Starwood 2006 Annual Report Download - page 39

Download and view the complete annual report

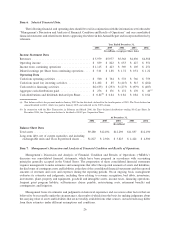

Please find page 39 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cumulative Effect of Accounting Change, Net of Tax

On January 1, 2006, we adopted SFAS No. 152 and recorded a charge of $70 million, net of a $46 million tax

benefit, in cumulative effect of accounting change.

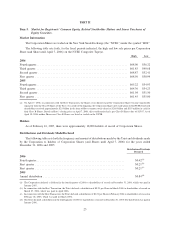

Year Ended December 31, 2005 Compared with Year Ended December 31, 2004

Continuing Operations

Revenues. Total revenues, including other revenues from managed and franchised properties, were

$5.977 billion, an increase of $609 million when compared to 2004 levels. Revenues reflected a 5.7% increase

in revenues from our owned, leased and consolidated joint venture hotels to $3.517 billion for the year ended

December 31, 2005 when compared to $3.326 billion in the corresponding period of 2004, a 38.9% increase in

vacation ownership and residential revenues to $889 million for the year ended December 31, 2005 when compared

to $640 million in the corresponding period of 2004, a 19.6% increase in management fees, franchise fees and other

income to $501 million for the year ended December 31, 2005 when compared to $419 million in the corresponding

period of 2004 and an increase of $87 million in other revenues from managed and franchised properties to

$1.070 billion for the year ended December 31, 2005 when compared to $983 million in the corresponding period of

2004.

The increase in revenues from owned, leased and consolidated joint venture hotels was due primarily to strong

results at our owned hotels in New York, New York, the Hawaiian Islands, Los Angeles, California, San Diego

California, Atlanta, Georgia, Seattle, Washington and Houston, Texas, partially offset by the loss of business due to

Hurricanes Dennis, Katrina, Rita and Wilma at our two owned hotels and one joint venture hotel in New Orleans,

two owned hotels in Florida and two owned hotels in Cancun, Mexico. Revenues at our Same-Store Owned Hotels

(119 hotels for the years ended December 31, 2005 and 2004, excluding 12 hotels sold or closed and 11 hotels

undergoing significant repositionings or without comparable results in 2005 and 2004) increased 8.2%, or

$240 million, to $3.183 billion for the year ended December 31, 2005 when compared to $2.943 billion in the

same period of 2004 due primarily to an increase in REVPAR. REVPAR at our Same-Store Owned Hotels increased

10.9% to $123.14 for the year ended December 31, 2005 when compared to the corresponding 2004 period. The

increase in REVPAR at these Same-Store Owned Hotels was attributed to increases in occupancy rates to 70.5% in

the year ended December 31, 2005 when compared to 68.3% in the same period in 2004, and a 7.5% increase in

ADR to $174.70 for the year ended December 31, 2005 compared to $162.50 for the corresponding 2004 period.

REVPAR at Same-Store Owned Hotels in North America increased 11.7% for the year ended December 31, 2005

when compared to the same period of 2004 due to increased transient and group travel business for the period,

primarily at our large owned hotels in the major United States cities and destinations discussed above. REVPAR at

our international Same-Store Owned Hotels increased by 8.8% for the year ended December 31, 2005 when

compared to the same period of 2004, with Europe, where we have our biggest concentration of international owned

hotels, increasing 7.8%. REVPAR for Same-Store Owned Hotels internationally increased 6.8% for the year ended

December 31, 2005 excluding the favorable effects of foreign currency translation. REVPAR for Same-Store

Owned Hotels in Europe increased 6.5% excluding the favorable effects of foreign currency translation.

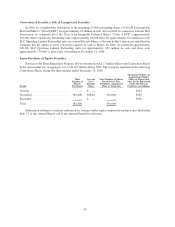

The increase in vacation ownership and residential sales and services of $249 million was primarily due to

sales of residential units at the St. Regis Museum Tower in San Francisco, California, which did not begin until the

fourth quarter of 2004. In the year ended December 31, 2005, we recognized approximately $183 million of

revenues from the San Francisco project compared to sales of $15 million in 2004. The St. Regis Museum Tower

opened in November 2005 with 260 hotel rooms and 102 condominium units. The increase in vacation ownership

and residential sales and services in 2005 was also due to an increase in the sales of VOIs of 11.3% to $591 million

in 2005 compared to $531 million in 2004. These increases represented increased sales volume as well as the

revenue recognition from progressing and completed projects accounted for under the percentage of completion

accounting methodology as required by generally accepted accounting principles primarily at the Westin

Ka’anapali Ocean Resort Villas in Maui, Hawaii, the Westin Kierland Resort and Spa in Scottsdale, Arizona,

and the Sheraton Vistana Villages in Orlando, Florida, partially offset by reduced revenues at the Westin Mission

Hills Resort in Rancho Mirage, California where substantially all of the available inventory was sold. Contract sales

of VOI inventory, which represents vacation ownership revenues before adjustments for percentage of completion

32