Thrifty Car Rental 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

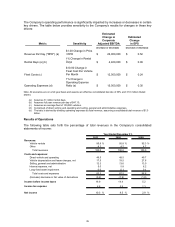

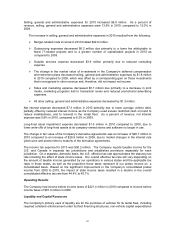

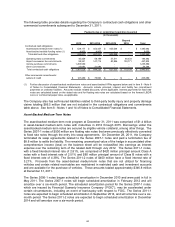

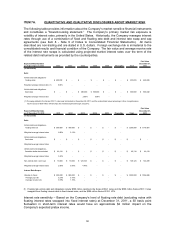

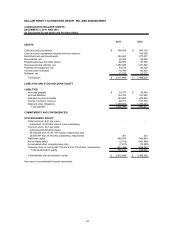

The following table provides details regarding the Company’s contractual cash obligations and other

commercial commitments subsequent to December 31, 2011:

Beyond

2012 2013-2014 2015-2016 2016 Total

Contractual cash obligations:

Asset-backed medium-term notes (1) 528,177$ 452,437$ 503,048$ -$ 1,483,662$

Asset-backed variable funding notes (1) 4,800 4,800 - - 9,600

Total debt and other obligations 532,977 457,237 503,048 - 1,493,262

Operating lease commitments 40,429 58,189 37,511 48,333 184,462

Airport concession fee commitments 98,351 147,714 80,996 130,771 457,832

Vehicle purchase commitments 1,255,589 - - - 1,255,589

Other commitments 23,682 31,086 - - 54,768

Total contractual cash obligations 1,951,028$ 694,226$ 621,555$ 179,104$ 3,445,913$

Other commercial commitments:

Letters of credit 127,489$ 75,600$ -$ -$ 203,089$

Payments due or commitment expiration by period

(in thousands)

(1) Further discussion of asset-backed medium-term notes and asset-backed VFNs appears below and in Item 8 - Note 8

of Notes to Consolidated Financial Statements. Amounts include principal, interest and facility fee commitment

payments on undrawn facilities. Amounts exclude related discounts, where applicable. Interest payments for fixed rate

notes are calculated based on the stated rate and for floating rate notes are calculated based on the forward LIBOR

curve or commercial paper rates, as applicable.

The Company also has self-insured liabilities related to third-party bodily injury and property damage

claims totaling $86.5 million that are not included in the contractual obligations and commitments

table above. See Item 8 - Notes 1 and 14 of Notes to Consolidated Financial Statements.

Asset-Backed Medium-Term Notes

The asset-backed medium-term note program at December 31, 2011 was comprised of $1.4 billion

in asset-backed medium-term notes with maturities in 2012 through 2015. Borrowings under the

asset-backed medium-term notes are secured by eligible vehicle collateral, among other things. The

Series 2007-1 notes of $500 million are floating rate notes that were previously effectively converted

to fixed rate notes through the entry into swap agreements. On December 28, 2011, the Company

terminated its swap agreements related to the Series 2007-1 notes and paid a termination fee of

$8.8 million to settle the liability. The remaining unamortized value of the hedge in accumulated other

comprehensive income (loss) on the balance sheet will be reclassified into earnings as interest

expense over the remaining term of the related debt through July 2012. The Series 2011-1 notes,

with a fixed blended interest rate of 2.81%, are comprised of $420 million principal amount Class A

notes with a fixed interest rate of 2.51% and $80 million principal amount of Class B notes with a

fixed interest rate of 4.38%. The Series 2011-2 notes of $400 million have a fixed interest rate of

3.21%. Proceeds from the asset-backed medium-term notes that are not utilized for financing

vehicles and certain related receivables are maintained in restricted cash and investment accounts

and are available for the purchase of vehicles. These amounts totaled approximately $346.8 million

at December 31, 2011.

The Series 2006-1 notes began scheduled amortization in December 2010 and were paid in full in

May 2011. The Series 2007-1 notes will begin scheduled amortization in February 2012 and will

amortize over a six-month period. The scheduled amortization period for the Series 2007-1 notes,

which are insured by Financial Guaranty Insurance Company (“FGIC”), may be accelerated under

certain circumstances, including an event of bankruptcy with respect to FGIC. The Series 2011-1

notes are expected to begin scheduled amortization in September 2014, and will amortize over a six-

month period. The Series 2011-2 notes are expected to begin scheduled amortization in December

2014 and will amortize over a six-month period.

44