Starwood 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

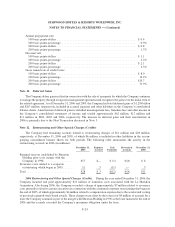

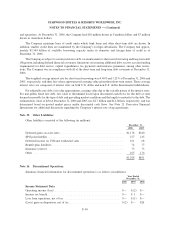

2005 Restructuring and Other Special Charges (Credits). During the year ended December 31, 2005, the

Company recorded a $13 million charge primarily related to severance costs in connection with the Company’s

restructuring as a result of its planned disposition of significant real estate assets. The Company also recorded

$3 million of transition costs associated with the acquisition of the Le Méridien brand and management business in

November 2005. These charges were offset by the reversal of $3 million of reserves related to the Company’s

acquisition of Sheraton Holding Corporation and its subsidiaries (formerly ITT Corporation) in 1998 as the related

obligations no longer exist.

2004 Other Special Credits. During the year ended December 31, 2004, the Company reversed a $37 million

special charge previously recorded in 1999 due to the favorable resolution of a litigation matter.

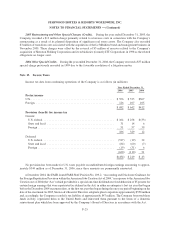

Note 13. Income Taxes

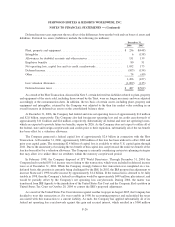

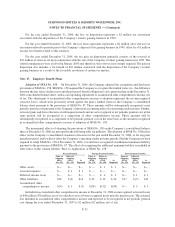

Income tax data from continuing operations of the Company is as follows (in millions):

2006 2005 2004

Year Ended December 31,

Pretax income

U.S. ..................................................... $556 $535 $307

Foreign................................................... 126 107 105

$ 682 $ 642 $412

Provision (benefit) for income tax

Current:

U.S. federal ............................................. $104 $258 $(33)

State and local ........................................... 31 14 6

Foreign ................................................. 51 57 39

186 329 12

Deferred:

U.S. federal ............................................. (517) (19) 32

State and local ........................................... (84) (60) (7)

Foreign ................................................. (19) (31) 6

(620) (110) 31

$(434) $ 219 $ 43

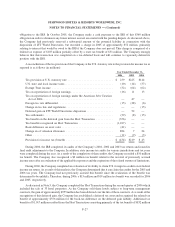

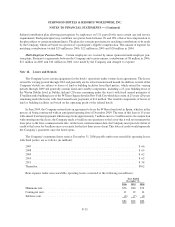

No provision has been made for U.S. taxes payable on undistributed foreign earnings amounting to approx-

imately $344 million as of December 31, 2006, since these amounts are permanently reinvested.

n December 2004, the FASB issued FASB Staff Position No. 109-2, “Accounting and Disclosure Guidance for

the Foreign Repatriation Provision within the American Jobs Creation Act of 2004,” in response to the American Jobs

Creation Act of 2004 (the “Act”) which provided for a special one-time dividends received deduction of 85 percent for

certain foreign earnings that were repatriated (as defined in the Act) in either an enterprise’s last tax year that began

before the December 2004 enactment date, or the first tax year that began during the one-year period beginning on the

date of the enactment. In 2005, Starwood’s Board of Directors adopted a plan to repatriate approximately $550 million

and, accordingly, the Company recorded a tax liability of approximately $47 million. The Company borrowed these

funds in Italy, repatriated them to the United States and reinvested them pursuant to the terms of a domestic

reinvestment plan which has been approved by the Company’s Board of Directors in accordance with the Act.

F-25

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)