Starwood 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

starwood hotels & resorts worldwide, inc.

annual report 2006

Table of contents

-

Page 1

starwood hotels & resorts worldwide, inc. annual report 2006 -

Page 2

starwood hotels & -

Page 3

...guest experiences that 'wow' our customers. As you know, on March 31, 2007, Steven J. Heyer, resigned as Chief Executive Officer and as a Director, and I was appointed Chief Executive Officer on an interim basis. The Board of Directors appreciates the good work Mr. Heyer has done to execute Starwood... -

Page 4

... our St. Regis, Westin and Sheraton brands to continue to drive strong growth in this under-penetrated business. Contract sales were up 19%, driven by a mix of price increases and additional units sold. Importantly, tour fjow and closing rates remain strong and we are well positioned to continue... -

Page 5

starwood hotels & resorts worldwide, inc. annual report 2006 -

Page 6

... executive offices, including zip code) (914) 640-8100 (Registrant's telephone number, including area code) Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, par value $0.01 per share New York Stock Exchange... -

Page 7

...Holders ...Executive Officers of the Registrants ...PART II Market for Registrants' Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...Item 6. Selected Financial Data ...Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 8

... by the Corporation, including SLC Operating Limited Partnership, a Delaware limited partnership (the "Operating Partnership"), which prior to April 10, 2006 included Starwood Hotels & Resorts, a Maryland real estate investment trust (the "Trust"), which was sold in the Host Transaction (defined... -

Page 9

... to them, the office, home and the best spots in town. Four Points by Sheraton (select-service hotels) delights the self-sufficient traveler with a new kind of comfort, approachable style and spirited, can-do service - all at the honest value our guests deserve. Our guests start their day feeling... -

Page 10

... Hotels & Resorts, Starwood's largest brands, have been serving guests for more than 60 years. Starwood Vacation Ownership (and its predecessor, Vistana, Inc.) has been selling VOIs for more than 20 years. Our principal executive offices are located at 1111 Westchester Avenue, White Plains, New York... -

Page 11

... stock, cash and debt assumption. As a result, our primary business objective is to maximize earnings and cash flow by increasing the number of our hotel management contracts and franchise agreements; acquiring and developing vacation ownership resorts and selling VOIs; and investing in real estate... -

Page 12

... vacation ownership resorts and leveraging our hotel real estate assets where possible through VOI construction or conversion and residential sales; Leveraging the Bliss and Remede product lines and distribution channels; and Increasing operating efficiencies through increased use of technology... -

Page 13

...a hotel, residential, resort and vacation ownership operator and developer. While some of our competitors are private management firms, several are large national and international chains that own and operate their own hotels, as well as manage hotels for third-party owners and develop and sell VOIs... -

Page 14

... impact our revenues and operating income. Regulation and Licensing of Gaming Facilities We have an interest in the gaming operations of the Aladdin Resort and Casino in Las Vegas, Nevada and we and certain of our affiliates and officers have obtained from the Nevada Gaming Authorities (herein... -

Page 15

..., the immediate purchase of such securities for cash at fair market value. Regulations of the Nevada Commission provide that control of a registered publicly traded corporation cannot be changed through merger, consolidation, acquisition or assets, management or consulting agreements, or any form of... -

Page 16

...our employee relations are satisfactory. Where you can find more information We file annual, quarterly and special reports, proxy statements and other information with the Securities & Exchange Commission ("SEC"). Our SEC filings are available to the public over the Internet at the SEC's web site at... -

Page 17

... laws, rules and regulations and other governmental and regulatory action; changes in travel patterns; changes in operating costs including, but not limited to, energy, labor costs (including the impact of unionization), food costs, workers' compensation and health-care related costs, insurance and... -

Page 18

...of Our Properties May Concentrate Risks. Generally there has not been a concentration of ownership of hotels operated under our brands by any single owner. Following the acquisition of the Le Méridien brand business and the Host Transaction, single ownership groups own significant numbers of hotels... -

Page 19

..., new or existing real estate zoning or tax laws can make it more expensive and/or time-consuming to develop real property or expand, modify or renovate hotels. When interest rates increase, the cost of acquiring, developing, expanding or renovating real property increases and real property values... -

