Starwood 2006 Annual Report Download - page 20

Download and view the complete annual report

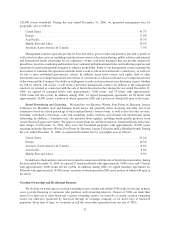

Please find page 20 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in Europe, Africa and the Middle East (including 21 properties with majority ownership); 55 owned, managed or

franchised properties in Latin America (including 9 properties with majority ownership); and 124 owned, managed

or franchised properties in the Asia Pacific region (including 4 properties with majority ownership). International

operations generally are subject to various political, geopolitical, and other risks that are not present in U.S. oper-

ations. These risks include the risk of war, terrorism, civil unrest, expropriation and nationalization as well as the

impact in cases in which there are inconsistencies between U.S. law and the laws of an international jurisdiction. In

addition, some international jurisdictions restrict the repatriation of non-U.S. earnings. Various other international

jurisdictions have laws limiting the ability of non-U.S. entities to pay dividends and remit earnings to affiliated

companies unless specified conditions have been met. In addition, sales in international jurisdictions typically are

made in local currencies, which subject us to risks associated with currency fluctuations. Currency devaluations and

unfavorable changes in international monetary and tax policies could have a material adverse effect on our

profitability and financing plans, as could other changes in the international regulatory climate and international

economic conditions. Other than Italy, where our risks are heightened due to the 9 properties we owned as of

December 31, 2006, our international properties are geographically diversified and are not concentrated in any

particular region.

Risks Relating to Operations in Syria

During fiscal 2006, Starwood subsidiaries generated approximately $2 million of revenue from management

and other fees from hotels located in Syria, a country that the United States has identified as a state sponsor of

terrorism. This amount constitutes significantly less than 1% of our worldwide annual revenues. The United States

does not prohibit U.S. investments in, or the exportation of services to, Syria, and our activities in that country are in

full compliance with U.S. and local law. However, the United States has imposed limited sanctions as a result of

Syria’s support for terrorist groups and its interference with Lebanon’s sovereignty, including a prohibition on the

exportation of U.S.-origin goods to Syria and the operation of government-owned Syrian air carriers in the United

States except in limited circumstances. The United States may impose further sanctions against Syria at any time for

foreign policy reasons. If so, our activities in Syria may be adversely affected, depending on the nature of any

further sanctions that might be imposed. In addition, our activities in Syria may reduce demand for our stock among

certain investors.

Debt Financing

As a result of our debt obligations, we are subject to: (i) the risk that cash flow from operations will be

insufficient to meet required payments of principal and interest and (ii) interest rate risk. Although we anticipate

that we will be able to repay or refinance our existing indebtedness and any other indebtedness when it matures,

there can be no assurance that we will be able to do so or that the terms of such refinancings will be favorable. Our

leverage may have important consequences including the following: (i) our ability to obtain additional financing for

acquisitions, working capital, capital expenditures or other purposes, if necessary, may be impaired or such

financing may not be available on terms favorable to us and (ii) a substantial decrease in operating cash flow or a

substantial increase in our expenses could make it difficult for us to meet our debt service requirements and force us

to sell assets and/or modify our operations.

Risks Relating to So-Called Acts of God, Terrorist Activity and War

Our financial and operating performance may be adversely affected by so-called acts of God, such as natural

disasters, in locations where we own and/or operate significant properties and areas of the world from which we

draw a large number of customers. Similarly, wars (including the potential for war), terrorist activity (including

threats of terrorist activity), political unrest and other forms of civil strife and geopolitical uncertainty have caused

in the past, and may cause in the future, our results to differ materially from anticipated results.

Some Potential Losses are Not Covered by Insurance

We carry insurance coverage for general liability, property, business interruption and other risks with respect to

our owned and leased properties and we make available insurance programs for owners of properties we manage.

These policies offer coverage terms and conditions that we believe are usual and customary for our industry.

13