Starwood 2006 Annual Report Download - page 78

Download and view the complete annual report

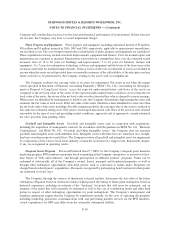

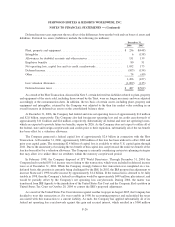

Please find page 78 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Acquisition”). The purchase price of approximately $252 million was funded from available cash and the return of

the original Le Méridien investment. The Company has accounted for this acquisition under the purchase method in

accordance with SFAS No. 141 and has allocated $114 million of the purchase price to goodwill with the remainder

assigned to the estimated fair value of the assets acquired and liabilities assumed.

Recapitalization of the Joint Venture that Owns the Sheraton Imperial Hotel. In August 2005, the

Company provided a $30 million loan related to the recapitalization of the joint venture that owns the Sheraton

Imperial Hotel in Kuala Lumpur, Malaysia. The Company has a 49% ownership interest in the joint venture.

Acquisition of the Remaining Interest in PT Indo-Pacific Sheraton. In August 2005, the Company

acquired the remaining 55% ownership interest in PT Indo-Pacific Sheraton (“IPS”) for approximately $12 million.

IPS is an Indonesian management company that has the exclusive right to manage all Sheraton hotels in Indonesia.

IPS currently manages ten properties. Prior to August 2005, the Company owned 45% of IPS.

Acquisition of Sheraton Kauai Resort. In March 2004, the Company acquired the 413-room Sheraton Kauai

Resort on Poipu Beach in Kauai, Hawaii. The purchase price for the property was approximately $40 million and

was funded from available cash. Prior to the acquisition, the Company managed the property for the former owner.

Tender Offer to Acquire Partnership Units of Westin Hotels Limited Partnership. In the fourth quarter of

2003, the Company commenced a tender offer to acquire any and all of the outstanding limited partnership units of

Westin Hotels Limited Partnership, the entity that indirectly owned the Westin Michigan Avenue Hotel in Chicago,

Illinois, one of the Company’s managed hotels. The tender offer expired on February 20, 2004 and approximately

34,000 units were tendered to the Company and accepted for payment, representing approximately 25% of the

outstanding units. The purchase price of approximately $26 million was funded from available cash. In January

2005, the Westin Michigan Avenue Hotel was sold and the Company received proceeds of approximately

$27 million.

Acquisition of Bliss World LLC. In January 2004, the Company acquired a 95% interest in Bliss World LLC

which, at the time of the acquisition, operated three stand alone spas (two in New York, New York and one in

London, England) and a beauty products business with distribution through its own internet site and catalogue as

well as through third party retail stores. The aggregate purchase price for the acquired interest was approximately

$25 million and was funded from available cash. The Company recorded approximately $22 million in goodwill

associated with this acquisition. In 2005, the Company acquired the remaining 5% interest for approximately

$1 million.

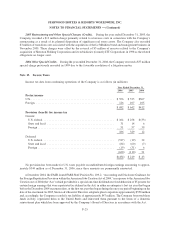

Note 5. Asset Dispositions and Impairments

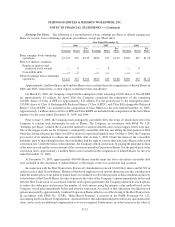

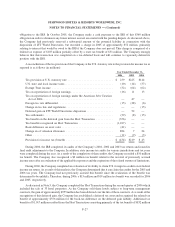

During the second quarter of 2006, the Company consummated the Host Transaction whereby subsidiaries of

Host acquired 33 properties and the stock of certain controlled subsidiaries, including Sheraton Holding and the

Trust. The stock and cash transaction was valued at approximately $4.1 billion, including debt assumption (based on

Host’s closing stock price on April 7, 2006 of $20.53). In the first phase of the transaction, 28 hotels and the stock of

certain controlled subsidiaries, including Sheraton Holding and the Trust, were acquired by Host for consideration

valued at $3.54 billion. On May 3, 2006, four additional hotels located in Europe were sold to Host for net proceeds

of approximately $481 million in cash. On June 13, 2006, the final hotel in Venice, Italy was sold to Host for net

proceeds of approximately $74 million in cash. In connection with the first phase of the transaction, Starwood

shareholders received approximately $2.8 billion in the form of Host common stock valued at $2.68 billion and

$119 million in cash for their Class B shares. Based on Host’s closing price on April 7, 2006, this consideration had

a per – Class B share value of $13.07. Starwood directly received approximately $738 million of consideration in

the first phase, including $600 million in cash, $77 million in debt assumption and $61 million in Host common

stock. In addition, the Corporation assumed from its subsidiary, Sheraton Holding, debentures with a principal

balance of $600 million. As the sale of the Class B shares involved a transaction with Starwood’s shareholders, the

book value of the Trust associated with this sale was treated as a non-reciprocal transaction with owners and was

F-17

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)