Thrifty Car Rental 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

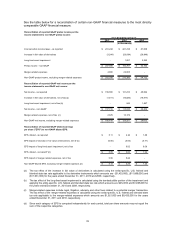

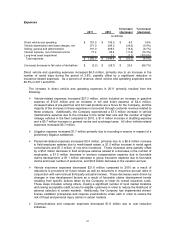

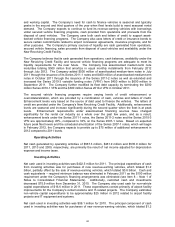

Expenses

$ Increase/ % Increase/

2011 2010 (decrease) (decrease)

Direct vehicle and operating 751.5$ 745.5$ 6.0$ 0.8%

Vehicle depreciation and lease charges, net 271.0 299.2 (28.2) (9.4%)

Selling, general and administrative 191.0 209.3 (18.3) (8.7%)

Interest expense, net of interest income 77.4 89.3 (11.9) (13.3%)

Long-lived asset impairment - 1.1 (1.1) (100.0%)

Total expenses 1,290.9$ 1,344.4$ (53.5)$ (4.0%)

(Increase) decrease in fair value of derivatives (3.2)$ (28.7)$ 25.5$ (88.7%)

(in millions)

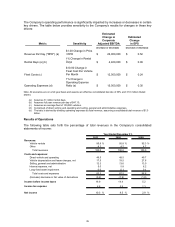

Direct vehicle and operating expenses increased $6.0 million, primarily due to an increase in the

number of rental days during the period of 3.8%, partially offset by a significant reduction in

insurance-related expenses. As a percent of revenue, direct vehicle and operating expenses were

48.5% in 2011 and 2010.

The increase in direct vehicle and operating expenses in 2011 primarily resulted from the

following:

Vehicle-related expenses increased $27.3 million, which included an increase in gasoline

expense of $12.6 million and an increase in toll and ticket expense of $4.4 million.

Increased sales of pre-paid fuel and toll road products are a focus for the Company, and the

majority of the increase in these expenses is recovered through customer revenue related to

these products. Additionally, the Company experienced a $7.5 million increase in vehicle

maintenance expense due to the increase in the rental fleet size and the number of higher

mileage vehicles in the fleet compared to 2010, a $1.4 million increase in shuttling expense

and a $0.7 million increase in general excise and surcharge taxes. All other vehicle-related

expenses increased $0.7 million.

Litigation expense increased $1.7 million primarily due to recording a reserve in respect of a

preliminary litigation settlement.

Personnel-related expenses increased $0.4 million, primarily due to a $6.6 million increase

in field employee salaries due to merit-based raises, a $1.5 million increase in rental agent

commissions and $1.3 million of one-time incentives. These increases were partially offset

by a $5.6 million decrease in field employee salaries related to a decrease in the number of

employees, a $1.5 million decrease in workers compensation expense due to favorable

claims development, a $1.1 million decrease in group insurance expense due to favorable

claims and lower number of personnel, and $0.8 million decrease in the vacation accrual.

Vehicle insurance expenses decreased $21.6 million compared to 2010 as a result of

reductions in provisions for future losses as well as reductions in insurance accrual rates in

conjunction with semi-annual third-party actuarial reviews. These decreases were driven by

changes in loss development factors as a result of favorable claims development trends

resulting from specific actions taken by the Company to lower its overall insurance costs.

Those steps included, among others, closing a significant number of local market locations

and raising acceptable credit scores for eligible customers in order to reduce the likelihood of

adverse selection in certain markets. Additionally, the Company has implemented drivers’

license validation procedures and requires examinations under oath in order to reduce the

risk of fraud and personal injury claims in certain markets.

Communications and computer expenses decreased $1.6 million due to cost reduction

initiatives.

37