Thrifty Car Rental 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company is subject to a maximum corporate leverage ratio of 3.0 to 1.0, a minimum corporate

interest coverage ratio of 2.0 to 1.0, and a minimum corporate EBITDA requirement of $75

million. In addition, the New Revolving Credit Facility contains covenants restricting its ability to

undertake certain activities, including, among others, restrictions on the Company and its

subsidiaries’ ability to incur additional indebtedness, make loans, acquisitions or other

investments, grant liens on its property, dispose of assets, pay dividends or conduct stock

repurchases, make capital expenditures or engage in certain transactions with affiliates.

Under the New Revolving Credit Facility, certain restrictions were relaxed or extended from the

Senior Secured Credit Facilities, including the Company’s ability, subject to certain limitations,

to make dividend, share repurchase and other restricted payments under the New Revolving

Credit Facility, in an amount up to $300 million, plus 50% of cumulative adjusted net income (or

minus 100% of cumulative adjusted net loss, as applicable) for the period beginning January 1,

2012 and ending on the last day of the fiscal quarter immediately preceding the restricted

payment.

Covenant Compliance

The Company was in compliance with all covenants under its financing arrangements as of

December 31, 2011.

During 2011, the Company paid $14.8 million in financing issuance costs primarily related to

the issuance of its Series 2011-1 notes and the renewal of the Series 2010-3 VFN.

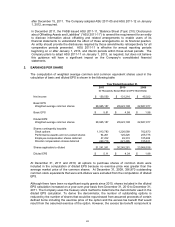

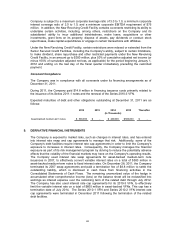

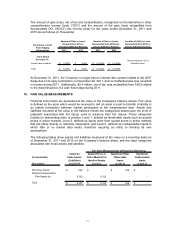

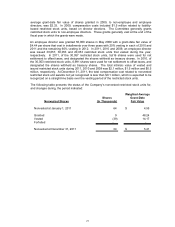

Expected maturities of debt and other obligations outstanding at December 31, 2011 are as

follows:

2012 2013 2014 2015 Thereafter

Asset-backed medium-term notes 500,000$ -$ 400,000$ 500,000$ -$

(In Thousands)

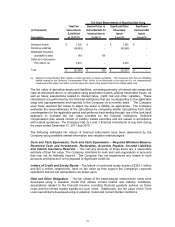

9. DERIVATIVE FINANCIAL INSTRUMENTS

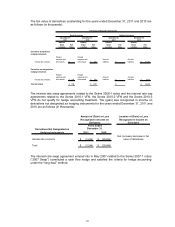

The Company is exposed to market risks, such as changes in interest rates, and has entered

into interest rate swap and cap agreements to manage that risk. Additionally, some of the

Company’s debt facilities require interest rate cap agreements in order to limit the Company’s

exposure to increases in interest rates. Consequently, the Company manages the financial

exposure as part of its risk management program by striving to reduce the potentially adverse

effects that the volatility of the financial markets may have on the Company’s operating results.

The Company used interest rate swap agreements for asset-backed medium-term note

issuances in 2007, to effectively convert variable interest rates on a total of $500 million in

asset-backed medium-term notes to fixed interest rates. On December 28, 2011, the Company

terminated its 2007 swap agreements and paid a termination fee of $8.8 million to settle the

outstanding liability, which is disclosed in cash flows from financing activities in the

Consolidated Statements of Cash Flows. The remaining unamortized value of the hedge in

accumulated other comprehensive income (loss) on the balance sheet will be reclassified into

earnings as interest expense over the remaining term of the related debt through July 2012.

The Company has also used interest rate cap agreements for its 2010-3 VFN, to effectively

limit the variable interest rate on a total of $600 million in asset-backed VFNs. This cap has a

termination date of July 2014. The Series 2010-1 VFN and Series 2010-2 VFN interest rate

cap agreements were terminated in December 2011 following the termination of the related

debt facilities.

69