Page 20

... Losses are Not Covered by Insurance We carry insurance coverage for general liability, property, business interruption and other risks with respect to our owned and leased properties and we make available insurance programs for owners of properties we manage. These policies offer coverage terms and... -

Page 21

... our properties resulting from a particular insurable event must be combined together for purposes of evaluating whether the annual aggregate limits and sub-limits contained in our policies have been exceeded and any such claims will also be combined with the claims of owners of managed hotels that... -

Page 22

...have recovered the marketing, selling (other than commissions in certain events), and general and administrative costs associated with such VOI, and such costs will be incurred again in connection with the resale of the repossessed VOI. Accordingly, there is no assurance that the sales price will be... -

Page 23

... we currently do not collect or pay or increase the costs of our services or increase our costs of operations. Our current business practice with our internet reservation channels is that the intermediary collects hotel occupancy tax from its customer based on the price that the intermediary paid us... -

Page 24

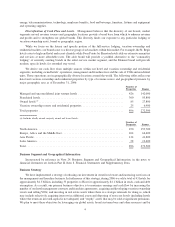

... in New York, New York and one in London, England and have opened five Bliss Spas in W Hotels. In addition, we have opened three Remède Spas in St. Regis hotels. The following table reflects our hotel and vacation ownership properties, by brand as of December 31, 2006: Hotels Properties Rooms VOI... -

Page 25

... in North America. However, in 2005 and 2006 we have sold 56 wholly owned hotels which has substantially reduced our revenues and operating income from owned, leased and consolidated joint venture hotels. The majority of these hotels were sold subject to long-term management or franchise contracts... -

Page 26

...Westin Westin Westin Westin Westin Maui Resort & Spa ...Peachtree Plaza, Atlanta ...Horton Plaza San Diego ...Galleria Houston ...San Francisco Airport ...Fort Lauderdale ... New York, NY Aspen, CO Phoenix, AZ New York, NY Chicago, IL San Francisco, CA Los Angeles, CA Chicago, IL New Orleans, LA New... -

Page 27

... companies to operate their hotels. When a management company does not offer a brand affiliation, the hotel owner often chooses to pay separate franchise fees to secure the benefits of brand marketing, centralized reservations and other centralized administrative functions, particularly in the sales... -

Page 28

...Owners of VOIs can trade their interval for intervals at other Starwood vacation ownership resorts, for intervals at certain vacation ownership resorts not otherwise sponsored by Starwood through an exchange company, or for hotel stays at Starwood properties. From time to time, we securitize or sell... -

Page 29

... Resort in Kauai, Hawaii and the purchase of land in Aruba where we plan to build a 154-unit Westin-branded vacation ownership resort. In late 2004, we began selling residential units at the St. Regis Museum Tower in San Francisco, California which opened in November 2005. We recognized revenues... -

Page 30

...Purchases of Equity Securities. Market Information The Corporation Shares are traded on the New York Stock Exchange (the "NYSE") under the symbol "HOT." The following table sets forth, for the fiscal periods indicated, the high and low sale prices per Corporation Share (and Share until April 7, 2006... -

Page 31

... Program, Starwood repurchased 21.7 million Shares and Corporation Shares in the open market for an aggregate cost of $1.263 billion during 2006. The Company repurchased the following Corporation Shares during the three months ended December 31, 2006: Total Number of Shares Purchased Average Price... -

Page 32

... and other distributions were reinvested. In addition, the Share prices for the periods prior to the Host Transaction on April 10, 2006 have been adjusted based on the value shareholders received for their Class B shares. The comparisons are provided in response to SEC disclosure requirements... -

Page 33

... recognition, bad debts, inventories, investments, plant, property and equipment, goodwill and intangible assets, income taxes, financing operations, frequent guest program liability, self-insurance claims payable, restructuring costs, retirement benefits and contingencies and litigation. Management... -

Page 34

... gross sales revenue of units sold. Management and Franchise Revenues - Represents fees earned on hotels managed worldwide, usually under long-term contracts, franchise fees received in connection with the franchise of the our Sheraton, Westin, Four Points by Sheraton, Le Méridien, St. Regis, W and... -

Page 35

... to airline miles. Properties are charged based on hotel guests' qualifying expenditures. Revenue is recognized by participating hotels and resorts when points are redeemed for hotel stays. We, through the services of third-party actuarial analysts, determine the fair value of the future redemption... -

