Starwood 2006 Annual Report Download - page 104

Download and view the complete annual report

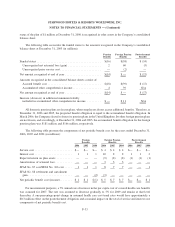

Please find page 104 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.tests, are tied to the results of a competitive set of hotels, and have exclusions for force majeure and acts of war and

terrorism. The Company does not anticipate any significant funding under these performance guarantees in 2007. In

connection with the acquisition of the Le Méridien brand in November 2005, the Company assumed the obligation

to guarantee certain performance levels at one Le Méridien managed hotel for the periods 2007 through 2013. This

guarantee is uncapped. However, the Company has estimated its exposure under this guarantee and does not

anticipate that payments made under the guarantee will be significant in any single year. The estimated fair value of

this guarantee of $6 million is reflected in other liabilities in the accompanying consolidated balance sheet at

December 31, 2006. The Company does not anticipate losing a significant number of management or franchise

contracts in 2007.

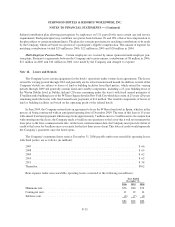

In connection with the purchase of the Le Méridien brand in November 2005, the Company was indemnified

for certain of Le Méridien’s historical liabilities by the entity that bought Le Méridien’s owned and leased hotel

portfolio. The indemnity is limited to the financial resources of that entity. However, at this time, the Company

believes that it is unlikely that it will have to fund any of these liabilities.

In connection with the sale of 33 hotels to Host in 2006, the Company agreed to indemnify Host for certain

liabilities, including operations and tax liabilities. At this time, the Company believes that it will not have to make

any material payments under such indemnities.

Litigation. The Corporation, Sheraton Corporation and Sheraton Holding (“Company Defendants”) are

defendants in certain litigations arising out of purported contracts allegedly requiring the purchase of telecom-

munication, video and power services from Intelnet International Corporation (“Intelnet”). The first suit was

commenced in late 1997 by Intelnet in the Superior Court of New Jersey Law Division: Camden County, alleging

that Sheraton Corporation violated what Intelnet claimed were Intelnet’s exclusive rights to provide telecommu-

nications and other services to Sheraton Holding and its affiliates (“First Suit”). The complaint sought injunctive

relief to enforce alleged exclusivity rights and unquantified monetary damages. The complaint was subsequently

amended in November 1998 to seek specific monetary and unspecified punitive damages. Sheraton Holding and

Sheraton Corporation served an answer denying Intelnet’s claims, and asserting counterclaims seeking damages

and a declaration that the purported contracts at issue were unenforceable.

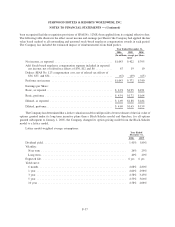

In June 1999, Intelnet commenced a second lawsuit in the Superior Court of New Jersey Law Division:

Camden County, naming Boardwalk Regency Corporation (formerly a subsidiary of the Corporation) and the

Corporation (the “BRC Action”). The claims in this case are similar in nature to those made in the First Suit, and

relate to an alleged breach of a purported exclusive contract to provide certain services to the Caesar’s Atlantic City

Hotel and Casino. The two suits have been consolidated and were in mediation until 2001. The mediation ended

during the first half of 2001. In late 2003, the Company Defendants filed several dispositive motions on various

grounds. In February 2004, the court granted the Company Defendants’ motion for summary judgment dismissing

Intelnet’s claims under one of the agreements at issue. The court denied summary judgment on the claims under the

principal contract at issue, but directed a trial solely on the issue of whether that contract was valid and enforceable

or fraudulently executed. A non-jury trial commenced in March 2004. At the conclusion of the evidentiary hearing,

the court found that the principal contract was not signed until after the allegedly breaching event. Accordingly, the

court dismissed all of the claims alleged by Intelnet against the Company Defendants under the principal contract.

In June 2004, the court dismissed all of the remaining claims asserted against the Company Defendants. The

Company filed a motion for summary judgment seeking dismissal of all claims pending in the BRC Action. On

August 24, 2004, Intelnet agreed to sever and dismiss with prejudice the BRC Action in its entirety, with the

condition that if its claims in the First Suit are reinstated on appeal, the BRC Action will be reinstated.

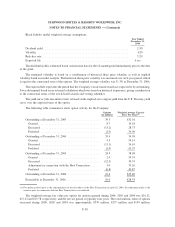

On August 19, 2004, Intelnet filed a notice of appeal with respect to the First Suit. On May 9, 2006, oral

argument was held in the Superior Court of New Jersey, Appellate Division (“Appellate Division”) on Intelnet’s

appeal of the decision in the First Suit. On August 4, 2006, the Appellate Division issued its opinion relating to the

First Suit, affirming the trial court’s rulings in favor of the Company that dismissed all of Intelnet’s claims. Intelnet

elected not to appeal the Appellate Division’s decision to the New Jersey Court of Appeals. A final judgment in

F-43

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)