TripAdvisor 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

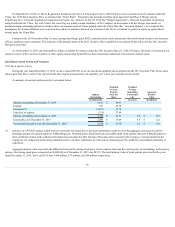

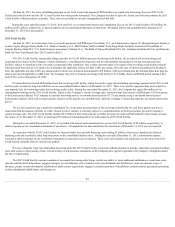

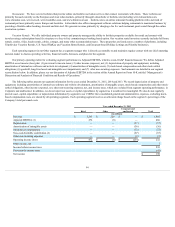

Areconciliationoftheprovisionforincometaxestotheamountscomputedbyapplyingthestatutoryfederalincometaxratetoincomebeforeincometaxes

isasfollows:

Year Ended December 31,

2015 2014 2013

(in millions)

Incometaxexpenseatthefederalstatutoryrateof35% $ 84 $ 113 $ 100

Foreignratedifferential (53) (49) (41)

Stateincometaxes,netofeffectoffederaltaxbenefit 4 13 8

Unrecognizedtaxbenefitsandrelatedinterest 12 14 9

Changeincost-sharingtreatmentofstock-basedcompensation (13) - -

Non-deductibletransactioncosts 1 1 -

Changeinvaluationallowance 5 5 2

Other,net 1 (1) 1

Provisionforincometaxes $ 41 $ 96 $ 79

During2011,theSingaporeEconomicDevelopmentBoardacceptedourapplicationtoreceiveataxincentiveundertheInternationalHeadquarters

Award.Thisincentiveprovidesforareducedtaxrateonqualifyingincomeof5%ascomparedtoSingapore’sstatutorytaxrateof17%andisconditionaluponour

meetingcertainemploymentandinvestmentthresholds.ThisagreementhasbeenextendeduntilJune30,2021aswehavemetcertainemploymentandinvestment

thresholds.Thisbenefitresultedinadecreasetothe2015taxprovisionof$4millionoraddedanincremental$0.03toourDilutedEPSfor2015.

ByvirtueofpreviouslyfiledconsolidatedincometaxreturnsfiledwithExpedia,wearecurrentlyunderanIRSauditforthe2009and2010taxyears,and

havevariousongoingstateincometaxaudits.WeareseparatelyunderexaminationbytheIRSforthe2012and2013taxyearsandhavecommencedan

employmenttaxauditwiththeIRSforthe2013and2014taxyears.Theseauditsincludequestioningofthetimingandtheamountofincomeanddeductionsand

theallocationofincomeamongvarioustaxjurisdictions.Theseexaminationsmayleadtoproposedorordinarycourseadjustmentstoourtaxes.Wearenolonger

subjecttotaxexaminationsbytaxauthoritiesforyearspriorto2007.AsofDecember31,2015,nomaterialassessmentshaveresulted.

DuringtheyearendedDecember31,2015,wereceivednotificationofadraftproposedadjustmentfromtheIRSforthe2009and2010taxyearsandwe

anticipatereceivingadditionalnoticesofproposedadjustmentsforthesameyears.Theseproposedadjustmentsarerelatedtotransferpricingwithourforeign

subsidiaries,andwouldresultinanincreasetoU.S.taxableincomeandfederaltaxexpensefor2009and2010,subjecttointerest.Ourpolicyistoreviewand

updatetaxreservesasfactsandcircumstanceschange.Basedonourinterpretationoftheregulationsandavailablecaselaw,webelievethepositionwehavetaken

withregardtotransferpricingwithourforeignsubsidiariesissustainable.WeintendtodefendourpositionthroughIRSadministrativeand,ifnecessary,by

judicialremedies.AsofDecember31,2015,noadditionaladjustmentshavebeenproposed.

InJuly2015,theUnitedStatesTaxCourt(the“Court”)issuedanopinionfavorabletoAlteraCorporation(“Altera”)withrespecttoAltera’slitigationwith

theInternalRevenueService(“IRS”).ThisopinionwassubmittedasafinaldecisionunderTaxCourt(“T.C.”)Rule155duringDecember2015.Thelitigation

relatestothetreatmentofstock-basedcompensationexpenseinaninter-companycost-sharingarrangementwithAltera’sforeignsubsidiary.Initsopinion,the

CourtacceptedAltera’spositionofexcludingstockbasedcompensationfromitsinter-companycost-sharingarrangement.TheIRShastherighttoappealthe

Courtdecision.Atthistime,theU.S.DepartmentoftheTreasuryhasnotwithdrawntherequirementfromitsregulationstoincludestock-basedcompensationin

intercompanycost-sharingarrangements.TheCompanyhasevaluatedtheimpactofthecourtcaseandrecordedataxbenefitof$13millioninitsconsolidated

statementofoperationsfortheyearendedDecember31,2015.TheCompanywillcontinuetomonitorthismatterandrelatedpotentialimpactstoitsconsolidated

financialstatements.

87