Page 36

... of a $202 million increase in management and franchise revenue to $564 million for the year ended December 31, 2006 due to the addition of new managed and franchised hotels. The increase included approximately $44 million of management and franchise fees from the 33 hotels sold to Host, as well as... -

Page 37

York City. In addition, we recorded a gain of $17 million on the sale of approximately $133 million of vacation ownership receivables in 2006. The gain on the sale of VOI notes receivable in 2005, prior to our adoption of SFAS No. 152, "Accounting for Real Estate Time-Sharing Transactions," of $25 ... -

Page 38

approximately $133 million of vacation ownership receivables during 2006. However, as discussed above, the gain is now included in vacation ownership and residential sales and services revenue. Equity Earnings and Gains and Losses from Unconsolidated Ventures, Net. Equity earnings and gains and ... -

Page 39

... generally accepted accounting principles primarily at the Westin Ka'anapali Ocean Resort Villas in Maui, Hawaii, the Westin Kierland Resort and Spa in Scottsdale, Arizona, and the Sheraton Vistana Villages in Orlando, Florida, partially offset by reduced revenues at the Westin Mission Hills Resort... -

Page 40

... reimbursements of costs incurred on behalf of managed hotel properties and franchisees and relate primarily to payroll costs at managed properties where we are the employer. Since the reimbursements are made based upon the costs incurred with no added margin, these revenues and corresponding... -

Page 41

... cash. Cash From Investing Activities In limited cases, we have made loans to owners of or partners in hotel or resort ventures for which we have a management or franchise agreement. Loans outstanding under this program, excluding the Westin Boston, Seaport Hotel discussed below, totaled $55 million... -

Page 42

... by state or local governments relating to our vacation ownership operations and by our insurers to secure large deductible insurance programs. To secure management contracts, we may provide performance guarantees to third-party owners. Most of these performance guarantees allow us to terminate... -

Page 43

... additional hotel properties (including equity investments), hotel renovations, VOI and residential construction, capital improvements, technology spend and other core and ancillary business acquisitions and investments and provide for general corporate purposes (including dividend payments) through... -

Page 44

...part of the Host Transaction. In one transaction, in order to accomplish this, we purchased Treasury securities sufficient to make the monthly debt service payments and the balloon payment due under the loan agreement. The Treasury securities were then substituted for the real estate and hotels that... -

Page 45

... Corporation Shares. The notes that were not converted prior to the redemption date were redeemed at the price of par plus accrued interest, effective June 5, 2006. In connection with the Host Transaction, a total of $600 million of notes issued by Sheraton Holding were assumed by the Corporation... -

Page 46

... general economic, political, financial, competitive, legislative and regulatory factors beyond our control. On July 26, 2006, Standard & Poor's upgraded our rating to BBBϪ from BB+ and revised their outlook from positive to stable. On August 28, 2006, Moody's Investors Service upgraded our rating... -

Page 47

... 2006. Based on this evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company's disclosure controls and procedures are effective in alerting them in a timely manner to material information required to be included in the Company's SEC reports. Management's Report... -

Page 48

... Ernst & Young LLP, the independent registered public accounting firm that audited the financial statements included in this Annual Report on Form 10-K, to attest to and report on management's evaluation of the Company's internal control over financial reporting. Its report is included herein. 41 -

Page 49

... ACCOUNTING FIRM The Board of Directors and Shareholders of Starwood Hotels & Resorts Worldwide, Inc. We have audited management's assessment, included in the accompanying Management's Report on Internal Control over Financial Reporting, that Starwood Hotels & Resorts Worldwide, Inc. (the "Company... -

Page 50

...the Board of Directors as of the date of this Annual Report, certain information regarding such Director. Name (Age) Principal Occupation and Business Experience Service Period Steven J. Heyer (54) ...Chief Executive Officer of the Company since October 2004. Served as President and Chief Operating... -

Page 51

... private investor. From December 1995 until March 2000, Mr. Duncan served as Chairman, President and Chief Executive Officer of The Cadillac Fairview Corporation Limited, a real estate operating company. Lizanne Galbreath (49) ...Managing Partner of Galbreath & Company, a real estate investment firm... -

