Thrifty Car Rental 2011 Annual Report Download - page 86

Download and view the complete annual report

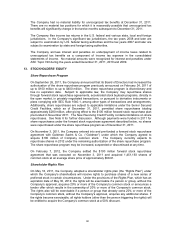

Please find page 86 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.commission and airport concession fees violate antitrust laws and various other rights and laws

by compelling out-of-state visitors to subsidize the passenger car rental tourism assessment

program, violation of the California Business and Professions Code breach of contract. The

Company has accrued a contingency related to the preliminary settlement.

The Colorado lawsuit alleges violation of the Colorado Consumer Protection Act. The lawsuit in

Colorado was dismissed with prejudice in July 2010 and the plaintiffs filed a notice of appeal in

August 2010. Appellate briefing was completed on May 16, 2011 and oral argument on the

appeal occurred on December 6, 2011, and the parties are awaiting a ruling. The Company

intends to vigorously defend these matters. Given the inherent uncertainties of litigation, the

Company cannot predict the ultimate outcome or reasonably estimate the amount of ultimate

loss that may arise from these lawsuits.

Various other legal actions, claims and governmental inquiries and proceedings have been in

the past, or may be in the future, asserted or instituted against the Company, including other

purported class actions or proceedings relating to the Hertz transaction terminated in October

2010 or a potential acquisition transaction, and some that may demand large monetary

damages or other relief which could result in significant expenditures. Litigation is subject to

many uncertainties and is inherently unpredictable. The Company is also subject to potential

liability related to environmental matters. The Company establishes reserves for litigation and

environmental matters when the loss is probable and reasonably estimable. It is reasonably

possible that the final resolution of some of these matters may require the Company to make

expenditures in excess of established reserves. The term “reasonably possible” is used herein

to mean that the chance of a future transaction or event occurring is more than remote but less

than probable. The Company evaluates developments in its legal matters that could affect the

amount of previously accrued reserves and makes adjustments as appropriate. Significant

judgment is required to determine both likelihood of a further loss and the estimated amount of

the loss. With respect to outstanding litigation and environmental matters, based on current

knowledge, the Company believes that the amount or range of reasonably possible loss will

not, either individually or in the aggregate, have a material adverse effect on its business or

consolidated financial statements. However, the outcome of such legal matters is inherently

unpredictable and subject to significant uncertainties.

Other

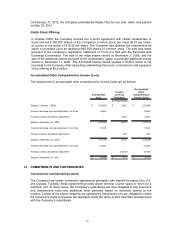

On April 4, 2011, the Company and HP Enterprise Services, LLC (“HP”) entered into a three

and one-half year data processing service agreement (the “Service Agreement”), which

requires annual payments of approximately $20 million for 2012 and 2013 and approximately

$10 million for 2014. The Company also has a telecommunications contract which will require

annual payments totaling $1.2 million for 2012. Additionally, the Company has software and

hardware maintenance agreements which require annual payments totaling approximately $2.1

million and $1.5 million for 2012 and 2013, respectively.

In addition to the letters of credit described in Note 8, the Company had letters of credit totaling

$4.0 million and $5.5 million at December 31, 2011 and 2010, respectively, which are primarily

used to support insurance programs and airport concession obligations in Canada. The

Company may also provide guarantees on behalf of franchisees to support compliance with

airport concession bids. Non-performance of the obligation by the franchisee would trigger the

obligation of the Company. At December 31, 2011, there were no such guarantees on behalf

of franchisees.

At December 31, 2011, the Company had outstanding vehicle purchase commitments of

approximately $1.3 billion over the next 12 months.

84