Thrifty Car Rental 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

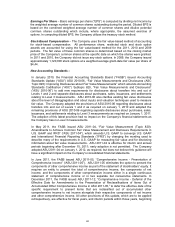

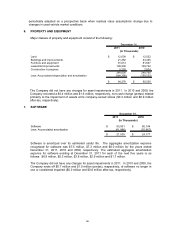

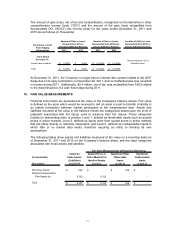

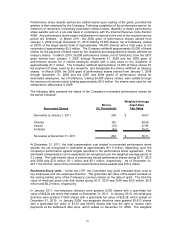

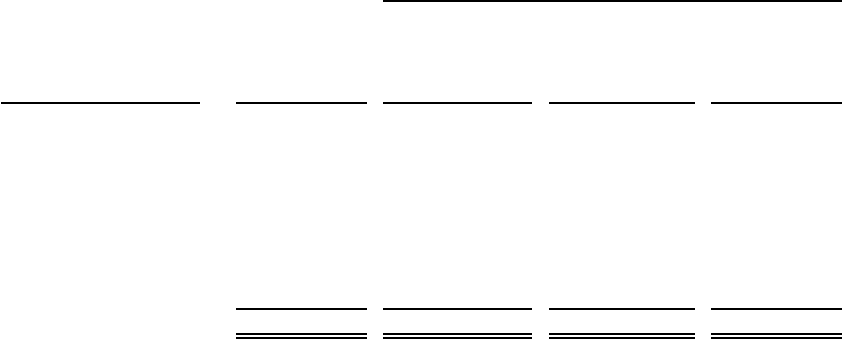

Total Fair Quoted Prices in Significant Other Significant

(in thousands) Value Assets Active Markets for Observable Unobservable

(Liabilities) Identical Assets Inputs Inputs

Description at 12/31/10 (Level 1) (Level 2) (Level 3)

Derivative Assets 1,355$ -$ 1,355$ -$

Derivative Liabilities (36,888) - (36,888) -

Marketable Securities

(available for sale) 169 169 - -

Deferred Compensation

Plan Assets (a) 3,916 - 3,916 -

Total (31,448)$ 169$ (31,617)$ -$

Fair Value Measurements at Reporting Date Using

(a) Deferred Compensation Plan Assets consist primarily of equity securities. The Company also has an offsetting

liability related to the Deferred Compensation Plan, which is not disclosed in the table as it is not independently

measured at fair value, but rather is set to equal fair value of the assets held in the related rabbi trust.

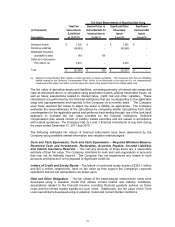

The fair value of derivative assets and liabilities, consisting primarily of interest rate swaps and

caps as discussed above, is calculated using proprietary models utilizing observable inputs, as

well as future assumptions related to interest rates, credit risk and other variables. These

calculations are performed by the financial institutions that are counterparties to the applicable

swap and cap agreements and reported to the Company on a monthly basis. The Company

uses these reported fair values to adjust the asset or liability as appropriate. The Company

evaluates the reasonableness of the calculations by comparing similar calculations from other

counterparties for the applicable period and performs back-testing through use of the look back

approach to evaluate the fair value provided by the financial institutions. Deferred

compensation plan assets consist of publicly traded securities and are valued in accordance

with market quotations. The Company had no Level 3 financial instruments at any time during

the years ended December 31, 2011 and 2010.

The following estimated fair values of financial instruments have been determined by the

Company using available market information and valuation methodologies.

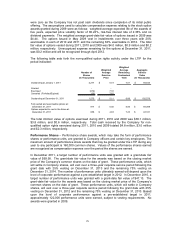

Cash and Cash Equivalents, Cash and Cash Equivalents – Required Minimum Balance,

Restricted Cash and Investments, Receivables, Accounts Payable, Accrued Liabilities

and Vehicle Insurance Reserves – The carrying amounts of these items are a reasonable

estimate of their fair value. The Company maintains its cash and cash equivalents in accounts

that may not be federally insured. The Company has not experienced any losses in such

accounts and believes it is not exposed to significant credit risk.

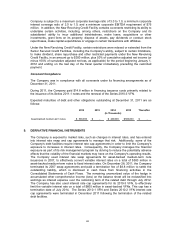

Letters of Credit and Surety Bonds – The letters of credit and surety bonds of $203.1 million

and $47.4 million, respectively, have no fair value as they support the Company's corporate

operations and are not anticipated to be drawn upon.

Debt and Other Obligations – The fair values of the asset-backed medium-term notes were

developed using a valuation model that utilizes current market and industry conditions,

assumptions related to the financial insurers providing financial guaranty policies on those

notes and the limited market liquidity for such notes. Additionally, the fair value of the Term

Loan was similarly developed using a valuation model and current market conditions.

72