Page 52

... Officer of the Corporation Chief Administrative Officer, General Counsel and Secretary of the Corporation Executive Vice President and Chief Marketing Officer of the Corporation Chairman of the Board and Chief Executive Officer of Starwood Vacation Ownership and President of the Real Estate Group... -

Page 53

... SEC rules on our web site. You may obtain a free copy of this code in print by writing to our Investor Relations Department, 1111 Westchester Avenue, White Plains, New York 10604. The Company has adopted a Worldwide Code of Conduct applicable to all of its directors, officers and employees... -

Page 54

...Employee Stock Purchase Plan, a stock purchase plan meeting the requirements of Section 423 of the Internal Revenue Code. The remaining information called for by Item 12 is incorporated by reference to the information under the caption "Security Ownership of Certain Beneficial Owners and Management... -

Page 55

...who is the Chairman of the Board and Chief Executive Officer of Starwood Vacation Ownership and President of the Real Estate Group. The remaining information called for by Item 13 is incorporated by reference to the information under the caption "Corporate Governance" in the Proxy Statement. Item 14... -

Page 56

... to Exhibit 4.1 to the Trust's and the Corporation's Joint Current Report on Form 8-K filed January 8, 1999). Second Indenture Supplement, dated as of April 9, 2006, among the Corporation, Sheraton Holding Corporation and Bank of New York Trust Company, N.A., as trustee (incorporated by reference to... -

Page 57

Exhibit Number Description of Exhibit 10.2 Form of Trademark License Agreement, dated as of December 10, 1997, between Starwood Capital and the Trust (incorporated by reference to Exhibit 10.22 to the Trust's and the Corporation's Joint Annual Report on Form 10-K for the fiscal year ended ... -

Page 58

...June 30, 2006 (the 2006 Form 10-Q2")).(1) Form of Amended and Restated Restricted Stock Agreement pursuant to the 2004 LTIP (incorporated by reference to Exhibit 10.2 to the 2006 Form 10-Q2).(1) Starwood Hotels & Resorts Worldwide, Inc. 2005 Annual Incentive Plan for Certain Executives (incorporated... -

Page 59

..., between Starwood Vacation Ownership and Raymond Gellein, Jr.(1)(2) Employment Agreement, dated as of September 21, 2006, between the Corporation and Matthew A. Ouimet (incorporated by reference to Exhibit 10.1 to the Corporation's and Trust's Joint Current Report on Form 8-K filed with the SEC on... -

Page 60

... by the undersigned, thereunto duly authorized. STARWOOD HOTELS & RESORTS WORLDWIDE, INC. By: /s/ STEVEN J. HEYER Steven J. Heyer Chief Executive Officer and Director Date: February 23, 2007 Pursuant to the requirements of the Securities Exchange Act of 1934, this Report has been signed below by... -

Page 61

Signature Title Date /s/ THOMAS O. RYDER Thomas O. Ryder /s/ DANIEL W. YIH Daniel W. Yih /s/ KNEELAND C. YOUNGBLOOD Kneeland C. Youngblood Director February 23, 2007 Director February 23, 2007 Director February 23, 2007 54 -

Page 62

STARWOOD HOTELS & RESORTS WORLDWIDE, INC. INDEX TO FINANCIAL STATEMENTS AND SCHEDULES Page Report of Independent Registered Public Accounting Firm...Consolidated Balance Sheets as of December 31, 2006 and 2005 ...Consolidated Statements of Income for the Years Ended December 31, 2006, 2005 and 2004... -

Page 63

... No. 152, Accounting for Real Estate Time-Sharing Transactions, on January 1, 2006 and adopted SFAS No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, on December 31, 2006. We also have audited, in accordance with the standards of the Public Company Accounting... -

Page 64

... 562,222 shares at December 31, 2006 and 2005, respectively ...Class B exchangeable preferred shares of the Trust; $0.01 par value; authorized 15,000,000 shares; outstanding 0 and 24,627 shares at December 31, 2006 and 2005, respectively ...Corporation common stock; $0.01 par value; authorized 1,050... -

Page 65

... per Share data) Year Ended December 31, 2006 2005 2004 Revenues Owned, leased and consolidated joint venture hotels ...Vacation ownership and residential sales and services ...Management fees, franchise fees and other income ...Other revenues from managed and franchised properties ... ...$2,692... -

