Thrifty Car Rental 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

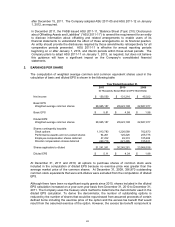

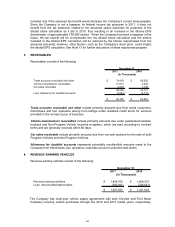

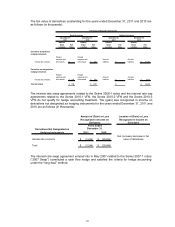

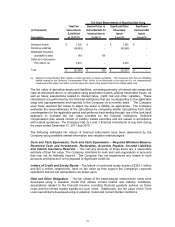

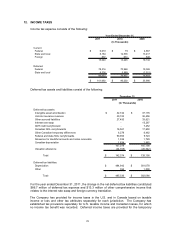

The fair value of derivatives outstanding for the years ended December 31, 2011 and 2010 are

as follows (in thousands):

Balance Balance Balance Balance

Sheet Fair Sheet Fair Sheet Fair Sheet Fair

Location

V

alue Location

V

alue Location

V

alue Location

V

alue

Interest rate contracts

Prepaid

expenses and

other assets -$

Prepaid

expenses and

other assets 861$

Accrued

liabilities -$

Accrued

liabilities 31,254$

Interest rate contracts

Prepaid

expenses and

other assets 548$

Prepaid

expenses and

other assets 494$

Accrued

liabilities -$

Accrued

liabilities 5,634$

Total derivatives 548$ 1,355$ -$ 36,888$

Fair Values of Derivative Instruments

Asset Derivatives Liability Derivatives

December 31, December 31, December 31, December 31,

2011 2010

Derivatives designated as

hedging instruments

Derivatives not designated as

hedging instruments

2011 2010

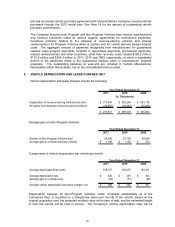

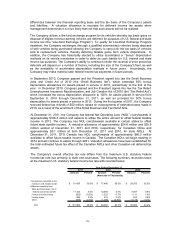

The interest rate swap agreements related to the Series 2006-1 notes and the interest rate cap

agreements related to the Series 2010-1 VFN, the Series 2010-2 VFN and the Series 2010-3

VFN do not qualify for hedge accounting treatment. The (gain) loss recognized in income on

derivatives not designated as hedging instruments for the years ended December 31, 2011 and

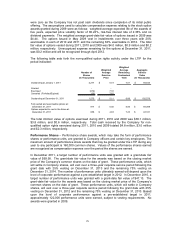

2010 are as follows (in thousands):

2011 2010

Interest rate contracts (3,244)$ (28,694)$

Total (3,244)$ (28,694)$

Net (increase) decrease in fair

value of derivatives

Derivatives Not Designated as

Hedging Instruments

Location of (Gain) or Loss

Recognized in Income on

Derivative

Years Ended

December 31,

Amount of (Gain) or Loss

Recognized in Income on

Derivative

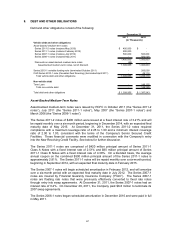

The interest rate swap agreement entered into in May 2007 related to the Series 2007-1 notes

(“2007 Swap”) constituted a cash flow hedge and satisfied the criteria for hedge accounting

under the “long-haul” method.

70