Starwood 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

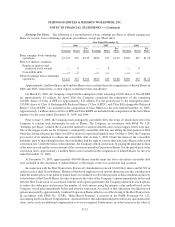

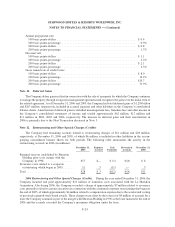

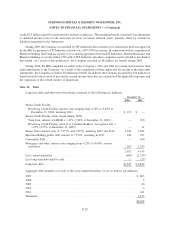

The intangible assets related to management and franchise agreements have finite lives, and accordingly, the

Company recognized amortization expense of $25 million, $19 million and $15 million, respectively, related to

these assets during the years ended December 31, 2006, 2005 and 2004. The other intangible assets noted above

have indefinite lives. Amortization expense relating to intangible assets with finite lives for each of the years ended

December 31 is expected to be as follows (in millions):

2007 . .................................................................. $27

2008 . .................................................................. $27

2009 . .................................................................. $24

2010 . .................................................................. $24

2011 . .................................................................. $23

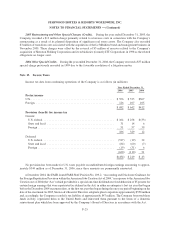

Note 9. Other Assets

Other assets include notes receivable of $293 million and $297 million, net of allowance for doubtful accounts,

at December 31, 2006 and 2005, respectively. Included in these balances at December 31, 2006 and 2005 are the

following fixed rate notes receivable related to the financing of VOIs (in millions):

2006 2005

December 31,

Gross VOI notes receivable ........................................... $296 $212

Allowance for uncollectible VOI notes receivable ........................... (31) (22)

Net VOI notes receivable ............................................. 265 190

Less current maturities of gross VOI notes receivable ........................ (25) (30)

Current portion of the allowance for uncollectible VOI notes receivable........... 2 3

Long-term portion of net VOI notes receivable ............................. $242 $163

The current maturities of net VOI notes receivable are included in accounts receivable in the Company’s

balance sheets.

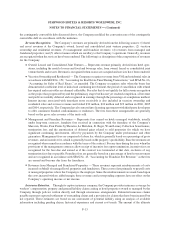

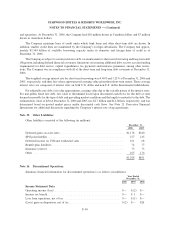

The interest rates of the owned VOI notes receivable are as follows:

2006 2005

December 31,

Range of stated interest rates ................................ 0%-18.0% 0% - 17.9%

Weighted average interest rate ............................... 11.9% 12.3%

The maturities of the gross VOI notes receivable are as follows (in millions):

2006 2005

December 31,

Due in 1 year...................................................... $ 25 $ 30

Due in 2 years ..................................................... 22 15

Due in 3 years ..................................................... 24 16

Due in 4 years ..................................................... 26 17

Due in 5 years ..................................................... 28 19

Due beyond 5 years ................................................. 171 115

Total gross VOI notes receivable ....................................... $296 $212

F-21

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)