Starwood 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

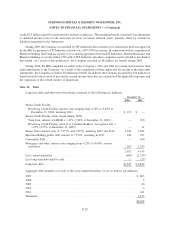

and operations. At December 31, 2006, the Company had $18 million drawn in Canadian dollars and $7 million

drawn in Australian dollars.

The Company maintains lines of credit under which bank loans and other short-term debt are drawn. In

addition, smaller credit lines are maintained by the Company’s foreign subsidiaries. The Company had approx-

imately $1.349 billion of available borrowing capacity under its domestic and foreign lines of credit as of

December 31, 2006.

The Company is subject to certain restrictive debt covenants under its short-term borrowing and long-term debt

obligations including defined financial covenants, limitations on incurring additional debt, escrow account funding

requirements for debt service, capital expenditures, tax payments and insurance premiums, among other restric-

tions. The Company was in compliance with all of the short-term and long-term debt covenants at December 31,

2006.

The weighted average interest rate for short-term borrowings was 4.40% and 3.21% at December 31, 2006 and

2005, respectively, and their fair values approximated carrying value given their short-term nature. These average

interest rates are composed of interest rates on both U.S. dollar and non-U.S. dollar denominated indebtedness.

For adjustable rate debt, fair value approximates carrying value due to the variable nature of the interest rates.

For non-public fixed rate debt, fair value is determined based upon discounted cash flows for the debt at rates

deemed reasonable for the type of debt and prevailing market conditions and the length to maturity for the debt. The

estimated fair value of debt at December 31, 2006 and 2005 was $2.7 billion and $4.4 billion, respectively, and was

determined based on quoted market prices and/or discounted cash flows. See Note 21. Derivative Financial

Instruments for additional discussion regarding the Company’s interest rate swap agreements.

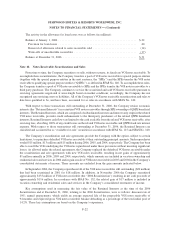

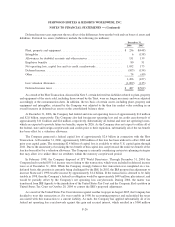

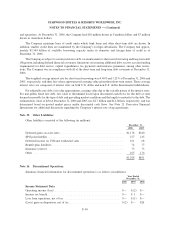

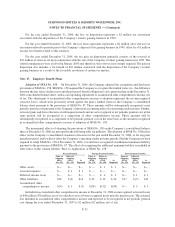

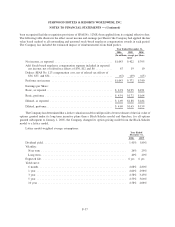

Note 15. Other Liabilities

Other liabilities consisted of the following (in millions):

2006 2005

December 31,

Deferred gains on asset sales ......................................... $1,178 $240

SPG point liability ................................................. 277 215

Deferred income on VOI and residential sales ............................ 161 68

Benefit plan liabilities .............................................. 74 77

Insurance reserves ................................................. 73 75

Other .......................................................... 165 176

$1,928 $851

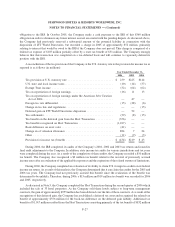

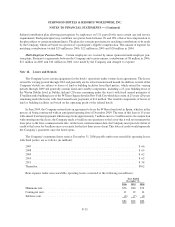

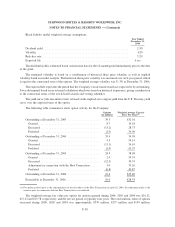

Note 16. Discontinued Operations

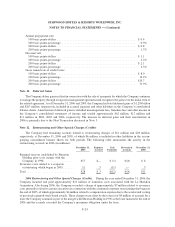

Summary financial information for discontinued operations is as follows (in millions):

2006 2005 2004

Year Ended

December 31,

Income Statement Data

Operating income (loss) .......................................... $— $(2) $—

Income tax benefit .............................................. $— $ 1 $—

Loss from operations, net of tax .................................... $— $(1) $—

(Loss) gain on disposition, net of tax ................................ $(2) $— $26

F-30

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)