Thrifty Car Rental 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

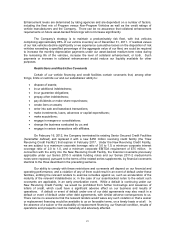

DTG’s common stock is listed on the New York Stock Exchange under the trading symbol “DTG.”

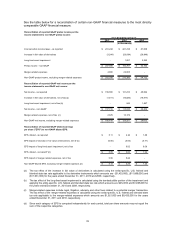

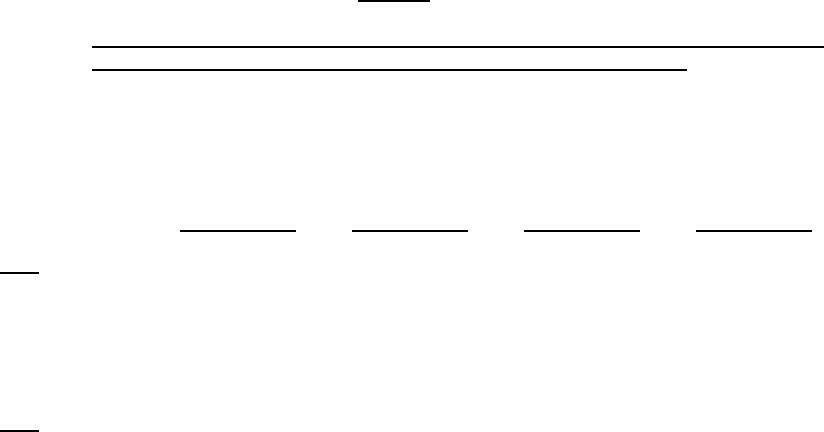

The high and low closing sales prices for the common stock for each quarterly period during 2011

and 2010 were as follows:

First Second Third Fourth

Quarter Quarter Quarter Quarter

2011

High 66.73$ 83.74$ 74.26$ 70.43$

Low 47.70$ 66.60$ 56.30$ 53.83$

2010

High 34.60$ 51.55$ 52.34$ 50.00$

Low 23.84$ 32.09$ 41.06$ 45.76$

The 28,141,936 shares of common stock outstanding at February 22, 2012 were held by

approximately 2,600 registered and beneficial holders. The Company has not paid cash dividends

since completion of its initial public offering in December 1997. The declaration of any dividends will

be subject to the approval of the Board. The payment of cash dividends is subject to limitations

under the New Revolving Credit Facility.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On September 26, 2011, the Company announced that its Board of Directors had increased the

authorization of the share repurchase program previously announced on February 24, 2011 of up to

$100 million to up to $400 million. The share repurchase program is discretionary and has no

expiration date. Subject to applicable law, the Company may repurchase shares through forward

stock repurchase agreements, accelerated stock buyback programs, directly in the open market, in

privately negotiated transactions, or pursuant to derivative instruments or plans complying with SEC

Rule 10b5-1, among other types of transactions and arrangements. The New Revolving Credit

Facility entered into on February 16, 2012, contains limitations on share repurchases. See Item 8 -

Note 8 of Notes to Consolidated Financial Statements for further discussion. Although payments

were funded in 2011 for share repurchases under the forward stock repurchase agreement

described below, no shares were repurchased under the share repurchase program as of December

31, 2011.

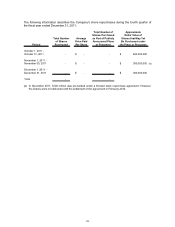

On November 3, 2011, the Company entered into and pre-funded a forward stock repurchase

agreement with Goldman Sachs & Co. (“Goldman”) under which the Company agreed to acquire

$100 million of Company common stock. The repurchase was settled in February 2012, and the

Company acquired 1,451,193 shares of its common stock at an average share price of

approximately $68.91. The Company currently expects to repurchase shares in 2012 under the

remaining authorization of the share repurchase program. The share repurchase program may be

increased, suspended or discontinued at any time.

28