Starwood 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

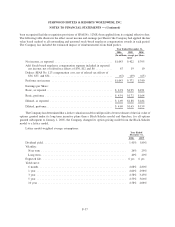

The new Fair Value Swaps hedge the change in fair value of certain fixed rate debt related to fluctuations in

interest rates and mature in 2012. The aggregate notional amount of the Fair Value Swaps was $300 million at

December 31, 2006. The Fair Value Swaps modify the Company’s interest rate exposure by effectively converting

debt with a fixed rate to a floating rate. The fair value of the Fair Value Swaps was a liability of approximately

$22 million at December 31, 2006 and is included in other liabilities in the Company’s consolidated balance sheet.

From time to time, the Company uses various hedging instruments to manage the foreign currency exposure

associated with the Company’s foreign currency denominated assets and liabilities (“Foreign Currency Hedges”).

At December 31, 2006, the Company had no Foreign Currency Hedges outstanding.

The counterparties to the Company’s derivative financial instruments are major financial institutions. The

Company does not expect its derivative financial instruments to significantly impact earnings in the next twelve

months.

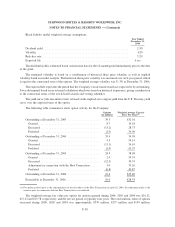

Note 22. Related Party Transactions

The Company on occasion made loans to employees, including executive officers, prior to August 23, 2002,

principally in connection with home purchases upon relocation. As of December 31, 2006, approximately $1 million

in loans to five employees were outstanding. All of these loans were non-interest bearing, and the majority were

home loans. Home loans are generally due five years from the date of issuance or upon termination of employment

and are secured by a second mortgage on the employee’s home. Theodore W. Darnall, a former executive officer,

received a home loan in connection with relocation in 1996 and 1998 (original balance of $750,000 ($150,000

bridge loan in 1996 and $600,000 home loan in 1998)). Mr. Darnall repaid $600,000 in 2003. As a result of the

acquisition of ITT Corporation in 1998, restricted stock awarded to Mr. Darnall in 1996 vested at a price for tax

purposes of $53 per Share. This amount was taxable at ordinary income rates. By late 1998, the value of the stock

had fallen below the amount of income tax owed. In order to avoid a situation in which the executive could be

required to sell all of the Shares acquired by him to cover income taxes, in April 1999 the Company made an

interest-bearing loan at 5.67% to Mr. Darnall of approximately $416,000 to cover the taxes payable. Mr. Darnall’s

loan was repaid in 2004. The balance of the bridge loan was repaid in 2006 when Mr. Darnall left the Company.

Brett Gellein is Director, Acquisitions and Pre-Development for Starwood Vacation Ownership. Mr. Gellein’s

salary and bonus were $86,769 for 2005 and $99,201 for 2006. Brett Gellein is the son of Raymond Gellein, who is

Chairman of the Board and Chief Executive Officer of Starwood Vacation Ownership and President of the Real

Estate Group.

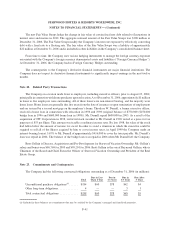

Note 23. Commitments and Contingencies

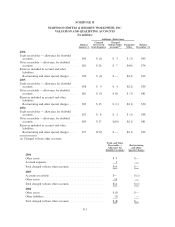

The Company had the following contractual obligations outstanding as of December 31, 2006 (in millions):

Total

Due in Less

Than 1 Year

Due in

1-3 Years

Due in

3-5 Years

Due After

5 Years

Unconditional purchase obligations

(a)

...... $184 $60 $78 $42 $4

Other long-term obligations ............. 4 — — 3 1

Total contractual obligations . . . ......... $188 $60 $78 $45 $5

(a) Included in these balances are commitments that may be satisfied by the Company’s managed and franchised properties.

F-41

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)