichincludestherisk-freerateofreturn,expectedvolatility,expectedtermandexpected

dividendyield.

Ourrisk-freeinterestrateisbasedontheratescurrentlyavailableonzero-couponU.S.Treasuryissues,ineffectatthetimeofthegrant,whoseremaining

maturityperiodmostcloselyapproximatesthestockoption’sexpectedtermassumption.Ourexpectedvolatilityiscalculatedbyequallyweightingthehistorical

volatilityandimpliedvolatilityonourownstock.Historicalvolatilityisdeterminedusingactualdailypriceobservationsofourstockpriceoveraperiod

equivalenttoorapproximatetotheexpectedtermofourstockoptiongrantstodate.Impliedvolatilityrepresentsthevolatilityofouractivelytradedoptionsonour

stock,withremainingmaturitiesinexcessoftwelvemonthsandmarketpricesapproximatetotheexercisepricesofthestockoptiongrant.Weestimateour

expectedtermusinghistoricalexercisebehaviorandexpectedpost-vestterminationdata.Ourexpecteddividendyieldiszero,aswehavenotpaidanydividendson

ourcommonstocktodateanddonotexpecttopayanycashdividendsfortheforeseeablefuture.

Ourstockoptionsgenerallyhaveatermoftenyearsfromthedateofgrantandgenerallyvestequitablyoverafour-yearrequisiteserviceperiod.We

amortizethegrant-datefairvalueofourstockoptiongrants,netofestimatedforfeitures,asstock-basedcompensationexpenseoverthevestingtermonastraight-

linebasis,withtheamountofcompensationexpenserecognizedatanydateatleastequalingtheportionofthegrant-datefairvalueoftheawardthatisvestedat

thatdate.

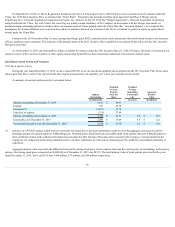

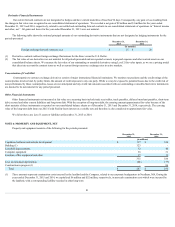

Restricted Stock Units. RSUsarestockawardsthataregrantedtoemployeesentitlingtheholdertosharesofourcommonstockastheawardvests.RSUs

aremeasuredatfairvaluebasedonthenumberofsharesgrantedandthequotedpriceofourcommonstockatthedateofgrant.Weamortizethefairvalueof

RSUs,netofestimatedforfeitures,asstock-basedcompensationexpenseoverthevestingtermofgenerallyfouryearsonastraight-linebasis,withtheamountof

compensationexpenserecognizedatanydateatleastequalingtheportionofthegrant-datefairvalueoftheawardthatisvestedatthatdate.

71