Starwood 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

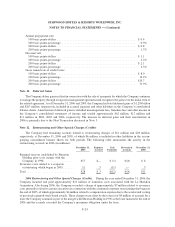

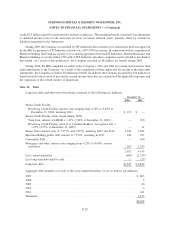

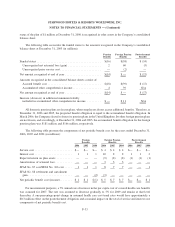

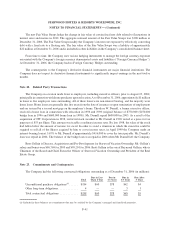

The weighted average assumptions used to determine benefit obligations at December 31 were as follows:

2006 2005 2006 2005 2006 2005

Pension

Benefits

Foreign Pension

Benefits

Postretirement

Benefits

Discount rate........................... 5.75% 5.50% 5.46% 5.09% 5.74% 5.49%

Rate of compensation increase .............. N/A N/A 3.90% 3.60% N/A N/A

The weighted average assumptions used to determine net periodic benefit cost for the years ended December 31

were as follows:

2006 2005 2004 2006 2005 2004 2006 2005 2004

Pension

Benefits

Foreign Pension

Benefits

Postretirement

Benefits

Discount rate ..................... 5.50% 5.51% 5.99% 5.09% 5.49% 5.87% 5.49% 5.50% 6.25%

Rate of compensation increase ........ N/A N/A N/A 3.60% 3.62% 3.74% N/A N/A N/A

Expected return on plan assets ........ N/A N/A 6.00% 6.91% 7.10% 7.02% 7.50% 8.00% 8.00%

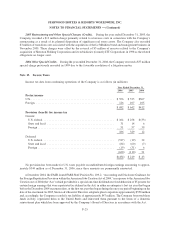

A number of factors were considered in the determination of the expected return on plan assets. These factors

included current and expected allocation of plan assets, the investment strategy, historical rates of return and

Company and investment expert expectations for investment performance over approximately a ten year period.

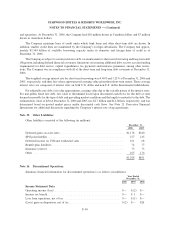

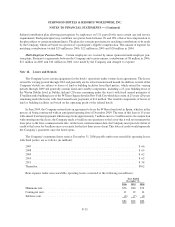

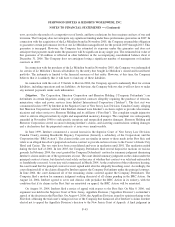

The weighted average asset allocations at December 31, 2006 and 2005 for the Company’s defined benefit

pension and postretirement benefit plans and the Company’s current target asset allocation ranges are as follows:

2006 2005 2006 2005 2006 2005

Target

Allocation

Percentage of

Plan Assets Target

Allocation

Percentage of

Plan Assets Target

Allocation

Percentage of

Plan Assets

Pension Benefits Foreign Pension Benefits Postretirement Benefits

Equity securities .......... N/A N/A N/A 59% 59% 64% 60% 75% 67%

Debt securities ........... N/A N/A N/A 40% 39% 32% 40% 25% 33%

Cash and other ........... N/A N/A N/A 1% 2% 4% 0% 0% 0%

100% 100% 100% 100% 100% 100%

The investment objective of the foreign pension plans and postretirement benefit plan is to seek long-term

capital appreciation and current income by investing in a diversified portfolio of equity and fixed income securities

with a moderate level of risk. At December 31, 2006, all remaining domestic pension plans are unfunded plans.

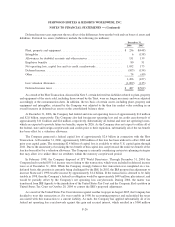

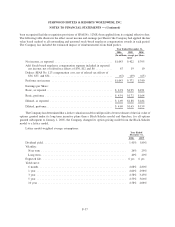

The Company expects to contribute approximately $1 million to its domestic pension plans, approximately

$11 million to its foreign pension plans, and approximately $2 million to the postretirement benefit plan in 2007.

The following table represents the Company’s expected pension and postretirement benefit plan payments for the

next five years and the five years thereafter (in millions):

Pension

Benefits

Foreign Pension

Benefits

Postretirement

Benefits

2007 ........................................ $1 $ 7 $2

2008 ........................................ $1 $ 7 $2

2009 ........................................ $1 $ 7 $2

2010 ........................................ $1 $ 7 $2

2011 ........................................ $1 $ 8 $2

2012 - 2016 ................................... $7 $52 $7

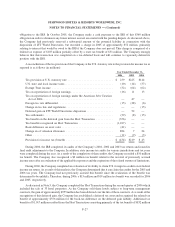

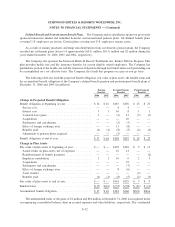

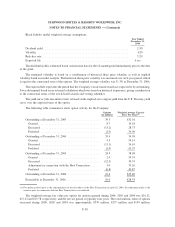

Defined Contribution Plans. The Company and its subsidiaries sponsor various defined contribution plans,

including the Starwood Hotels & Resorts Worldwide, Inc. Savings and Retirement Plan, which is a voluntary

F-34

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)