Starwood 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

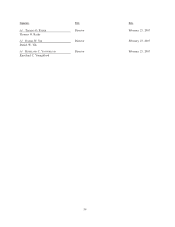

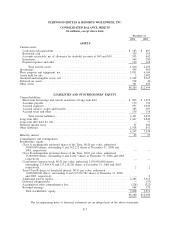

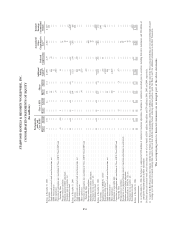

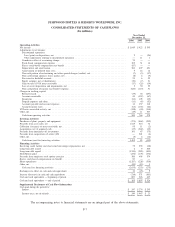

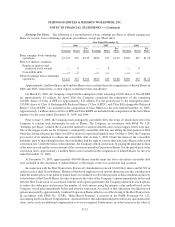

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

2006 2005

December 31,

ASSETS

Current assets:

Cash and cash equivalents .............................................. $ 183 $ 897

Restricted cash ...................................................... 329 295

Accounts receivable, net of allowance for doubtful accounts of $49 and $50 ......... 593 642

Inventories ......................................................... 566 280

Prepaid expenses and other . ............................................ 139 169

Total current assets ................................................ 1,810 2,283

Investments ........................................................... 436 403

Plant, property and equipment, net .......................................... 3,831 4,169

Assets held for sale ..................................................... 2 2,882

Goodwill and intangible assets, net ......................................... 2,302 2,315

Deferred tax assets ..................................................... 518 40

Other assets .......................................................... 381 402

$9,280 $12,494

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Short-term borrowings and current maturities of long-term debt .................. $ 805 $ 1,219

Accounts payable .................................................... 179 156

Accrued expenses .................................................... 955 1,049

Accrued salaries, wages and benefits . . . ................................... 383 297

Accrued taxes and other ................................................ 139 158

Total current liabilities ............................................. 2,461 2,879

Long-term debt ........................................................ 1,827 2,849

Long-term debt held for sale .............................................. — 77

Deferred income taxes ................................................... 31 602

Other liabilities ........................................................ 1,928 851

6,247 7,258

Minority interest ....................................................... 25 25

Commitments and contingencies

Stockholders’ equity:

Class A exchangeable preferred shares of the Trust; $0.01 par value; authorized

30,000,000 shares; outstanding 0 and 562,222 shares at December 31, 2006 and

2005, respectively .................................................. — —

Class B exchangeable preferred shares of the Trust; $0.01 par value; authorized

15,000,000 shares; outstanding 0 and 24,627 shares at December 31, 2006 and 2005,

respectively ....................................................... — —

Corporation common stock; $0.01 par value; authorized 1,050,000,000 shares;

outstanding 213,484,439 and 217,218,781 shares at December 31, 2006 and 2005,

respectively ....................................................... 2 2

Trust Class B shares of beneficial interest; $0.01 par value; authorized

1,000,000,000 shares; outstanding 0 and 217,218,781 shares at December 31, 2006

and 2005, respectively ............................................... — 2

Additional paid-in capital............................................... 2,286 5,412

Deferred compensation ................................................ — (53)

Accumulated other comprehensive loss. . ................................... (228) (322)

Retained earnings .................................................... 948 170

Total stockholders’ equity ............................................. 3,008 5,211

$9,280 $12,494

The accompanying notes to financial statements are an integral part of the above statements.

F-3