Starwood 2006 Annual Report Download - page 76

Download and view the complete annual report

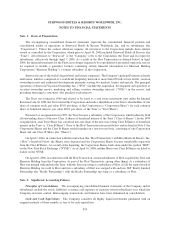

Please find page 76 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans — an amendment of FASB Statements No. 87, 88, 106, and 132(R),” which requires

plan sponsors of defined benefit pension and other postretirement benefit plans (collectively, “Benefit Plans”) to

recognize the funded status of their Benefit Plans in the consolidated balance sheet, measure the fair value of plan

assets and benefit obligations as of the date of the fiscal year-end statement of financial position, and provide

additional disclosures. On December 31, 2006, the Company adopted the recognition and disclosure provisions of

SFAS No. 158. The effect of adopting SFAS No. 158 on the Company’s financial condition at December 31, 2006

has been included in the accompanying consolidated financial statements. SFAS No. 158 has been applied

prospectively and does not impact the Company’s prior year financial statements. SFAS No. 158’s provisions

regarding the change in the measurement date of Benefit Plans are not applicable as the Company currently uses a

measurement date of December 31 for its pension plan. See Note 17 for further discussion of the effect of adopting

SFAS No. 158 on the Company’s consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” which provides enhanced

guidance for using fair value to measure assets and liabilities. SFAS No. 157 establishes a common definition of fair

value, provides a framework for measuring fair value under U.S. generally accepted accounting principles and

expands disclosure requirements about fair value measurements. SFAS No. 157 is effective for financial statements

issued in fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The

Company is currently evaluating the impact, if any, the adoption of SFAS No. 157 will have on the consolidated

financial statements.

In June 2006, the FASB issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes”

(“FIN 48”). This interpretation, among other things, creates a two step approach for evaluating uncertain tax

positions. Recognition (step one) occurs when an enterprise concludes that a tax position, based solely on its

technical merits, is more-likely-than-not to be sustained upon examination. Measurement (step two) determines the

amount of benefit that more-likely-than-not will be realized upon settlement. Derecognition of a tax position that

was previously recognized would occur when a company subsequently determines that a tax position no longer

meets the more-likely-than-not threshold of being sustained. FIN 48 specifically prohibits the use of a valuation

allowance as a substitute for derecognition of tax positions, and it has expanded disclosure requirements. FIN 48 is

effective for fiscal years beginning after December 15, 2006, in which the impact of adoption should be accounted

for as a cumulative-effect adjustment to the beginning balance of retained earnings. The Company expects the

adoption of FIN 48 will result in an adjustment to its tax reserves previously accrued under SFAS No. 5 and is

currently quantifying the overall impact to retained earnings.

In March 2006, the FASB issued SFAS No. 156, “Accounting for Servicing of Financial Assets, an amendment

of FASB Statement No. 140,” which amends SFAS No. 140, “Accounting for Transfers and Servicing of Financial

Assets and Extinguishments of Liabilities.” SFAS No. 156 changes SFAS No. 140 by requiring that Mortgage

Servicing Rights (“MSRs”) be initially recognized at their fair value and by providing the option to either: (1) carry

MSRs at fair value with changes in fair value recognized in earnings; or (2) continue recognizing periodic

amortization expense and assess the MSRs for impairment as originally required by SFAS No. 140. This option may

be applied by class of servicing asset or liability. SFAS No. 156 is effective for all separately recognized servicing

assets and liabilities acquired or issued after the beginning of an entity’s fiscal year that begins after September 15,

2006, with early adoption permitted. As the Company’s servicing agreements are negotiated at arms-length based

on market conditions, the Company has not recognized any servicing assets or liabilities. As such, SFAS No. 156

has no impact on the Company.

In December 2004, the FASB issued SFAS No. 123(R), which requires all share-based payments, including

grants of employee stock options, to be recognized in the income statement based on their fair value. Proforma

disclosure is no longer an alternative. In accordance with the transition rules, the Company adopted

SFAS No. 123(R) effective January 1, 2006 under the modified prospective method. The Company recorded

F-15

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)