Starwood 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

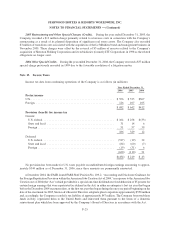

on the $2.4 billion capital loss generated for federal tax purposes. The remaining benefit consisted of an adjustment

to deferred income taxes for the increased tax basis of certain retained assets, partially offset by current tax

liabilities generated in the transaction.

During 2005, the Company was notified by ITT Industries that a refund of tax and interest had been approved

by the IRS for payment to ITT Industries related to its 1993-1995 tax returns. In connection with its acquisition of

Sheraton Holding, the Company is party to a tax sharing agreement between ITT Industries, Hartford Insurance and

Sheraton Holding as a result of their 1995 split of ITT Industries into these companies and is entitled to one-third of

this refund. As a result of this notification, the Company recorded an $8 million tax benefit during 2005.

During 2004, the IRS completed its audits of the Company’s 1999 and 2000 tax returns and issued its final

audit adjustments to the Company. As a result of the completion of these audits and the receipt of the final audit

adjustments, the Company recorded a $5 million tax benefit. In addition, the Company recognized a $10 million tax

benefit related to the reversal of previously accrued income taxes after an evaluation of the applicable exposures and

the expiration of the related statutes of limitations.

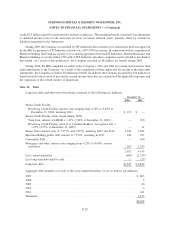

Note 14. Debt

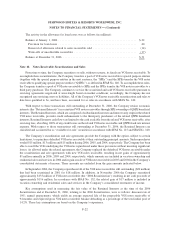

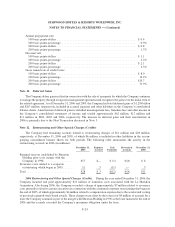

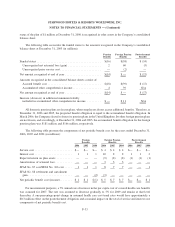

Long-term debt and short-term borrowings consisted of the following (in millions):

2006 2005

December 31,

Senior Credit Facility:

Revolving Credit Facility, interest rates ranging from 4.74% to 6.84% at

December 31, 2006, maturing 2011 .............................. $ 435 $ —

Senior Credit Facility (fully repaid during 2006):

Term loan, interest at LIBOR + 1.25% (5.64% at December 31, 2005) ...... — 450

Revolving Credit Facility, interest at Canadian Bankers’ Acceptance rate +

1.25% (4.57% at December 31, 2005)............................. — 11

Senior Notes interest rates of 7.375% and 7.875%, maturing 2007 and 2012 .... 1,481 1,494

Sheraton Holding public debt, interest at 7.375%, maturing in 2015 .......... 449 597

Convertible Debt ................................................ — 360

Mortgages and other, interest rates ranging from 4.25% to 8.60%, various

maturities ................................................... 267 1,233

2,632 4,145

Less current maturities ........................................... (805) (1,219)

Less long-term debt held for sale .................................... — (77)

Long-term debt ................................................. $1,827 $ 2,849

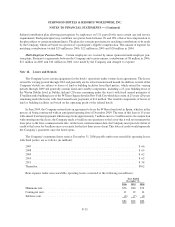

Aggregate debt maturities for each of the years ended December 31 are as follows (in millions):

2007 ................................................................. $ 805

2008 ................................................................. 5

2009 ................................................................. 40

2010 ................................................................. 6

2011 ................................................................. 441

Thereafter ............................................................. 1,335

$2,632

F-28

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)