Starwood 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

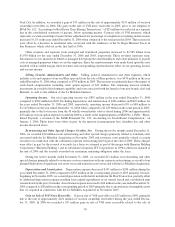

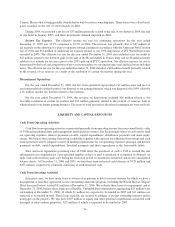

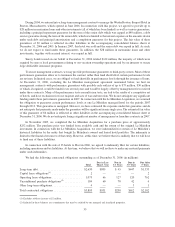

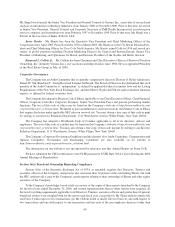

Cash Used for Financing Activities

The following is a summary of our debt portfolio (including capital leases) as of December 31, 2006:

Amount

Outstanding at

December 31, 2006

(a)

Interest Terms

Interest Rate at

December 31,

2006

Average

Maturity

(Dollars in millions) (In years)

Floating Rate Debt

Senior Credit Facility:

Revolving Credit Facility ........... $ 435 Various + 0.475% 5.77% 4.1

Mortgages and Other ................ 132 Various 7.10% 1.5

Interest Rate Swaps ................. 300 9.59%

Total/Average ..................... $ 867 7.30% 3.5

Fixed Rate Debt

Sheraton Holding Public Debt ......... $ 449 7.38% 8.9

Senior Notes ...................... 1,481

(b)

6.70% 3.0

Mortgages and Other ................ 135 7.49% 8.3

Interest Rate Swaps ................. (300) 7.88%

Total/Average ..................... $1,765 6.81% 4.6

Total Debt

Total Debt and Average Terms ......... $2,632 6.97% 4.4

(a) Excludes approximately $484 million of our share of unconsolidated joint venture debt, all of which was non-recourse.

(b) Includes approximately $(17) million at December 31, 2006 of fair value adjustments related to existing and terminated fixed-to-floating

interest rate swaps for the Senior Notes.

Fiscal 2006 Developments. On March 15, 2006, we completed the redemption of the remaining 25,000

outstanding Class B EPS for approximately $1 million in cash. On April 10, 2006, in connection with the Host

Transaction, we redeemed all of the Class A EPS and Realty Partnership units for approximately $34 million in

cash. In the year ended December 31, 2006, we redeemed approximately 926,000 SLC Operating Limited

Partnership units for approximately $56 million in cash.

In February 2006, we closed a new, five-year $1.5 billion Senior Credit Facility (“2006 Facility”). The 2006

Facility replaced the previous $1.45 billion Revolving and Term Loan Credit Agreement (“Existing Facility”)

which would have matured in October 2006. Approximately $240 million of the Term Loan balance under the

Existing Facility was paid down with cash and the remainder was refinanced with the 2006 Facility. The 2006

Facility is expected to be used for general corporate purposes. The 2006 Facility matures February 10, 2011 and has

a current interest rate of LIBOR + 0.475%. We currently expect to be in compliance with all covenants of the 2006

Facility.

During March 2006, we gave notice to receive additional commitments totaling $300 million under our 2006

Facility (“2006 Facility Add-On”) on a short-term basis to facilitate the close of the Host Transaction and for

general working capital purposes. In June 2006, we amended the 2006 Facility such that the 2006 Facility Add-On

will not mature until June 30, 2007.

In the first quarter of 2006 in two separate transactions we defeased approximately $510 million of debt

secured in part by several hotels that were part of the Host Transaction. In one transaction, in order to accomplish

this, we purchased Treasury securities sufficient to make the monthly debt service payments and the balloon

payment due under the loan agreement. The Treasury securities were then substituted for the real estate and hotels

that originally served as collateral for the loan. As part of the defeasance, the Treasury securities and the debt were

transferred to a third party successor borrower that is responsible for all remaining obligations under this debt. In the

37