Page 66

STARWOOD HOTELS & RESORTS WORLDWIDE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Year Ended December 31, 2006 2005 2004 Net income ...Other comprehensive income (loss), net of taxes: Foreign currency translation adjustments ...Recognition of accumulated foreign currency ... -

Page 67

... of a tax benefit of $143 million, $66 million and $70 million in 2006, 2005 and 2004, respectively. (c) As part of the Host Transaction, the Company sold the Class A Shares of the Trust and shareholders sold the Class B Shares of the Trust. The book value of the Trust associated with this sale was... -

Page 68

... of distributions ...Gain on sale of VOI notes receivable ...Loss on asset dispositions and impairments, net ...Non-cash portion of income tax (benefit) expense ...Changes in working capital: Restricted cash...Accounts receivable ...Inventories ...Prepaid expenses and other ...Accounts payable and... -

Page 69

... the acquisition, development and operation of vacation ownership resorts; marketing and selling vacation ownership interests ("VOIs") in the resorts; and providing financing to customers who purchase such interests. The Trust was formed in 1969 and elected to be taxed as a real estate investment... -

Page 70

... herein. All other investments are generally accounted for under the cost method. The fair market value of investments is based on the market prices for the last day of the period if the investment trades on quoted exchanges. For non-traded investments, fair value is estimated based on the... -

Page 71

...comparisons of fair value to book value annually, or upon the occurrence of a trigger event. Impairment charges, if any, are recognized in operating results. Frequent Guest Program. Starwood Preferred Guest@ ("SPG") is the Company's frequent guest incentive marketing program. SPG members earn points... -

Page 72

... amount of loss. Changes in these factors could materially impact the Company's financial position or its results of operations. Derivative Financial Instruments. The Company enters into interest rate swap agreements to manage interest rate exposure. The net settlements paid or received under these... -

Page 73

...B Shares. Holders of Starwood employee stock options did not receive this consideration while the market price of our publicly traded shares was reduced to reflect the payment of this consideration directly to the holders of the Class B Shares. In order to preserve the value of the Company's options... -

Page 74

... sales revenue of the units sold. Management and Franchise Revenues - Represents fees earned on hotels managed worldwide, usually under long-term contracts, franchise fees received in connection with the franchise of the Company's Sheraton, Westin, Four Points by Sheraton, Le Méridien, St. Regis... -

Page 75

... a significant portion of which was reimbursed by managed and franchised hotels. Retained Interests. The Company periodically sells notes receivable originated by our vacation ownership business in connection with the sale of VOIs. The Company retains interests in the assets transferred to qualified... -

Page 76

STARWOOD HOTELS & RESORTS WORLDWIDE, INC. NOTES TO FINANCIAL STATEMENTS - (Continued) In September 2006, the FASB issued SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans - an amendment of FASB Statements No. 87, 88, 106, and 132(R)," which requires plan... -

Page 77

... of Position 04-2, "Accounting for Real Estate TimeSharing Transactions." These statements were issued to address the diversity in practice caused by a lack of guidance specific to real estate time-sharing transactions. Among other things, the standard addresses the treatment of sales incentives... -

Page 78

... Sheraton Kauai Resort on Poipu Beach in Kauai, Hawaii. The purchase price for the property was approximately $40 million and was funded from available cash. Prior to the acquisition, the Company managed the property for the former owner. Tender Offer to Acquire Partnership Units of Westin Hotels... -

Page 79

...quarter of 2006. In December 2005, the Company sold the Hotel Danieli in Venice, Italy for approximately 177 million euros (approximately $213 million based on the exchange rate at the time the sale closed) in cash. The Company continues to manage the hotel subject to a long-term management contract... -

Page 80

...October 2006, Starwood closed on the sale of land near the Montreal Airport to a developer who plans to build two Starwood branded hotels on the site. The purchase agreement contains a provision that may allow, but not obligate, Starwood to repurchase the land for the purchase price it received less... -

Page 81

... the Company received the final third-party valuation of the intangible assets acquired and adjusted their value and the related deferred tax asset accordingly. Intangible assets consisted of the following (in millions): December 31, 2006 2005 Trademarks and trade names ...Management and franchise... -

Page 82

STARWOOD HOTELS & RESORTS WORLDWIDE, INC. NOTES TO FINANCIAL STATEMENTS - (Continued) The intangible assets related to management and franchise agreements have finite lives, and accordingly, the Company recognized amortization expense of $25 million, $19 million and $15 million, respectively, ... -

