Starwood 2006 Annual Report Download - page 90

Download and view the complete annual report

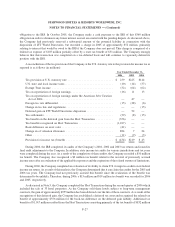

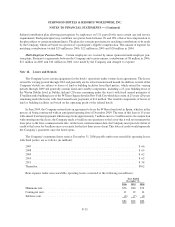

Please find page 90 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In February 2006, the Company closed a new, five-year $1.5 billion Senior Credit Facility (“2006 Facility”).

The 2006 Facility replaced the previous $1.45 billion Revolving and Term Loan Credit Agreement (“Existing

Facility”) which would have matured in October 2006. Approximately $240 million of the Term Loan balance

under the Existing Facility was paid down with cash and the remainder was refinanced with the 2006 Facility. The

2006 Facility is expected to be used for general corporate purposes. The 2006 Facility matures February 10, 2011.

During March 2006, the Company gave notice to receive additional commitments totaling $300 million under

the 2006 Facility (“2006 Facility Add-On”) on a short-term basis to facilitate the close of the Host Transaction and

for general working capital purposes. In June 2006, the Company amended the 2006 Facility such that the 2006

Facility Add-On will not mature until June 30, 2007.

In the first quarter of 2006 in two separate transactions the Company defeased approximately $510 million of

debt secured in part by several hotels that were part of the Host Transaction. In one transaction, in order to

accomplish this, the Company purchased Treasury securities sufficient to make the monthly debt service payments

and the balloon payment due under the loan agreement. The Treasury securities were then substituted for the real

estate and hotels that originally served as collateral for the loan. As part of the defeasance, the Treasury securities

and the debt were transferred to a third party successor borrower that is responsible for all remaining obligations

under this debt. In the second transaction, the Company deposited Treasury securities in an escrow account to cover

the debt service payments. As such, neither debt is reflected on the Company’s consolidated balance sheet as of

December 31, 2006. In connection with the defeasance, the Company incurred early extinguishment of debt costs of

approximately $37 million which was recorded in interest expense in the Company’s consolidated statement of

income.

In the second quarter of 2006, the Company gave notice to redeem the $360 million of 3.5% convertible notes,

originally issued in May 2003. Under the terms of the convertible indenture, prior to the redemption date of June 5,

2006, the note holders had the right to convert their notes into Shares at the stated conversion rate. Under the terms

of the indenture, the Company settled the conversions by paying the principal portion of the notes in cash and the

excess amount by issuing approximately 3 million Corporation Shares. The settlement of the excess amount was

treated as a non-cash exchange and, consequently, was excluded from the consolidated statement of cash flows. The

notes that were not converted prior to the redemption date were redeemed at the price of par plus accrued interest,

effective June 5, 2006.

In connection with the Host Transaction, a total of $600 million of notes issued by Sheraton Holding were

assumed by the Corporation. On June 2, 2006, we redeemed $150 million in principal amount of these notes which

had a coupon of 7.75% and a maturity in 2025. The stated redemption price for these notes was 103.186%. We

borrowed under the 2006 Facility and used existing unrestricted cash balances to fund the cash portions of these

transactions.

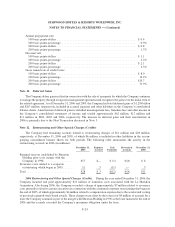

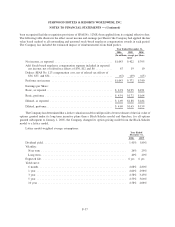

On October 22, 2004, the President signed the American Jobs Creation Act of 2004 (the “Act”). The Act

created a temporary incentive for U.S. corporations to repatriate accumulated income earned abroad by providing

an 85 percent dividends received deduction for certain dividends from controlled foreign corporations. In order to

repatriate funds in accordance with the Act, in October 2005 the Company increased several existing bank credit

lines available to its wholly owned subsidiary, Starwood Italia, from 129 million euros to 399 million euros,

350 million euros of which was borrowed at that time. These credit lines had interest rates ranging from Euribor +

0.50% to Euribor + 0.85% and maturities ranging from April 1, 2006 to May 8, 2007. These proceeds, along with

approximately 100 million euros which Starwood Italia borrowed from the Corporate Credit Line (total borrowings

of 450 million euros) were used to temporarily finance the repatriation of approximately $550 million pursuant to

the Act. As of December 31, 2006, the majority of these temporary borrowings were repaid.

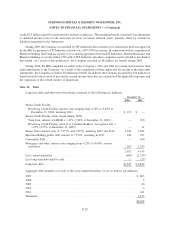

The Company has the ability to draw down on its Revolving Credit Facility in various currencies. Drawdowns

in currencies other than the U.S. dollar represent a natural hedge of the Company’s foreign denominated net assets

F-29

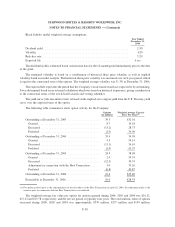

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)