Thrifty Car Rental 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

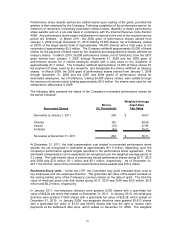

During the first and second quarters of 2011, the Company incurred $3.5 million and $1.1

million, respectively, in merger-related expenses. See Note 17 for further discussion.

During the fourth quarter of 2010, the Company recorded favorable changes in vehicle

insurance reserve estimates of $13.4 million in conjunction with receiving actuarial updates on

its vehicle insurance programs. See Note 14 for further discussion.

During the first, second, third and fourth quarters of 2010, the Company incurred $1.7 million,

$6.9 million, $11.9 million and $2.1 million, respectively, in merger-related expenses. See Note

17 for further discussion.

In 2010, the majority relating to the third quarter, the Company wrote off $1.1 million (pretax)

primarily related to software no longer in use and to impairments of assets at its company-

owned stores.

17. PROPOSED ACQUISITION AND RELATED MATTERS

In late February 2011, the Company submitted its certification of substantial compliance with

the Second Request of the U.S. Federal Trade Commission (“FTC”) relating to a potential

acquisition of the Company by Avis Budget.

On May 9, 2011, Hertz announced its plans to commence an exchange offer to acquire the

Company. On May 24, 2011, HDTMS, Inc., a wholly owned subsidiary of Hertz, commenced an

exchange offer to exchange each of the issued and outstanding shares of the Company’s

common stock for (i) $57.60 in cash, without interest and less any required withholding taxes,

and (ii) 0.8546 shares of common stock, par value $0.01 per share, of Hertz common stock (the

“Exchange Offer”). The Exchange Offer had an expiration date of July 8, 2011; however, Hertz

extended the Exchange Offer through November 1, 2011. On October 27, 2011, Hertz

announced that it was withdrawing its Exchange Offer for all outstanding shares of the

Company, in light of the Company's plan to commence its announced share repurchase

program and current market conditions. However, Hertz noted that they remain interested in

acquiring the Company and remain engaged with the FTC to secure antitrust clearance for a

proposed transaction.

On August 21, 2011, the Company issued a letter advising Hertz and Avis Budget of the

Company's intention to solicit for submission in early October 2011 best and final definitive

proposals regarding a potential business combination. In its letter, the Company stated that

any proposal that did not eliminate the antitrust regulatory risk of the transaction for its

shareholders would not likely be acceptable. In conjunction with the Company’s request for final

proposals regarding a potential business combination on September 14, 2011, Avis Budget

announced that it would not participate in a bid to buy the Company, citing current market

conditions.

As of October 10, 2011, the Company had not received any proposals meeting this criterion

and announced that it has formally concluded its process to solicit definitive proposals

regarding a potential business combination. Consequently, the Company has terminated its

solicitation process and will continue to execute its current stand-alone plan.

Pending litigation relating to the now terminated merger agreement is described in Note 14.

18. SUBSEQUENT EVENTS

In preparing the consolidated financial statements, the Company has reviewed events that

have occurred after December 31, 2011 through the issuance of the financial statements. The

Company noted no reportable subsequent events other than the subsequent events noted in

Notes 8 and 13.

******

86