Thrifty Car Rental 2011 Annual Report Download - page 64

Download and view the complete annual report

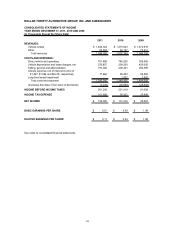

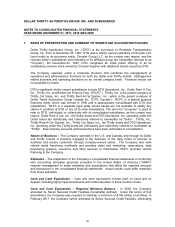

Please find page 64 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Earnings Per Share – Basic earnings per share (“EPS”) is computed by dividing net income by

the weighted average number of common shares outstanding during the period. Diluted EPS is

based on the combined weighted average number of common shares and dilutive potential

common shares outstanding which include, where appropriate, the assumed exercise of

options. In computing diluted EPS, the Company utilizes the treasury stock method.

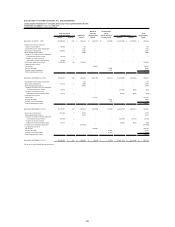

Stock-Based Compensation – The Company uses the fair value-based method of accounting

for stock-based compensation. All performance share, restricted stock and stock option

awards are accounted for using the fair value-based method for the 2011, 2010 and 2009

periods. The fair value of these common shares is determined based on the closing market

price of the Company’s common shares at the specific date on which the shares were granted.

In 2011 and 2010, the Company did not issue any stock options. In 2009, the Company issued

approximately 1,120,000 stock options at a weighted average grant-date fair value per share of

$4.44.

New Accounting Standards –

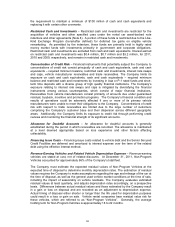

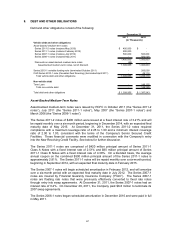

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting

Standards Update (“ASU”) ASU 2010-06, “Fair Value Measurements and Disclosures (ASC

Topic 820): Improving Disclosures about Fair Value Measurements” which amends Accounting

Standards Codification (“ASC”) Subtopic 820, “Fair Value Measurements and Disclosures”

(“ASU 2010-06”) to add new requirements for disclosures about transfers into and out of

Levels 1 and 2 and separate disclosures about purchases, sales, issuances, and settlements

relating to Level 3 measurements. ASU 2010-06 also clarifies existing fair value disclosures

about the level of disaggregation and about inputs and valuation techniques used to measure

fair value. The Company adopted the provisions of ASU 2010-06 regarding disclosures about

transfers into and out of Levels 1 and 2 as required on January 1, 2010 and adopted the

remaining provisions of ASU 2010-06 regarding separate disclosures about purchases, sales,

issuances, and settlements relating to Level 3 measurements as required on January 1, 2011.

The adoption of this latest provision had no impact on the Company’s financial statements as

the Company has no Level 3 measurements.

In May 2011, the FASB issued ASU 2011-04, “Fair Value Measurement (Topic 820):

Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in

U.S. GAAP and IFRS” (“ASU 2011-04”), which amends U.S. GAAP to converge U.S. GAAP

and International Financial Reporting Standards (“IFRS”) by changing the wording used to

describe many of the requirements in U.S. GAAP for measuring fair value and for disclosing

information about fair value measurements. ASU 2011-04 is effective for interim and annual

periods beginning after December 15, 2011; early adoption is not permitted. The Company

adopted ASU 2011-04 on January 1, 2012, as required, but does not believe this guidance will

have a significant impact on the Company’s consolidated financial statements.

In June 2011, the FASB issued ASU 2011-05, “Comprehensive Income - Presentation of

Comprehensive Income” (“ASU 2011-05”). ASU 2011-05 eliminates the option to present the

components of other comprehensive income as part of the statement of stockholders’ equity. It

requires an entity to present the total of comprehensive income, the components of net

income, and the components of other comprehensive income either in a single continuous

statement of comprehensive income or in two separate but consecutive statements. In

December 2011, the FASB issued ASU 2011-12, “Comprehensive Income - Deferral of the

Effective Date for Amendments to the Presentation of Reclassifications of Items Out of

Accumulated Other Comprehensive Income in ASU 2011-05,” to defer the effective date of the

specific requirement to present items that are reclassified out of accumulated other

comprehensive income to net income alongside their respective components of net income

and other comprehensive income. All other provisions of this update, which are to be applied

retrospectively, are effective for fiscal years, and interim periods within those years, beginning

62