Page 83

... with new VOI notes receivable, resulting in net gains of approximately $1 million annually in 2006, 2005 and 2004, respectively, which amounts are included in vacation ownership and residential sales and services in 2006 and in gain on sale of VOI notes receivable in 2005 and 2004 in the Company... -

Page 84

..., and aggregate servicing fees of $4 million, $3 million and $3 million related to these VOI notes receivable in 2006, 2005, and 2004, respectively. At the time of each VOI notes receivable sale and at the end of each financial reporting period, the Company estimates the fair value of its Retained... -

Page 85

... (in millions): December 31, 2005 Expenses Accrued Cash Payments Reversal of Accruals December 31, 2006 Retained reserves established by Sheraton Holding prior to its merger with the Company in 1998 ...Severance costs related to a corporate restructuring which began in 2005 ...Total ... $17 11 $28... -

Page 86

...transition costs associated with the acquisition of the Le Méridien brand and management business in November 2005. These charges were offset by the reversal of $3 million of reserves related to the Company's acquisition of Sheraton Holding Corporation and its subsidiaries (formerly ITT Corporation... -

Page 87

...) include the following (in millions): December 31, 2006 2005 Plant, property and equipment ...Intangibles ...Allowances for doubtful accounts and other reserves ...Employee benefits ...Net operating loss, capital loss and tax credit carryforwards ...Deferred income ...Other ...Less valuation... -

Page 88

... $19 million tax benefit was recorded for 2006 and 2005, respectively. As discussed in Note 5, the Company completed the Host Transaction during the second quarter of 2006 which included the sale of 33 hotel properties. As the Company sold these hotels subject to long-term management contracts, the... -

Page 89

... had been approved by the IRS for payment to ITT Industries related to its 1993-1995 tax returns. In connection with its acquisition of Sheraton Holding, the Company is party to a tax sharing agreement between ITT Industries, Hartford Insurance and Sheraton Holding as a result of their 1995 split... -

Page 90

... Host Transaction. In one transaction, in order to accomplish this, the Company purchased Treasury securities sufficient to make the monthly debt service payments and the balloon payment due under the loan agreement. The Treasury securities were then substituted for the real estate and hotels that... -

Page 91

..., limitations on incurring additional debt, escrow account funding requirements for debt service, capital expenditures, tax payments and insurance premiums, among other restrictions. The Company was in compliance with all of the short-term and long-term debt covenants at December 31, 2006. The... -

Page 92

...16 million associated with the disposition of the Company's former gaming business as a result of the favorable resolution of certain tax matters. Note 17. Employee Benefit Plans Adoption of SFAS No. 158. On December 31, 2006, the Company adopted the recognition and disclosure provisions of SFAS No... -

Page 93

... 31, 2006, 2005 and 2004, respectively. The Company also sponsors the Starwood Hotels & Resorts Worldwide, Inc. Retiree Welfare Program. This plan provides health care and life insurance benefits for certain eligible retired employees. The Company has prefunded a portion of the health care and life... -

Page 94

...2009 and remain at that level thereafter. A one-percentage-point change in assumed health care cost trend rates would have approximately a $0.3 million effect on the postretirement obligation and a nominal impact on the total of service and interest cost components of net periodic benefit cost. F-33 -

Page 95

... plans and postretirement benefit plan is to seek long-term capital appreciation and current income by investing in a diversified portfolio of equity and fixed income securities with a moderate level of risk. At December 31, 2006, all remaining domestic pension plans are unfunded plans. The Company... -

Page 96

... the operating profit of the related hotels. In June 2004, the Company entered into an agreement to lease the W Barcelona hotel in Spain, which is in the process of being constructed with an anticipated opening date of December 2009. The term of this lease is 15 years with annual fixed rent payments... -

Page 97

... Limited Partnership (the "Operating Partnership") were issued by the Trust and Corporation in connection with the acquisition of Westin Hotels & Resorts Worldwide, Inc. and certain of its affiliates. On March 15, 2006, the Company completed the redemption of the remaining 25,000 outstanding shares... -

