Thrifty Car Rental 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEAR ENDED DECEMBER 31, 2011, 2010 AND 2009

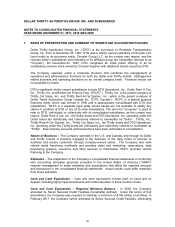

1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Dollar Thrifty Automotive Group, Inc. (“DTG”) is the successor to Pentastar Transportation

Group, Inc. Prior to December 23, 1997, DTG was a wholly owned subsidiary of Chrysler LLC

(such entity or its successor entity, Chrysler Group LLC, as the context may require, and the

relevant entity’s subsidiaries and members of its affiliated group are hereinafter referred to as

“Chrysler”). On December 23, 1997, DTG completed an initial public offering of all its

outstanding common stock owned by Chrysler together with additional shares issued by DTG.

The Company operates under a corporate structure that combines the management of

operations and administrative functions for both the Dollar and Thrifty brands. Management

makes business and operating decisions on an overall company basis. Financial results are

not available by brand.

DTG’s significant wholly owned subsidiaries include DTG Operations, Inc., Dollar Rent A Car,

Inc., Thrifty, Inc. and Rental Car Finance Corp. (“RCFC”). Thrifty, Inc. is the parent company of

Thrifty Car Sales, Inc. and Thrifty Rent-A-Car System, Inc., which is the parent company of

Dollar Thrifty Automotive Group Canada Inc. (“DTG Canada”). RCFC is a special purpose

financing entity, which was formed in 1995 and is appropriately consolidated with DTG and

subsidiaries. RCFC is a separate legal entity whose assets are not available to satisfy any

claims of creditors of DTG or any of its other subsidiaries. The term the “Company” is used to

refer to DTG, individually or collectively with its consolidated subsidiaries, as the context may

require. Dollar Rent A Car, Inc., the Dollar brand and DTG Operations, Inc. operating under the

Dollar brand are individually and collectively referred to hereinafter as “Dollar”. Thrifty, Inc.,

Thrifty Rent-A-Car System, Inc., Thrifty Car Sales, Inc., the Thrifty brand and DTG Operations,

Inc. operating under the Thrifty brand are individually and collectively referred to hereinafter as

“Thrifty”. Intercompany accounts and transactions have been eliminated in consolidation.

Nature of Business – The Company operates in the U.S. and Canada, and through its Dollar

and Thrifty brands is primarily engaged in the business of the daily rental of vehicles to

business and leisure customers through company-owned stores. The Company also sells

vehicle rental franchises worldwide and provides sales and marketing, reservations, data

processing systems, insurance and other services to franchisees. RCFC provides vehicle

financing to the Company.

Estimates – The preparation of the Company’s consolidated financial statements in conformity

with accounting principles generally accepted in the United States of America (“GAAP”)

requires management to make estimates and assumptions that affect the reported amounts

and disclosures in the consolidated financial statements. Actual results could differ materially

from those estimates.

Cash and Cash Equivalents – Cash and cash equivalents include cash on hand and on

deposit, including highly liquid investments with initial maturities of three months or less.

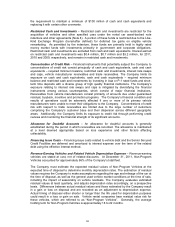

Cash and Cash Equivalents – Required Minimum Balance – In 2009, the Company

amended its Senior Secured Credit Facilities (hereinafter defined). Under the terms of that

amendment, the Company was required to maintain a minimum of $100 million at all times. In

February 2011, the Company further amended its Senior Secured Credit Facilities, eliminating

58