Starwood 2006 Annual Report Download - page 77

Download and view the complete annual report

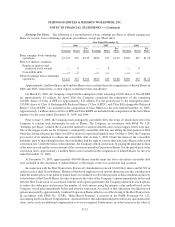

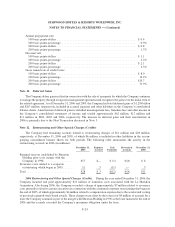

Please find page 77 of the 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$47 million of stock option expense in the year ended December 31, 2006, net of the estimated impact of

reimbursements from third parties.

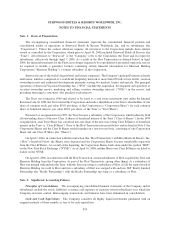

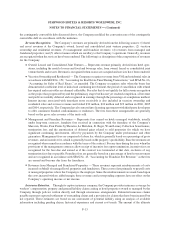

In December 2004, the FASB issued SFAS No. 152, which amends SFAS No. 66, and SFAS No. 67,

“Accounting for Costs and Initial Rental Operations of Real Estate Projects,” in association with the issuance of

American Institute of Certified Public Accountants Statement of Position 04-2, “Accounting for Real Estate Time-

Sharing Transactions.” These statements were issued to address the diversity in practice caused by a lack of

guidance specific to real estate time-sharing transactions. Among other things, the standard addresses the treatment

of sales incentives provided by a seller to a buyer to consummate a transaction, the calculation of accounting for

uncollectible notes receivable, the recognition of changes in inventory cost estimates, recovery or repossession of

VOIs, selling and marketing costs, associations and upgrade and reload transactions. The standard also requires a

change in the classification of the provision for loan losses for VOI notes receivable from an expense to a reduction

in revenue.

In accordance with SFAS No. 66, as amended by SFAS No. 152, the Company recognizes sales when the

period of cancellation with refund has expired, receivables are deemed collectible and the buyer has demonstrated a

sufficient level of initial and continuing involvement. For sales that do not qualify for full revenue recognition as the

project has progressed beyond the preliminary stages but has not yet reached completion, all revenue and associated

direct expenses are initially deferred and recognized in earnings through the percentage-of-completion method.

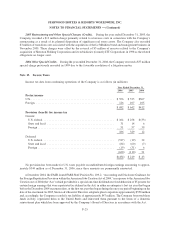

The Company adopted SFAS No. 152 on January 1, 2006 and recorded a charge of $70 million, net of a

$46 million tax benefit, as a cumulative effect of accounting change in its 2006 consolidated statement of income.

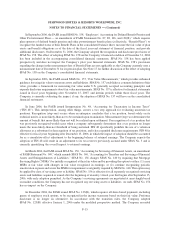

Note 3. Restricted Cash

State and local regulations governing sales of VOIs and residential properties allow the purchaser of such a

VOI or property to rescind the sale subsequent to its completion for a pre-specified number of days or until a

certificate of occupancy is obtained. As such, cash collected from such sales during the rescission period is

classified as restricted cash in the Company’s consolidated balance sheets. At December 31, 2006 and 2005, the

Company had short-term restricted cash balances of $329 million and $295 million, respectively, primarily

consisting of such restricted cash.

Note 4. Significant Acquisitions

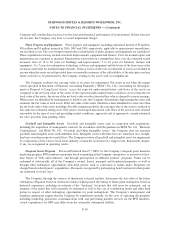

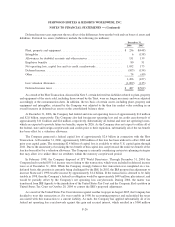

Acquisition of Real, Tangible and Intangible Assets from Club Regina Resorts. In December 2006,

Starwood completed a transaction to, among other things, purchase real assets from Club Regina Resorts (“CRR”)

in Mexico. These assets included land and fixed assets adjacent to The Westin Resort & Spa in Los Cabos, Mexico,

and terminated CRR’s rights to solicit guests at three Westin properties in Mexico. In addition to the purchase of

these assets, the transaction included the settlement of all pending and threatened legal claims between the parties

and the exchange of a new issue of CRR notes with a lower principal amount for the principal amount of existing

CRR notes that had been previously fully reserved. Total consideration of approximately $41 million was paid by

Starwood for these items. The portion related to the legal settlement was expensed.

Development of Restaurant Concepts with Chef Jean-Georges Vongerichten. In May 2006, Starwood

partnered with Chef Jean-Georges Vongerichten and a private equity firm to create a joint venture that will develop,

own, operate, manage and license world-class restaurant concepts created by Jean-Georges Vongerichten, including

operating the existing Spice Market restaurant located in New York City. The concepts owned by the venture will be

available for Starwood’s upper-upscale and luxury hotel brands including W, Westin, Le Meridien and St. Regis.

Additionally, the venture may own and operate freestanding restaurants outside of Starwood’s hotels. Starwood

invested approximately $22 million in this venture.

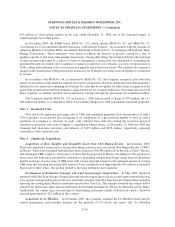

Acquisition of Le Méridien. In November 2005, the Company acquired the Le Méridien brand and the

related management and franchise business for the portfolio of 122 hotels and resorts (the “Le Méridien

F-16

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)