Starwood 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.favor of the Company and against Intelnet in the First Suit has been entered. By virtue of the agreement between the

parties discussed above, the BRC Action is now also finally resolved. The Company presently anticipates no further

litigation by Intelnet relating to the First Suit or the BRC Litigation.

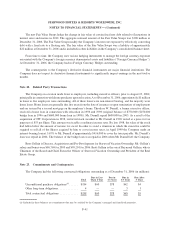

Starwood Asia Pacific Management Pte Ltd and Starwood Hotels and Resorts Worldwide, Inc. are Defendants

in Suit No. 961 of 2002/C commenced by Asia Hotel Investments Ltd (“AHIL”) in the High Court of Singapore. In

connection with its interest in the acquisition of a majority stake in a hotel in Bangkok, Thailand, AHIL considered

Starwood as a potential operator of the hotel and the parties signed a Confidentiality and Non-Circumvention

Agreement (the “AHIL Agreement”) in December of 2001. The AHIL Agreement placed certain restrictions on

Starwood’s dealings as they related to the hotel. AHIL proved unsuccessful in its acquisition attempt and Starwood

was contacted by the successful bidder to manage the hotel as a Westin and a management contract was signed.

AHIL is alleging that the new owner of the majority stake could not have completed the acquisition of that stake

without an agreement by Starwood to operate the hotel as a Westin and that Starwood’s agreement to do so was in

violation of the AHIL Agreement.

AHIL brought suit in the trial court in Singapore and claimed loss of profits of approximately US$54 million.

However, at the time of the trial AHIL reduced its claim to one of loss of chance and asked the court to assess

damages. Starwood vigorously objected to such claims and put forth a two-fold defense claiming:

(a) that no breach had been committed; and

(b) that even if a breach had been committed, it was merely technical, that is as AHIL was unsuccessful in

acquiring the majority stake in the hotel, AHIL’s loss, if any, was not caused by Starwood, but by its

own inability to consummate the acquisition.

The trial judge agreed with Starwood that the breach was merely technical and awarded AHIL nominal damages of

ten Singapore dollars.

AHIL appealed its case to the Court of Appeal (which is the highest court in the Singapore judicial system) and

in a majority decision of 2-1 (with the Chief Justice strongly dissenting), AHIL’s appeal was allowed. The majority

ruled that the matter should be sent for assessment of damages for the court to ascertain what chance AHIL had to

acquire the majority stake in the hotel, and place a value on that chance.

The hearing of the assessment of damages concluded in the first quarter of 2006, and closing submissions were

delivered by both parties in the second quarter of 2006. It is expected that the court’s decision on the assessment of

damages will be delivered in the first quarter of 2007. Starwood does not expect the resolution of this matter will

have a material adverse effect on the consolidated results of operations, financial position or cash flows.

The Company is involved in various other legal matters that have arisen in the normal course of business, some

of which include claims for substantial sums. Accruals have been recorded when the outcome is probable and can be

reasonably estimated. While the ultimate results of claims and litigation cannot be determined, the Company does

not expect that the resolution of all legal matters will have a material adverse effect on its consolidated results of

operations, financial position or cash flow. However, depending on the amount and the timing, an unfavorable

resolution of some or all of these matters could materially affect the Company’s future results of operations or cash

flows in a particular period.

Collective Bargaining Agreements. At December 31, 2006, approximately 38% of the Company’s

U.S.-based employees were covered by various collective bargaining agreements providing, generally, for basic

pay rates, working hours, other conditions of employment and orderly settlement of labor disputes. Generally, labor

relations have been maintained in a normal and satisfactory manner, and management believes that the Company’s

employee relations are satisfactory.

Environmental Matters. The Company is subject to certain requirements and potential liabilities under

various federal, state and local environmental laws, ordinances and regulations. Such laws often impose liability

F-44

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)