Page 98

... December 31, 2006 2005 2004 (In millions, except per Share data) Net income, as reported ...Add: Stock-based employee compensation expense included in reported net income, net of related tax effects of $36, $12 and $6 ...Deduct: SFAS No. 123 compensation cost, net of related tax effects of $36... -

Page 99

... based on market analysis. The historical share price volatility was measured over an 8-year period, which is equal to the contractual term of the options. The weighted average volatility was 31.3% at December 31, 2006. The expected life represents the period that the Company's stock-based awards... -

Page 100

...49.12 $28.93 In April 2006, as part of the Host Transaction, the Company depaired its Corporation Shares and Class B Shares. As a result, the number of the Company's options and their strike prices have been adjusted as discussed in Note 2. The aggregate intrinsic value of outstanding options as of... -

Page 101

... is to manage the impact of interest rate fluctuations on the results of operations, cash flows and the market value of the Company's debt. At December 31, 2006, the Company had no outstanding interest rate swap agreements under which the Company pays a fixed rate and receives a variable rate of... -

Page 102

... for 2005 and $99,201 for 2006. Brett Gellein is the son of Raymond Gellein, who is Chairman of the Board and Chief Executive Officer of Starwood Vacation Ownership and President of the Real Estate Group. Note 23. Commitments and Contingencies The Company had the following contractual obligations... -

Page 103

... state or local governments relating to our vacation ownership operations and by our insurers to secure large deductible insurance programs. To secure management contracts, the Company may provide performance guarantees to third-party owners. Most of these performance guarantees allow the Company to... -

Page 104

... sale of 33 hotels to Host in 2006, the Company agreed to indemnify Host for certain liabilities, including operations and tax liabilities. At this time, the Company believes that it will not have to make any material payments under such indemnities. Litigation. The Corporation, Sheraton Corporation... -

Page 105

... providing, generally, for basic pay rates, working hours, other conditions of employment and orderly settlement of labor disputes. Generally, labor relations have been maintained in a normal and satisfactory manner, and management believes that the Company's employee relations are satisfactory... -

Page 106

... Four Points» by Sheraton as well as hotels and resorts which are managed or franchised under these brand names in exchange for fees. The vacation ownership and residential segment includes the development, ownership and operation of vacation ownership resorts, marketing and selling VOIs, providing... -

Page 107

... ...Total ...Operating income: Hotel ...Vacation ownership and residential ...Total segment operating income ...Selling, general, administrative and other ...Restructuring and other special (charges) credits, net ...Operating income ...Gain on sale of VOI notes receivable ...Equity earnings and... -

Page 108

STARWOOD HOTELS & RESORTS WORLDWIDE, INC. NOTES TO FINANCIAL STATEMENTS - (Continued) The following table presents revenues and long-lived assets by geographical region (in millions): 2006 Revenues 2005 2004 (In millions) Long-Lived Assets 2006 2005 United States ...Italy ...All other international... -

Page 109

... per Share data) Year 2006 Revenues ...Costs and expenses ...Income from continuing operations ...Discontinued operations ...Cumulative effect of accounting change, net of tax ...Net income...Earnings per Share: Basic - Income from continuing operations ...Discontinued operations ...Cumulative... -

Page 110

... II STARWOOD HOTELS & RESORTS WORLDWIDE, INC. VALUATION AND QUALIFYING ACCOUNTS (In millions) Additions (Deductions) Charged Charged Balance Balance to/reversed to/from Other Payments/ January 1, from Expenses Other December 31, Accounts(a) 2006 Trade receivables - allowance for doubtful accounts... -

Page 111

This Page Intentionally Left Blank -

Page 112

... Westin Bear Mountain The Westin Dallas Fort Worth Airport The Westin Tampa Harbour Island The Westin Key West Resort & Marina Sunset Key Guest Cottages, a Westin Resort The Westin St. Maarten, Dawn Beach Resort & Spa Westin Aruba Resort, Spa and Casino The Westin Arlington Gateway The Westin Real... -

Page 113

... Stock Transfer & Trust Company 59 Maiden Lane, New York, New York 10038 800 350 6202, www.amstock.com Form 10-K and Other Investor Information A copy of the Annual Report of Starwood Hotels & Resorts Worldwide, Inc. ("Starwood") on Form 10-K ï¬lled with the Securities and Exchange Commission... -

Page 114

-

Page 115