Shutterfly 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our management, under the supervision of our Chief Executive Officer and Chief Financial Officer, conducted an evaluation of the

effectiveness of our internal control over financial reporting based on the framework in Internal Control—

Integrated Framework, issued by the

Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that our internal

control over financial reporting was effective as of December 31, 2009.

The Company reviewed the results of management’

s assessment with the Audit Committee of the Board of Directors. The effectiveness of the

Company's internal control over financial reporting as of December 31, 2009 has been audited by PricewaterhouseCoopers LLP, an independent

registered public accounting firm, as stated in their report which appears herein.

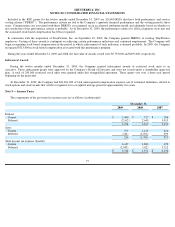

Remediation of Material Weakness

In Management's Report on Internal Control over Financial Reporting included in our restated Annual Report on Form 10-

K/A for the year

ended December 31, 2008, and our quarterly report on Form 10-

Q for the fiscal quarter ended September 30, 2009, our management concluded

that, as of December 31, 2008 and September 30, 2009, our internal control over financial reporting was not effective to provide reasonable

assurance regarding the reliability of financial reporting and the preparation of financial statements for external reporting purposes in accordance

with GAAP due to the following material weakness:

Subsequent to the identification of the material weakness in October 2009, we have taken the following remediation measures related to the

calculation of stock-

based compensation expense, the application of the forfeiture rate, and the overall reliance on the third party software

information for financial reporting purposes:

•

We

did not maintain effective controls to ensure the completeness and accuracy of stock

-

based compensation expense. Specifically,

we did not maintain effective controls to ensure the proper application of forfeiture rates in the calculation of stock-

based compensation

expense in accordance with generally accepted accounting principles. In October 2009, the Company became aware of a recent alert

from its third party software provider which noted that prior versions of its software did not properly calculate stock-

based

compensation when users selected the option to use a weighted average forfeiture rate for all tranches of a particular award, as opposed

to selecting the option to apply individual forfeiture rates to each tranche. The error was isolated to a single standard report provided in

the software package that calculated the stock based compensation to be recorded for a given date range. As a result, when the report

was generated, for individual tranches that vested during a stated date range, the stock based compensation expense calculated on the

report and associated with that tranche did not equal at least 100 percent of the grant date fair value of the award as required under

generally accepted accounting principles.

•

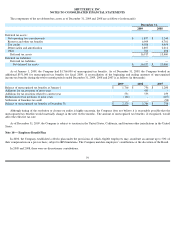

Identified all significant reports generated from the third party equity software related to financial reporting and implemented controls

over the completeness and accuracy of these reports. These controls consist of:

(i)

cross

-

validating report data to another source,

( ii

)

manually recalculating the report data to ensure that the software is producing results compliant with generally accepted

accounting principles, and

(

iii)

manually calculating stock

-

based compensation on an individual grant basis for a sample of equity awards to verify that the

report data is consistent with our expected outcome.

•

Enhanced existing financial reporting controls to include additional review steps with respect to significant reports generated from the

third party equity software, including review of alerts and updates from the third party equity software provider, review of report

parameters and review of events that would impact accounting for equity

-

related accounts and disclosures.

83