Starwood 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

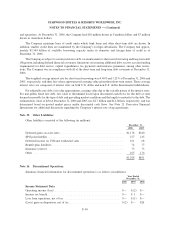

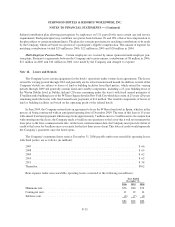

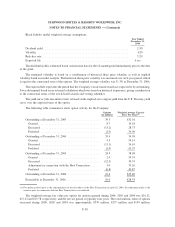

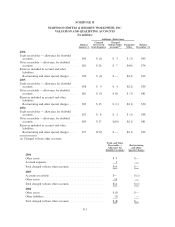

The following table summarizes the Company’s restricted stock activity during 2006:

Number of

Restricted

Stock Units

(in millions)

Weighted Average

Grant Date Value

Per Share

Outstanding at December 31, 2005 .......................... 1.9 $51.91

Granted ............................................ 2.4 $57.84

Distributed .......................................... (0.1) $23.81

Adjustment in connection with the Host Transaction ........... 0.9 $55.70

Forfeited............................................ (0.4) $47.25

Outstanding at December 31, 2006 .......................... 4.7 $46.21

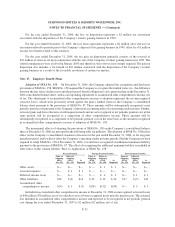

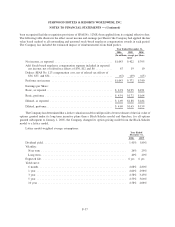

2002 Employee Stock Purchase Plan

In April 2002, the Board of Directors adopted (and in May 2002 the shareholders approved) the Company’s

2002 Employee Stock Purchase Plan (the “ESPP”) to provide employees of the Company with an opportunity to

purchase common stock through payroll deductions and reserved 10,000,000 Shares for issuance under the ESPP.

The ESPP commenced in October 2002.

All full-time regular employees who have completed 30 days of continuous service and who are employed by

the Company on U.S. payrolls are eligible to participate in the ESPP. Eligible employees may contribute up to 20%

of their total cash compensation to the ESPP. Amounts withheld are applied at the end of every three month

accumulation period to purchase Shares. The value of the Shares (determined as of the beginning of the offering

period) that may be purchased by any participant in a calendar year is limited to $25,000. Participants may withdraw

their contributions at any time before Shares are purchased.

For the purchase periods prior to June 1, 2005, the purchase price was equal to 85% of the lower of (a) the fair

market value of Shares on the day of the beginning of the offering period or (b) the fair market value of Shares on the

date of purchase. Effective June 1, 2005, the purchase price is equal to 95% of the fair market value of Shares on the

date of purchase. Approximately 115,000 Shares were issued under the ESPP during the year ended December 31,

2006 at purchase prices ranging from $50.60 to $60.96. Approximately 257,000 Shares were issued under the ESPP

during the year ended December 31, 2005 at purchase prices ranging from $45.19 to $57.48. Approximately

334,000 Shares were issued under the ESPP during the year ended December 31, 2004 at purchase prices ranging

from $29.66 to $37.91.

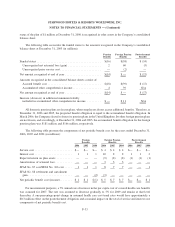

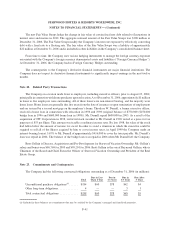

Note 21. Derivative Financial Instruments

The Company enters into interest rate swap agreements to manage interest expense. The Company’s objective

is to manage the impact of interest rate fluctuations on the results of operations, cash flows and the market value of

the Company’s debt. At December 31, 2006, the Company had no outstanding interest rate swap agreements under

which the Company pays a fixed rate and receives a variable rate of interest.

In March 2004, the Company terminated certain interest rate swap agreements, with a notional amount of

$1 billion under which the Company was paying floating rates and receiving fixed rates of interest (“Fair Value

Swaps”), resulting in a $33 million cash payment to the Company. The proceeds were used for general corporate

purposes and will result in a reduction of the interest expense on the corresponding underlying debt (Sheraton

Holding Public Debt and Senior Notes) through 2007, the scheduled maturity of the terminated Fair Value Swaps. In

order to adjust its fixed versus floating rate debt position, the Company immediately entered into two new Fair

Value Swaps.

F-40

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)