Starwood 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

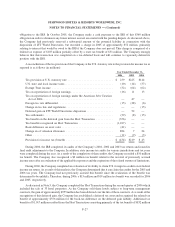

obligation to the IRS. In October 2005, the Company made a cash payment to the IRS of this $360 million

obligation in order to eliminate any future interest accrual associated with the pending dispute. As discussed above,

the Company had previously reserved a substantial amount of the potential liability in connection with the

disposition of ITT World Directories, but recorded a charge in 2005 of approximately $52 million, primarily

relating to interest that would be owed to the IRS if the Company does not prevail. This charge is comprised of a

federal tax expense of $103 million partially offset by a state tax benefit of $51 million. The Company strongly

believes that this transaction was completed on a tax-deferred basis and will continue to vigorously defend its

position with the IRS.

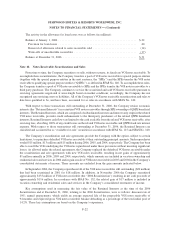

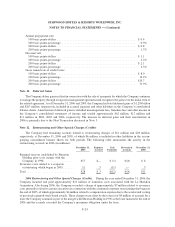

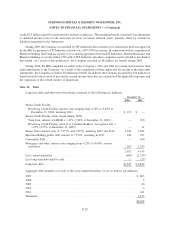

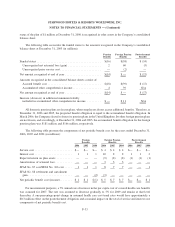

A reconciliation of the tax provision of the Company at the U.S. statutory rate to the provision for income tax as

reported is as follows (in millions):

2006 2005 2004

Year Ended December 31,

Tax provision at U.S. statutory rate ............................. $ 239 $225 $144

U.S. state and local income taxes ............................... (10) (14) (37)

Exempt Trust income ....................................... (32) (64) (62)

Tax on repatriation of foreign earnings ........................... (16) 11 13

Tax on repatriation of foreign earnings under the American Jobs Creation

Act of 2004 ............................................. — 47 —

Foreign tax rate differential ................................... (15) (28) (6)

Change in tax law and regulations .............................. — — (15)

Deferred gain on ITT World Directories disposition ................. — 52 —

Tax settlements ............................................ (59) (8) (15)

Tax benefit on the deferred gain from the Host Transaction . . ......... (356) — —

Tax benefits recognized on Host Transaction ...................... (1,017) — —

Basis difference on asset sales ................................. (41) — —

Change in of valuation allowance .............................. 884 7 24

Other ................................................... (11) (9) (3)

Provision for income tax (benefit) .............................. $ (434) $219 $ 43

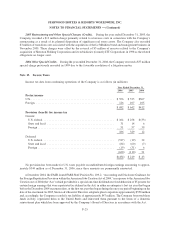

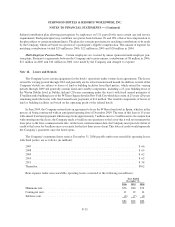

During 2006, the IRS completed its audits of the Company’s 2001, 2002 and 2003 tax returns and issued its

final audit adjustments to the Company. In addition, state income tax audits for various jurisdictions and tax years

were completed during the year. As a result of the completion of these audits, the Company recorded a $50 million

tax benefit. The Company also recognized a $9 million tax benefit related to the reversal of previously accrued

income taxes after an evaluation of the applicable exposures and the expiration of the related statutes of limitations.

During 2006, the Company completed an evaluation of its ability to claim U.S. foreign tax credits on its federal

income tax return. As a result of this analysis, the Company determined that it can claim the credits for the 2005 and

2006 tax years. The Company had not previously accrued this benefit since the realization of the benefit was

determined to be unlikely. Therefore, during 2006, a $15 million and $19 million tax benefit was recorded for 2006

and 2005, respectively.

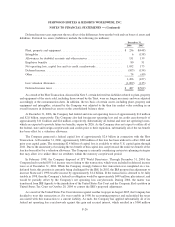

As discussed in Note 5, the Company completed the Host Transaction during the second quarter of 2006 which

included the sale of 33 hotel properties. As the Company sold these hotels subject to long-term management

contracts, the gain of approximately $955 million has been deferred over the life of those contracts. As a result of the

recognition of this deferred gain, the Company has established a deferred tax asset and recognized the related tax

benefit of approximately $356 million for the book-tax difference on the deferred gain liability. Additional tax

benefits of $1,017 million resulted from the Host Transaction consisting primarily of the tax benefit of $832 million

F-27

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)