Thrifty Car Rental 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

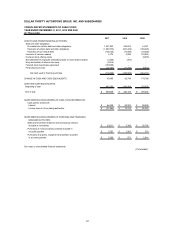

included only if the assumed tax benefit would decrease the Company’s current taxes payable.

Since the Company is not a taxpayer for federal income tax purposes in 2011, it does not

benefit from the tax deduction related to the assumed option exercises for purposes of the

diluted share calculation as it did in 2010, thus resulting in an increase in the dilutive EPS

denominator of approximately 700,000 shares. When the Company becomes a taxpayer in the

future, the tax benefit will be incorporated into the diluted share calculation and the shares

included in the diluted EPS calculation will be reduced by the shares repurchased from the

assumed proceeds; however, other factors, such as the Company’s stock price, could impact

the diluted EPS calculation. See Note 13 for further discussion of share repurchase program.

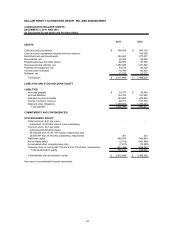

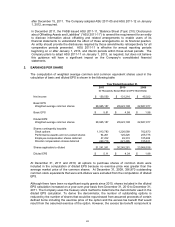

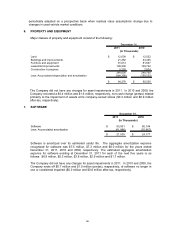

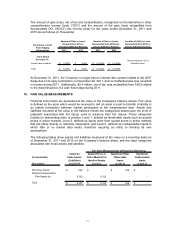

3. RECEIVABLES

Receivables consist of the following:

2011 2010

Trade accounts receivable and other 74,403$ 68,528$

Vehicle manufacturer receivables 21,510 4,543

Car sales receivable 2,287 1,100

98,200 74,171

Less: Allowance for doubtful accounts (2,840) (4,715)

95,360$ 69,456$

December 31,

(In Thousands)

Trade accounts receivable and other include primarily amounts due from rental customers,

franchisees and tour operators arising from billings under standard credit terms for services

provided in the normal course of business.

Vehicle manufacturer receivables include primarily amounts due under guaranteed residual,

buyback and Non-Program Vehicle incentive programs, which are paid according to contract

terms and are generally received within 60 days.

Car sales receivable include primarily amounts due from car sale auctions for the sale of both

Program Vehicles and Non-Program Vehicles.

Allowance for doubtful accounts represents potentially uncollectible amounts owed to the

Company from franchisees, tour operators, corporate account customers and others.

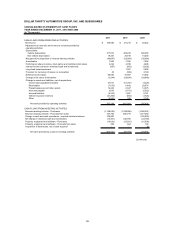

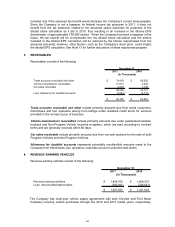

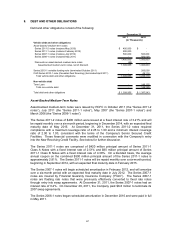

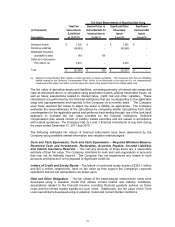

4. REVENUE–EARNING VEHICLES

Revenue-earning vehicles consist of the following:

2011 2010

Revenue-earning vehicles 1,858,766$ 1,668,473$

Less: Accumulated depreciation (390,931) (326,651)

1,467,835$ 1,341,822$

December 31,

(In Thousands)

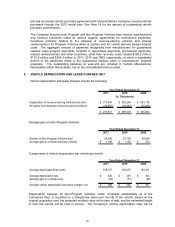

The Company has multi-year vehicle supply agreements with both Chrysler and Ford Motor

Company covering vehicle purchases through the 2012 and 2013 model years, respectively,

64