Starwood 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

energy, telecommunications, technology, employee benefits, food and beverage, furniture, fixtures and equipment

and operating supplies.

Diversification of Cash Flow and Assets. Management believes that the diversity of our brands, market

segments served, revenue sources and geographic locations provide a broad base from which to enhance revenue

and profits and to strengthen our global brands. This diversity limits our exposure to any particular lodging or

vacation ownership asset, brand or geographic region.

While we focus on the luxury and upscale portion of the full-service lodging, vacation ownership and

residential markets, our brands cater to a diverse group of sub-markets within this market. For example, the St. Regis

hotels cater to high-end hotel and resort clientele while Four Points by Sheraton hotels deliver extensive amenities

and services at more affordable rates. The aloft brand will provide a youthful alternative to the “commodity

lodging” of currently existing brands in the select-service market segment, and the Element brand will provide

modern, upscale hotels for extended stay travel.

We derive our cash flow from multiple sources within our hotel and vacation ownership and residential

segments, including owned hotels’ operations, management and franchise fees and the sale of VOIs and residential

units. These operations are in geographically diverse locations around the world. The following tables reflect our

hotel and vacation ownership and residential properties by type of revenue source and geographical presence by

major geographic area as of December 31, 2006:

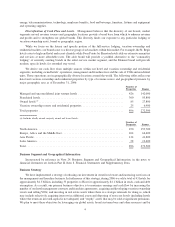

Number of

Properties Rooms

Managed and unconsolidated joint venture hotels ............................. 426 142,000

Franchised hotels ..................................................... 360 95,800

Owned hotels

(a)

...................................................... 85 27,800

Vacation ownership resorts and residential properties .......................... 25 6,900

Total properties ...................................................... 896 272,500

(a) Includes wholly owned, majority owned and leased hotels.

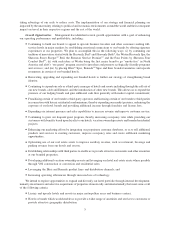

Number of

Properties Rooms

North America ...................................................... 450 153,700

Europe, Africa and the Middle East ....................................... 264 64,600

Asia Pacific ......................................................... 124 41,800

Latin America ....................................................... 58 12,400

Total .............................................................. 896 272,500

Business Segment and Geographical Information

Incorporated by reference in Note 24. Business Segment and Geographical Information, in the notes to

financial statements set forth in Part II, Item 8. Financial Statements and Supplementary Data.

Business Strategy

We have implemented a strategy of reducing our investment in owned real estate and increasing our focus on

the management and franchise business. In furtherance of this strategy, during 2006 we sold a total of 43 hotels for

approximately $4.5 billion, including 33 properties to Host for approximately $4.1 billion in stock, cash and debt

assumption. As a result, our primary business objective is to maximize earnings and cash flow by increasing the

number of our hotel management contracts and franchise agreements; acquiring and developing vacation ownership

resorts and selling VOIs; and investing in real estate assets where there is a strategic rationale for doing so, which

may include selectively acquiring interests in additional assets and disposing of non-core hotels (including hotels

where the return on invested capital is not adequate) and “trophy” assets that may be sold at significant premiums.

We plan to meet these objectives by leveraging our global assets, broad customer base and other resources and by

4