Starwood 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Share. This amount was taxable at ordinary income rates. By late 1998, the value of the stock had fallen below the

amount of income tax owed. In order to avoid a situation in which the executive could be required to sell all of the

Shares acquired by him to cover income taxes, in April 1999 we made an interest-bearing loan at 5.67% to

Mr. Darnall of approximately $416,000 to cover the taxes payable. Mr. Darnall’s loan was repaid in 2004. The

balance of the bridge loan was repaid in 2006 when Mr. Darnall left the Company.

Other

Brett Gellein is Director, Acquisitions and Pre-Development for Starwood Vacation Ownership. Mr. Gellein’s

salary and bonus were $86,769 for 2005 and $99,201 for 2006. Brett Gellein is the son of Raymond Gellein, who is

the Chairman of the Board and Chief Executive Officer of Starwood Vacation Ownership and President of the Real

Estate Group.

The remaining information called for by Item 13 is incorporated by reference to the information under the

caption “Corporate Governance” in the Proxy Statement.

Item 14. Principal Accountant Fees and Services.

The Audit Committee has adopted a policy requiring pre-approval by the committee of all services (audit and

non-audit) to be provided to the Company by its independent auditors. In accordance with that policy, the Audit

Committee has given its approval for the provision of audit services by Ernst & Young LLP for fiscal 2006. All other

services must be specifically pre-approved by the full Audit Committee or by a designated member of the Audit

Committee who has been delegated the authority to pre-approve the provision of services.

Fees paid by the Company to its independent auditors are set forth in the proxy statement under the heading

“Audit Fees” and are incorporated herein by reference.

PART IV

Item 15. Exhibits, Financial Statements, Financial Statement Schedules and Reports on Form 8-K.

(a) The following documents are filed as a part of this Annual Report:

1. The financial statements and financial statement schedule listed in the Index to Financial Statements and

Schedules following the signature pages hereof.

2. Exhibits:

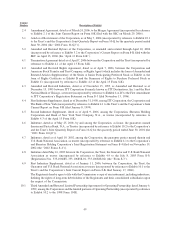

Exhibit

Number Description of Exhibit

2.1 Formation Agreement, dated as of November 11, 1994, among the Trust, the Corporation, Starwood

Capital and the Starwood Partners (incorporated by reference to Exhibit 2 to the Trust’s and the

Corporation’s Joint Current Report on Form 8-K dated November 16, 1994). (The SEC file numbers

of all filings made by the Corporation and the Trust pursuant to the Securities Exchange Act of 1934, as

amended, and referenced herein are: 1-7959 (the Corporation) and 1-6828 (the Trust)).

2.2 Form of Amendment No. 1 to Formation Agreement, dated as of July 1995, among the Trust, the

Corporation and the Starwood Partners (incorporated by reference to Exhibit 10.23 to the Trust’s and the

Corporation’s Joint Registration Statement on Form S-2 filed with the SEC on June 29, 1995 (Registration

Nos. 33-59155 and 33-59155-01)).

2.3 Master Agreement and Plan of Merger, dated as of November 14, 2005, among Host Marriott

Corporation, Host Marriott, L.P., Horizon Supernova Merger Sub, L.L.C., Horizon SLT Merger Sub,

L.P., Starwood Hotels & Resorts Worldwide, Inc., Starwood Hotels & Resorts, Sheraton Holding

Corporation and SLT Realty Limited Partnership (the “Merger Agreement”) (incorporated by

reference to Exhibit 10.1 to the Corporation’s and the Trust’s Joint Current Report on From 8-K filed

November 14, 2005).

48