Starwood 2006 Annual Report Download - page 97

Download and view the complete annual report

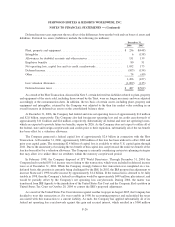

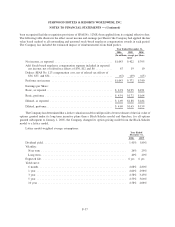

Please find page 97 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 19. Stockholders’ Equity

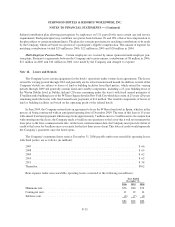

Share Repurchases. In May 2006, the Board of Directors of the Company authorized the repurchase of up to

an additional $600 million of Corporation Shares under the Company’s existing Corporation Share repurchase

authorization (the “Share Repurchase Authorization”). During the year ended December 31, 2006, the Company

repurchased 21.7 million Shares and Corporation Shares at a total cost of $1.263 billion. Pursuant to the Share

Repurchase Authorization, through December 31, 2006, Starwood has repurchased 59.4 million Shares and

Corporation Shares in the open market for an aggregate cost of $2.7 billion. As of December 31, 2006,

approximately $380 million remains available under the Share Repurchase Authorization.

Disposition of the Trust. As part of the Host Transaction, the Company sold the Class A Shares of the Trust,

and shareholders sold the Class B Shares of the Trust. As this sale involved a transaction with Starwood’s

shareholders, the book value of the Trust associated with this sale was treated as a non-reciprocal transaction with

owners and was removed through retained earnings up to the amount of retained earnings that existed at the sale date

with the remaining balance reducing additional paid-in capital. See Notes 1 and 5 for additional information on the

Host Transaction.

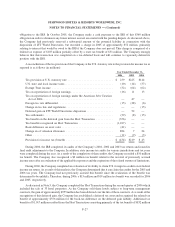

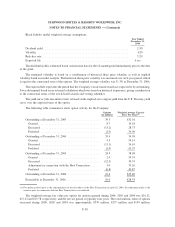

Exchangeable Preferred Shares. During 1998, 6.3 million shares of Class A EPS, 5.5 million shares of

Class B EPS and approximately 800,000 limited partnership units of the SLT Realty Limited Partnership (the

“Realty Partnership”) and SLC Operating Limited Partnership (the “Operating Partnership”) were issued by the

Trust and Corporation in connection with the acquisition of Westin Hotels & Resorts Worldwide, Inc. and certain of

its affiliates.

On March 15, 2006, the Company completed the redemption of the remaining 25,000 outstanding shares of

Class B EPS for approximately $1 million in cash. On April 10, 2006, when the Company consummated the first

phase of the Host Transaction, holders of Class A EPS received from Host $0.503 in cash and 0.6122 shares of Host

common stock. Also in connection with the Host Transaction, the Company redeemed all of the Class A EPS

(approximately 562,000 shares) and Realty Partnership units (approximately 40,000 units) for approximately

$34 million in cash. The Operating Partnership units are convertible into Shares at the unit holder’s option, provided

that the Company has the option to settle conversion requests in cash or Shares. For the year ended December 31,

2006, the Company redeemed approximately 926,000 Operating Partnership units for approximately $56 million in

cash, and there were approximately 179,000 of these units outstanding at December 31, 2006.

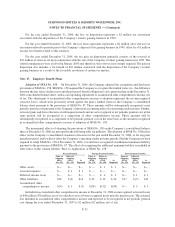

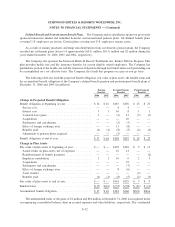

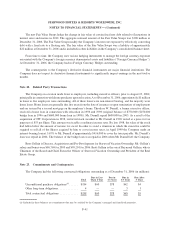

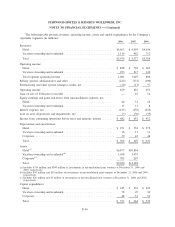

Note 20. Stock-Based Compensation

In 2004, the Company adopted the 2004 Long-Term Incentive Compensation Plan (“2004 LTIP”), which

superseded the 2002 Long Term Incentive Compensation Plan (“2002 LTIP”) and provides for the purchase of

Shares by directors, officers, employees, consultants and advisors, pursuant to equity award grants. Although no

additional awards will be granted under the 2002 LTIP, the Company’s 1999 Long Term Incentive Compensation

Plan or the Company’s 1995 Share Option Plan, the provisions under each of the previous plans will continue to

govern awards that have been granted and remain outstanding under those plans. The aggregate award pool for non-

qualified or incentive stock options, performance shares, restricted stock or any combination of the foregoing which

are available to be granted under the 2004 LTIP at December 31, 2006 was approximately 70 million (with options

counted as one share and restricted stock and performance units counted as 2.8 shares).

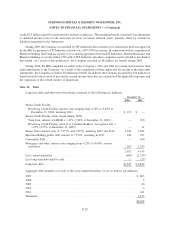

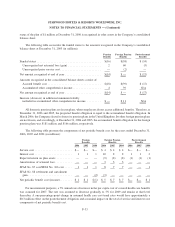

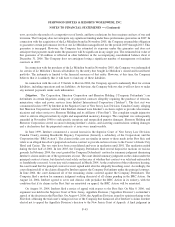

Prior to January 1, 2006, the Company accounted for those plans under the recognition and measurement

principles of Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees,” and

related interpretations. In general, no stock-based employee compensation cost related to stock options was

reflected in 2005 or 2004 net income, as options granted to employees under these plans had an exercise price equal

to the fair value of the underlying common stock on the date of grant. Effective January 1, 2006, the Company

adopted the fair value recognition provisions of SFAS No. 123(R). Under the modified prospective method of

adoption selected by the Company, compensation cost recognized in 2006 is the same as that which would have

F-36

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)