Thrifty Car Rental 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

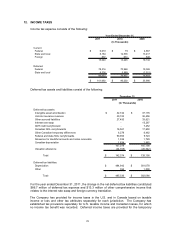

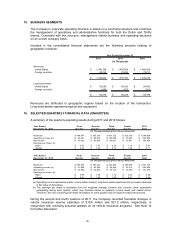

12. INCOME TAXES

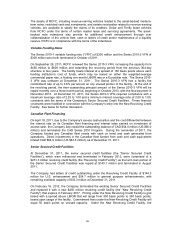

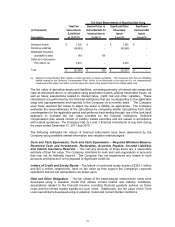

Income tax expense consists of the following:

Year Ended December 31,

2011 2010 2009

Current:

Federal 6,019$ 79$ 4,867$

State and local 8,184 12,535 13,417

Foreign 837 631 848

15,040 13,245 19,132

Deferred:

Federal 78,316 70,968 19,365

State and local 8,336 5,989 (2,511)

86,652 76,957 16,854

101,692$ 90,202$ 35,986$

(In Thousands)

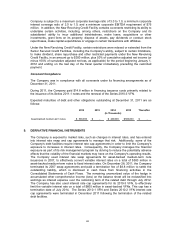

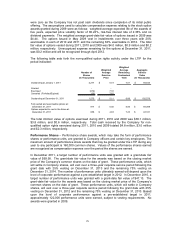

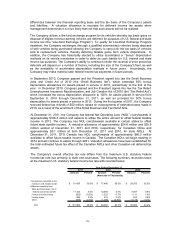

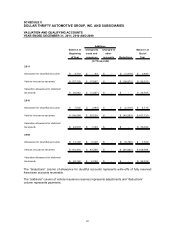

Deferred tax assets and liabilities consist of the following:

2011 2010

Deferred tax assets:

Intangible asset amortization 32,744$ 37,176$

Vehicle insurance reserves 30,183 38,456

Other accrued liabilities 27,450 33,621

Interest rate swap - 15,267

AMT credit carryforward - 7,252

Canadian NOL carryforwards 16,561 17,650

Other Canadian temporary differences 6,278 6,462

Federal and state NOL carryforwards 50,993 5,723

Allowance for doubtful accounts and notes receivable 1,036 1,729

Canadian depreciation 1,834 1,862

167,079 165,198

Valuation allowance (24,705) (26,042)

Total 142,374$ 139,156$

Deferred tax liabilities:

Depreciation 484,942$ 381,078$

Other 394 1,008

Total 485,336$ 382,086$

December 31,

(In Thousands)

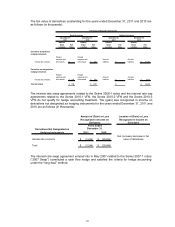

For the year ended December 31, 2011, the change in the net deferred tax liabilities constituted

$86.7 million of deferred tax expense and $13.3 million of other comprehensive income that

relates to the interest rate swap and foreign currency translation.

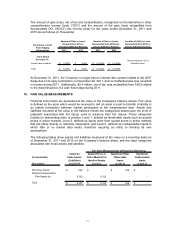

The Company has provided for income taxes in the U.S. and in Canada based on taxable

income or loss and other tax attributes separately for each jurisdiction. The Company has

established tax provisions separately for U.S. taxable income and Canadian losses, for which

no income tax benefit was recorded. Deferred income taxes are provided for the temporary

78