Thrifty Car Rental 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On February 17, 2012, the Company extended the Rights Plan for one year, which now expires

on May 30, 2013.

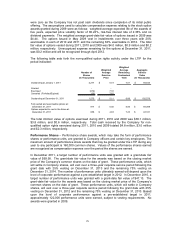

Public Stock Offering

In October 2009, the Company entered into a terms agreement with certain underwriters to

issue and sell 5,750,000 shares of the Company’s common stock, par value $0.01 per share,

at a price to the public of $19.25 per share. The Company also granted the underwriters an

option to purchase up to an additional 862,500 shares of common stock. The sale was made

pursuant to the Company’s registration statement on Form S-3 filed with the Securities and

Exchange Commission. The sale of the initial shares closed on November 3, 2009, and the

sale of the additional shares pursuant to the underwriters’ option to purchase additional shares

closed on November 11, 2009. The 6,612,500 shares issued resulted in $120.6 million of net

proceeds to the Company after deducting underwriting discounts, commissions and expenses

of the offering of $6.6 million.

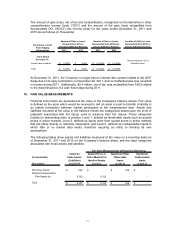

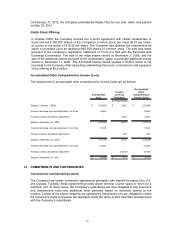

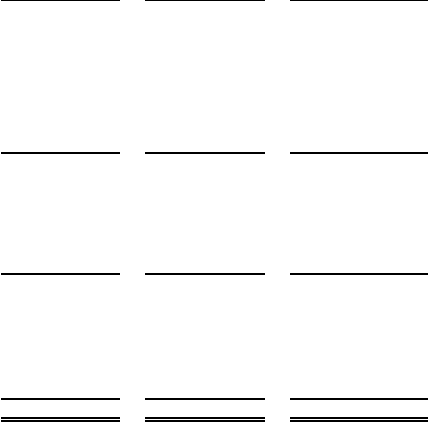

Accumulated Other Comprehensive Income (Loss)

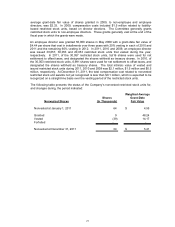

The components of accumulated other comprehensive income (loss) are as follows:

Interest Rate

Swap

Foreign

Currency

Translation

Accumulated

Other

Comprehensive

Income (Loss)

(In Thousands)

Balance, January 1, 2009 (32,952)$ 3,564$ (29,388)$

Interest rate swap and cap adjustment, net of tax 8,662 - 8,662

Foreign currency translation adjustment - 2,352 2,352

Balance, December 31, 2009 (24,290) 5,916 (18,374)

Interest rate swap and cap adjustment, net of tax 5,543 - 5,543

Foreign currency translation adjustment - 502 502

Balance, December 31, 2010 (18,747) 6,418 (12,329)

Interest rate swap and cap adjustment, net of tax 10,259 - 10,259

Foreign currency translation adjustment - (5,547) (5,547)

Balance, December 31, 2011 (8,488)$ 871$ (7,617)$

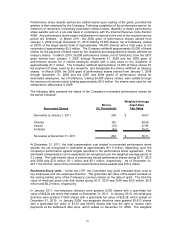

14. COMMITMENTS AND CONTINGENCIES

Concessions and Operating Leases

The Company has certain concession agreements principally with airports throughout the U.S.

and Canada. Typically, these agreements provide airport terminal counter space in return for a

minimum rent. In many cases, the Company’s subsidiaries are also obligated to pay insurance

and maintenance costs and additional rents generally based on revenues earned at the

location. Certain of the airport locations are operated by franchisees who are obligated to make

the required rent and concession fee payments under the terms of their franchise arrangements

with the Company’s subsidiaries.

81