Thrifty Car Rental 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The assets of RCFC, including revenue-earning vehicles related to the asset-backed medium-

term notes, restricted cash and investments, and certain receivables related to revenue-earning

vehicles, are available to satisfy the claims of its creditors. Dollar and Thrifty lease vehicles

from RCFC under the terms of certain master lease and servicing agreements. The asset-

backed note indentures also provide for additional credit enhancement through over

collateralization of the vehicle fleet, cash or letters of credit and/or maintenance of a liquidity

reserve. RCFC is in compliance with the terms of the indentures.

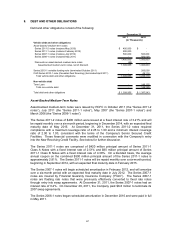

Variable Funding Notes

The Series 2010-1 variable funding note (“VFN”) of $200 million and the Series 2010-2 VFN of

$300 million were both terminated in October of 2011.

On September 29, 2011, RCFC renewed the Series 2010-3 VFN, increasing the capacity from

$450 million to $600 million and extending the revolving period from the previous 364-day

structure to two years. The facility bears interest at a spread of 130 basis points above each

funding institution’s cost of funds, which may be based on either the weighted-average

commercial paper rate, a floating one-month LIBOR rate or a Eurodollar rate. The Series 2010-

3 VFN was undrawn at December 31, 2011. The Series 2010-3 VFN has a facility fee

commitment rate of up to 0.8% per annum on any unused portion of the facility. At the end of

the revolving period, the then-outstanding principal amount of the Series 2010-3 VFN will be

repaid monthly over a three-month period, beginning in October 2013, with the final payment in

December 2013. At December 31, 2011, the Series 2010-3 VFN required compliance with a

maximum leverage ratio of 2.25 to 1.00 and a minimum interest coverage ratio of 2.00 to 1.00,

consistent with the terms of the Company’s Senior Secured Credit Facilities. These financial

covenants were modified in connection with the Company’s entry into the New Revolving Credit

Facility. See below for further discussion.

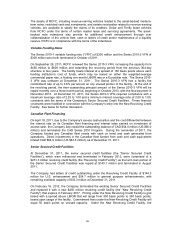

Canadian Fleet Financing

On April 18, 2011, due to the Company’s excess cash position and the cost differential between

the interest rate on its Canadian fleet financing and interest rates earned on investment of

excess cash, the Company fully repaid the outstanding balance of CAD $54.0 million (US $56.0

million) and terminated the CAD Series 2010 Program. During the remainder of 2011, the

Company funded any Canadian fleet needs with cash on hand and cash generated from

operations. Direct investments in the Canadian fleet funded from cash and cash equivalents

totaled CAD $64.9 million (US $63.5 million) as of December 31, 2011.

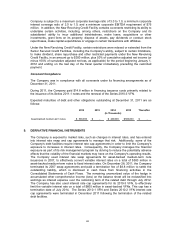

Senior Secured Credit Facilities

At December 31, 2011, the senior secured credit facilities (the “Senior Secured Credit

Facilities”), which were refinanced and terminated in February 2012, were comprised of a

$231.3 million revolving credit facility (the “Revolving Credit Facility”) as the term loan portion of

the Senior Secured Credit Facilities was repaid at $143.1 million and terminated in August

2011.

The Company had letters of credit outstanding under the Revolving Credit Facility of $144.3

million for U.S. enhancement and $54.7 million in general purpose enhancements, with

remaining available capacity of $32.3 million at December 31, 2011.

On February 16, 2012, the Company terminated the existing Senior Secured Credit Facilities

and replaced it with a new $450 million revolving credit facility (the “New Revolving Credit

Facility”) that expires in February 2017. Pricing under the New Revolving Credit Facility is grid

based with a spread above LIBOR that will range from 300 basis points to 350 basis points,

based upon usage of the facility. Commitment fees under the New Revolving Credit Facility will

equal 50 basis points on unused capacity. Under the New Revolving Credit Facility, the

68