Starwood 2006 Annual Report Download - page 29

Download and view the complete annual report

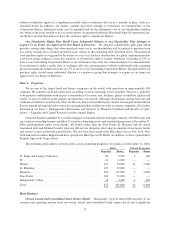

Please find page 29 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have also entered into arrangements with several owners for mixed use hotel projects that will include a

residential component. We have entered into licensing agreements for the use of certain of our brands to allow the

owners to offer branded condominiums to prospective purchasers. In consideration, we typically receive a licensing

fee equal to a percentage of the gross sales revenue of the units sold. The licensing arrangement generally terminates

upon the earlier of sell-out of the units or a specified length of time.

At December 31, 2006, we had 25 residential and vacation ownership resorts and sites in our portfolio with

15 actively selling VOIs and residences, 6 expected to start construction in 2007 or 2008 and 4 that have sold all

existing inventory. During 2006 and 2005, we invested approximately $411 million and $231 million, respectively,

for vacation ownership capital expenditures, including VOI construction at Westin Ka’anapali Ocean Resort Villas

North in Maui, Hawaii, and the Westin Princeville Resort in Kauai, Hawaii and the purchase of land in Aruba where

we plan to build a 154-unit Westin-branded vacation ownership resort.

In late 2004, we began selling residential units at the St. Regis Museum Tower in San Francisco, California

which opened in November 2005. We recognized revenues of approximately $53 million and $183 million in 2006

and 2005, respectively, related to the sale of these residential units which were sold out in the first half of 2006. In

2006 we began selling residential units at the St. Regis Hotel in New York, New York and recognized revenues of

approximately $41 million. During 2006 and 2005, we invested approximately $23 million and $65 million,

respectively, for residential inventory.

Item 3. Legal Proceedings.

Incorporated by reference to the description of legal proceedings in Note 23. Commitments and Contingencies,

in the notes to financial statements set forth in Part II, Item 8. Financial Statements and Supplementary Data.

Item 4. Submission of Matters to a Vote of Security Holders.

Not applicable.

Executive Officers of the Registrants

See Part III, Item 10. of this Annual Report for information regarding the executive officers of the Registrants,

which information is incorporated herein by reference.

22