Starwood 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

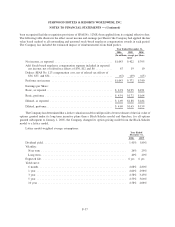

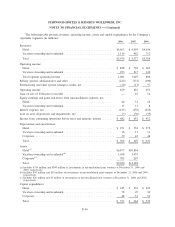

The following table presents revenues, operating income, assets and capital expenditures for the Company’s

reportable segments (in millions):

2006 2005 2004

Revenues:

Hotel ...................................................... $4,863 $ 4,995 $4,656

Vacation ownership and residential ................................ 1,116 982 712

Total ...................................................... $5,979 $ 5,977 $5,368

Operating income:

Hotel ...................................................... $ 828 $ 792 $ 664

Vacation ownership and residential ................................ 253 215 142

Total segment operating income .................................. 1,081 1,007 806

Selling, general, administrative and other ............................. (222) (172) (190)

Restructuring and other special (charges) credits, net .................... (20) (13) 37

Operating income .............................................. 839 822 653

Gain on sale of VOI notes receivable ................................ — 25 14

Equity earnings and gains and losses from unconsolidated ventures, net:

Hotel ...................................................... 46 51 24

Vacation ownership and residential ................................ 15 13 8

Interest expense, net ............................................ (215) (239) (254)

Loss on asset dispositions and impairments, net ........................ (3) (30) (33)

Income from continuing operations before taxes and minority interest ........ $ 682 $ 642 $ 412

Depreciation and amortization:

Hotel ...................................................... $ 251 $ 352 $ 372

Vacation ownership and residential ................................ 16 13 11

Corporate. . ................................................. 39 42 48

Total ...................................................... $ 306 $ 407 $ 431

Assets:

Hotel

(a)

.................................................... $6,877 $10,854

Vacation ownership and residential

(b)

.............................. 1,698 1,433

Corporate

(c)

................................................. 705 207

Total ...................................................... $9,280 $12,494

(a) Includes $314 million and $300 million of investments in unconsolidated joint ventures at December 31, 2006 and

2005, respectively.

(b) Includes $43 million and $30 million of investments in unconsolidated joint ventures at December 31, 2006 and 2005,

respectively.

(c) Includes $26 million and $3 million of investments in unconsolidated joint ventures at December 31, 2006 and 2005,

respectively.

Capital expenditures:

Hotel ...................................................... $ 245 $ 318 $ 245

Vacation ownership and residential ................................ 78 95 34

Corporate. . ................................................. 48 51 54

Total ...................................................... $ 371 $ 464 $ 333

F-46

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)