Starwood 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

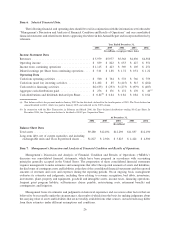

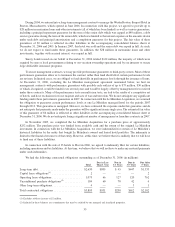

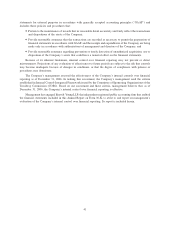

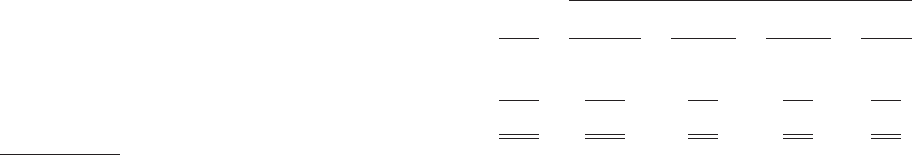

We had the following commercial commitments outstanding as of December 31, 2006 (in millions):

Total

Less Than

1 Year 1-3 Years 3-5 Years

After

5 Years

Amount of Commitment Expiration Per Period

Standby letters of credit .......................... $148 $148 $— $— $—

Hotel loan guarantees

(1)

.......................... 51 10 41 — —

Total commercial commitments .................... $199 $158 $41 $— $—

(1) Excludes fair value of guarantees which are reflected in our consolidated balance sheet.

In December 2006, we completed a transaction to, among other things, purchase real assets from Club Regina

Resorts (“CRR”) in Mexico. These assets included land and fixed assets adjacent to The Westin Resort & Spa in

Los Cabos, Mexico and terminated CRR’s rights to solicit guests at three Westin properties in Mexico. In addition to

the purchase of these assets, the transaction included the settlement of all pending and threatened legal claims

between the parties and the exchange of a new issue of CRR notes with a lower principal amount for the principal

amount of existing CRR notes that had been previously fully reserved. Total consideration of approximately

$41 million was paid by us for these items.

In May 2006, we partnered with Chef Jean-Georges Vongerichten and a private equity firm to create a joint

venture that will develop, own, operate, manage and license world-class restaurant concepts created by

Jean-Georges Vongerichten, including operating the existing Spice Market restaurant located in New York City.

The concepts owned by the venture will be available for Starwood’s upper-upscale and luxury hotel brands

including W, Westin, Le Méridien and St. Regis. Additionally, the venture may own and operate freestanding

restaurants outside of Starwood’s hotels. We invested approximately $22 million in this venture.

In January 2004, we acquired a 95% interest in Bliss World LLC which at that time operated three stand alone

spas (two in New York, New York and one in London, England) and a beauty products business with distribution

through its own internet site and catalogue as well as through third party retail stores. The purchase price for the

acquired interest was approximately $25 million, and was funded from available cash. In 2005, we acquired the

remaining 5% interest for approximately $1 million.

We intend to finance the acquisition of additional hotel properties (including equity investments), hotel

renovations, VOI and residential construction, capital improvements, technology spend and other core and ancillary

business acquisitions and investments and provide for general corporate purposes (including dividend payments)

through our credit facilities described below, through the net proceeds from dispositions, through the assumption of

debt, through the issuance of additional equity or debt securities and from cash generated from operations.

We periodically review our business to identify properties or other assets that we believe either are non-core

(including hotels where the return on invested capital is not adequate), no longer complement our business, are in

markets which may not benefit us as much as other markets during an economic recovery or could be sold at

significant premiums. We are focused on enhancing real estate returns and monetizing investments. In the second

quarter of 2006, in connection with the Host Transaction, we completed the sale of 33 hotels and the stock of certain

controlled subsidiaries to Host for consideration valued at $4.1 billion which consisted of approximately $2.8 billion

in the form of Host common stock and cash paid directly to our shareholders and $1.3 billion of consideration paid

to Starwood, including $1.2 billion in cash, $77 million in debt assumption and $61 million in Host common stock.

During the year ended December 31, 2006, we sold ten additional owned hotels and interests in nine unconsolidated

joint ventures for gross proceeds of approximately $588 million in cash. There can be no assurance, however, that

we will be able to complete future dispositions on commercially reasonable terms or at all.

36