Thrifty Car Rental 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and working capital. The Company’s need for cash to finance vehicles is seasonal and typically

peaks in the second and third quarters of the year when fleet levels build to meet seasonal rental

demand. The Company expects to continue to fund its revenue-earning vehicles with borrowings

under secured vehicle financing programs, cash provided from operations and proceeds from the

disposal of used vehicles. The Company uses both cash and letters of credit to support asset-

backed vehicle financing programs. The Company also uses letters of credit or insurance bonds to

secure certain commitments related to airport concession agreements, insurance programs, and for

other purposes. The Company’s primary sources of liquidity are cash generated from operations,

secured vehicle financing, sales proceeds from disposal of used vehicles and availability under the

New Revolving Credit Facility.

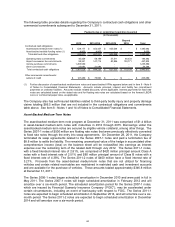

The Company believes that its cash generated from operations, cash balances, availability under the

New Revolving Credit Facility and secured vehicle financing programs are adequate to meet its

liquidity requirements for the near future. The Company has asset-backed medium-term note

maturities totaling $500 million that amortize in equal monthly installments from February 2012

through July 2012. The Company added $500 million of asset-backed medium-term notes in July

2011 through the issuance of its Series 2011-1 notes and $400 million of asset-backed medium-term

notes in October 2011 through the issuance of the Series 2011-2 notes as well as extended and

increased the Series 2010-3 variable funding notes (“VFN”) from $450 million to $600 million in

September 2011. The Company further modified its fleet debt capacity by terminating the $200

million Series 2010-1 VFN and the $300 million Series 2010-2 VFN in October 2011.

The secured vehicle financing programs require varying levels of credit enhancement or

overcollateralization, which are provided by a combination of cash, vehicles and letters of credit.

Enhancement levels vary based on the source of debt used to finance the vehicles. The letters of

credit are provided under the Company’s New Revolving Credit Facility. Additionally, enhancement

levels are seasonal and increase significantly during the second quarter when the fleet is at peak

levels. Enhancement requirements under asset-backed financing sources have changed

significantly for the rental car industry as a whole over the past few years, and as a result,

enhancement levels under the Series 2011-1 notes, the Series 2011-2 notes and the Series 2010-3

VFN are approximately 45%, compared to 30% on the Series 2007-1 notes. Based on expected

future peak fleet levels and the scheduled amortization of the Series 2007-1 notes, which will begin

in February 2012, the Company expects to provide up to $75 million of additional enhancement in

2012 compared to 2011 levels.

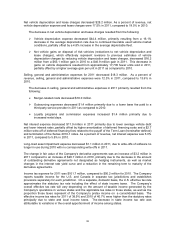

Operating Activities

Net cash generated by operating activities of $567.3 million, $461.9 million and $535.9 million for

2011, 2010 and 2009, respectively, are primarily the result of net income adjusted for depreciation

expense and income taxes.

Investing Activities

Net cash used in investing activities was $402.5 million for 2011. The principal expenditure of cash

from investing activities was for purchases of new revenue-earning vehicles, which totaled $1.2

billion, partially offset by the sale of revenue-earning vehicles, which totaled $0.8 billion. Cash and

cash equivalents – required minimum balance was eliminated in February 2011 as the $100 million

requirement under the Company’s financing arrangements was eliminated (see Item 8 – Note 1 of

Notes to Consolidated Financial Statements). Additionally, restricted cash and investments

decreased $75.9 million from December 31, 2010. The Company also used cash for non-vehicle

capital expenditures of $16.6 million in 2011. These expenditures consist primarily of airport facility

improvements for the Company’s rental locations and IT-related projects. The Company estimates

non-vehicle capital expenditures to be approximately $25 million in 2012 related to airport facility

projects and IT equipment and systems.

Net cash used in investing activities was $59.1 million for 2010. The principal component of cash

used in investing activities was for purchases of new revenue-earning vehicles, which totaled $1.2

42