Thrifty Car Rental 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

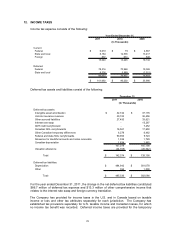

differences between the financial reporting basis and the tax basis of the Company’s assets

and liabilities. A valuation allowance is recorded for deferred income tax assets when

management determines it is more likely than not that such assets will not be realized.

The Company utilizes a like-kind exchange program for its vehicles whereby tax basis gains on

disposal of eligible revenue-earning vehicles are deferred for purposes of U.S. federal and state

income tax (the “Like-Kind Exchange Program”). To qualify for Like-Kind Exchange Program

treatment, the Company exchanges (through a qualified intermediary) vehicles being disposed

of with vehicles being purchased allowing the Company to carry-over the tax basis of vehicles

sold to replacement vehicles, thereby deferring taxable gains from vehicle dispositions. In

addition, the Company has historically elected to utilize accelerated or “bonus” depreciation

methods on its vehicle inventories in order to defer its cash liability for U.S. federal and state

income tax purposes. The Company’s ability to continue to defer the reversal of prior period tax

deferrals will depend on a number of factors, including the size of the Company’s fleet, as well

as the availability of accelerated depreciation methods in future years. Accordingly, the

Company may make material cash federal income tax payments in future periods.

In September 2010, Congress passed and the President signed into law the Small Business

Jobs and Credit Act of 2010 (the “Small Business Act”), which extended 50% bonus

depreciation allowances for assets placed in service in 2010, retroactively to the first of the

year. In December 2010, Congress passed and the President signed into law the Tax Relief,

Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (the “Tax Relief Act”),

which increased the bonus depreciation allowance to 100% for assets placed in service from

September 9, 2010 through December 31, 2011, as well as provided for 50% bonus

depreciation for assets placed in service in 2012. During the first quarter of 2011, the Company

received federal tax refunds of $50 million, based on overpayments of estimated taxes made in

2010, as a result of the enactment of the Small Business and Tax Relief Acts.

At December 31, 2011, the Company has federal Net Operating Loss (“NOL”) carryfowards of

approximately $166.3 million and expects to utilize the entire amount to offset federal taxable

income in 2012. The Company has NOL carryforwards available in certain states to offset

future state taxable income. A valuation allowance of approximately $24.6 million and $25.9

million existed at December 31, 2011 and 2010, respectively, for Canadian NOLs and

approximately $0.1 million at both December 31, 2011 and 2010, for state NOLs. At

December 31, 2011, DTG Canada has NOL carryforwards of approximately $66.2 million

available to offset future taxable income in Canada. The Canadian NOLs will begin expiring in

2014 and will continue to expire through 2031. Valuation allowances have been established for

the total estimated future tax effect of the Canadian NOLs and other Canadian net deferred tax

assets.

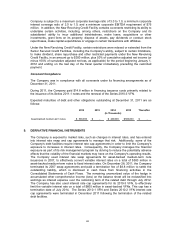

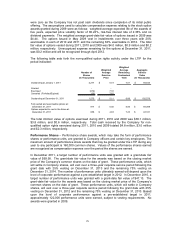

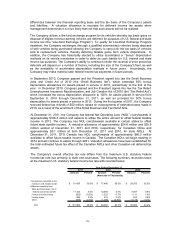

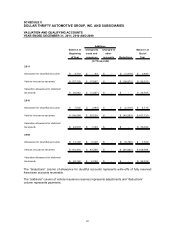

The Company’s overall effective tax rate differs from the maximum U.S. statutory federal

income tax rate due primarily to state and local taxes. The following summary reconciles taxes

at the maximum U.S. statutory federal income tax rate with recorded taxes:

A

mount Percent

A

mount Percent Amount Percent

(Amounts in Thousands)

Tax expense computed at the

maximum U.S. statutory rate

91,435$ 35.0% 77,496$ 35.0% 28,353$ 35.0%

Difference resulting from:

State and local taxes, net of

federal income tax benefit

11,132 4.2% 12,056 5.4% 7,007 8.6%

Foreign (income) losses

(623) (0.2%) 1,522 0.7% 1,111 1.4%

Foreign taxes

586 0.2% 416 0.2% 633 0.8%

Other

(838) (0.3%) (1,288) (0.6%) (1,118) (1.4%)

Total

101,692$ 38.9% 90,202$ 40.7% 35,986$ 44.4%

Year Ended December 31,

2011 2010 2009

79