Thrifty Car Rental 2011 Annual Report Download - page 43

Download and view the complete annual report

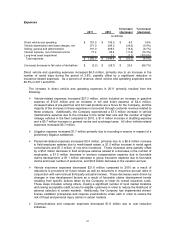

Please find page 43 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Selling, general and administrative expenses for 2010 increased $9.0 million. As a percent of

revenue, selling, general and administrative expenses were 13.6% in 2010, compared to 13.0% in

2009.

The increase in selling, general and administrative expenses in 2010 resulted from the following:

Merger-related costs incurred in 2010 totaled $22.6 million.

Outsourcing expenses decreased $6.2 million due primarily to a lower fee attributable to

fewer IT-related projects and to a greater number of capitalizable projects in 2010 as

compared to 2009.

Outside services expense decreased $3.6 million primarily due to reduced consulting

expense.

The change in the market value of investments in the Company’s deferred compensation

and retirement plans decreased selling, general and administrative expenses by $1.8 million

in 2010 compared to 2009, which was offset by a corresponding gain on those investments

that is recognized in other revenue and, therefore, did not impact net income.

Sales and marketing expense decreased $0.7 million due primarily to a decrease in print

media, marketing programs tied to transaction levels and reduced promotional advertising

expenses.

All other selling, general and administrative expenses decreased by $1.3 million.

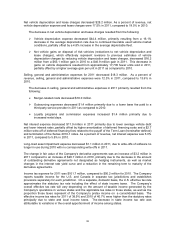

Net interest expense decreased $7.3 million in 2010 primarily due to lower average vehicle debt,

partially offset by reduced interest income as the Company used excess restricted cash on hand to

reduce indebtedness, and to reinvest in the rental fleet. As a percent of revenue, net interest

expense was 5.8% in 2010, compared to 6.2% in 2009.

Long-lived asset impairment expense decreased $1.5 million in 2010 compared to 2009, due to

lower write-offs of long-lived assets at its company-owned stores and software no longer in use.

The change in fair value of the Company’s derivative agreements was an increase of $28.7 million in

2010 compared to an increase of $28.8 million in 2009, due to market changes in the interest rate

yield curve and shorter time to maturity of the derivative agreements.

The income tax expense for 2010 was $90.2 million. The Company reports taxable income for the

U.S. and Canada in separate tax jurisdictions and establishes provisions separately for each

jurisdiction. On a separate, domestic basis, the U.S. effective tax rate approximates the statutory tax

rate including the effect of state income taxes. Our overall effective tax rate will vary depending on

the amount of taxable income generated by our operations in various states and the applicable tax

rates in those states, as well as the proportion those taxes represent of our pretax income on a

consolidated basis. Based on the significant improvement in the Company’s consolidated pretax

income from 2009 to 2010, the impact of state income taxes resulted in a decline in the overall

consolidated effective tax rate from 44.4% to 40.7%.

Operating Results

The Company had income before income taxes of $221.4 million in 2010 compared to income before

income taxes of $81.0 million in 2009.

Liquidity and Capital Resources

The Company’s primary uses of liquidity are for the purchase of vehicles for its rental fleet, including

required collateral enhancement under its fleet financing structures, non-vehicle capital expenditures

41